- United Kingdom

- /

- Diversified Financial

- /

- LSE:WISE

Earnings Not Telling The Story For Wise plc (LON:WISE) After Shares Rise 27%

The Wise plc (LON:WISE) share price has done very well over the last month, posting an excellent gain of 27%. Taking a wider view, although not as strong as the last month, the full year gain of 15% is also fairly reasonable.

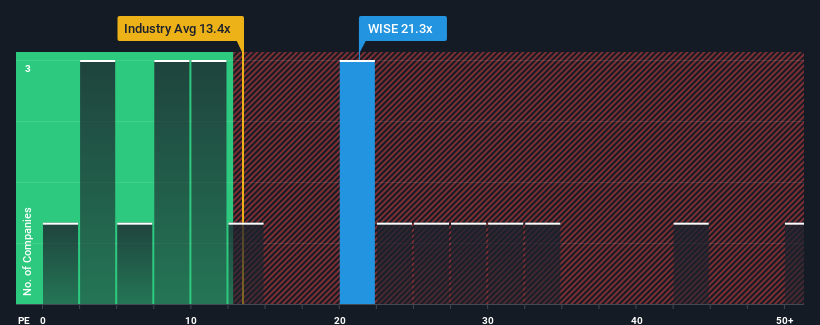

Following the firm bounce in price, Wise may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 21.3x, since almost half of all companies in the United Kingdom have P/E ratios under 16x and even P/E's lower than 9x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Recent times have been advantageous for Wise as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Wise

Does Growth Match The High P/E?

Wise's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 95%. The latest three year period has also seen an excellent 1,273% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 8.3% per annum as estimated by the twelve analysts watching the company. Meanwhile, the broader market is forecast to expand by 13% per year, which paints a poor picture.

With this information, we find it concerning that Wise is trading at a P/E higher than the market. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Bottom Line On Wise's P/E

Wise's P/E is getting right up there since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Wise's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings are highly unlikely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Wise that you should be aware of.

If these risks are making you reconsider your opinion on Wise, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Wise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:WISE

Wise

Provides cross-border and domestic financial services for personal and business customers in the United Kingdom, rest of Europe, the Asia-Pacific, North America, and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives