- United Kingdom

- /

- Capital Markets

- /

- LSE:SCIN

What Type Of Shareholders Own The Most Number of The Scottish Investment Trust PLC (LON:SCIN) Shares?

A look at the shareholders of The Scottish Investment Trust PLC (LON:SCIN) can tell us which group is most powerful. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones. Companies that have been privatized tend to have low insider ownership.

Scottish Investment Trust is not a large company by global standards. It has a market capitalization of UK£517m, which means it wouldn't have the attention of many institutional investors. In the chart below, we can see that institutions own shares in the company. Let's delve deeper into each type of owner, to discover more about Scottish Investment Trust.

View our latest analysis for Scottish Investment Trust

What Does The Institutional Ownership Tell Us About Scottish Investment Trust?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

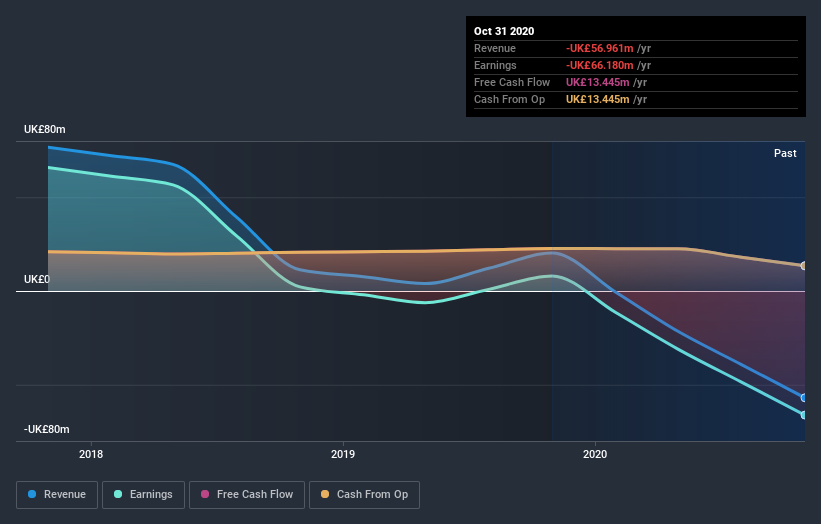

As you can see, institutional investors have a fair amount of stake in Scottish Investment Trust. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Scottish Investment Trust's historic earnings and revenue below, but keep in mind there's always more to the story.

Institutional investors own over 50% of the company, so together than can probably strongly influence board decisions. Scottish Investment Trust is not owned by hedge funds. A J Bell Holdings Limited, Asset Management Arm is currently the company's largest shareholder with 22% of shares outstanding. Rathbone Investment Management Limited is the second largest shareholder owning 5.6% of common stock, and 1607 Capital Partners, LLC holds about 5.3% of the company stock.

We also observed that the top 9 shareholders account for more than half of the share register, with a few smaller shareholders to balance the interests of the larger ones to a certain extent.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. As far I can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of Scottish Investment Trust

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our information suggests that The Scottish Investment Trust PLC insiders own under 1% of the company. We do note, however, it is possible insiders have an indirect interest through a private company or other corporate structure. It seems the board members have no more than UK£256k worth of shares in the UK£517m company. Many investors in smaller companies prefer to see the board more heavily invested. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public, with a 26% stake in the company, will not easily be ignored. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Scottish Investment Trust better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Scottish Investment Trust (of which 2 are concerning!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you decide to trade Scottish Investment Trust, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:SCIN

Scottish Investment Trust

The Scottish Investment Trust PLC is a publicly owned investment manager.

Adequate balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion