- United Kingdom

- /

- Capital Markets

- /

- LSE:PHLL

Here's Why Petershill Partners (LON:PHLL) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Petershill Partners (LON:PHLL). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Petershill Partners

How Fast Is Petershill Partners Growing Its Earnings Per Share?

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Commendations have to be given in seeing that Petershill Partners grew its EPS from US$0.016 to US$0.32, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company. This could point to the business hitting a point of inflection.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of Petershill Partners' revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Petershill Partners shareholders can take confidence from the fact that EBIT margins are up from 80% to 94%, and revenue is growing. Both of which are great metrics to check off for potential growth.

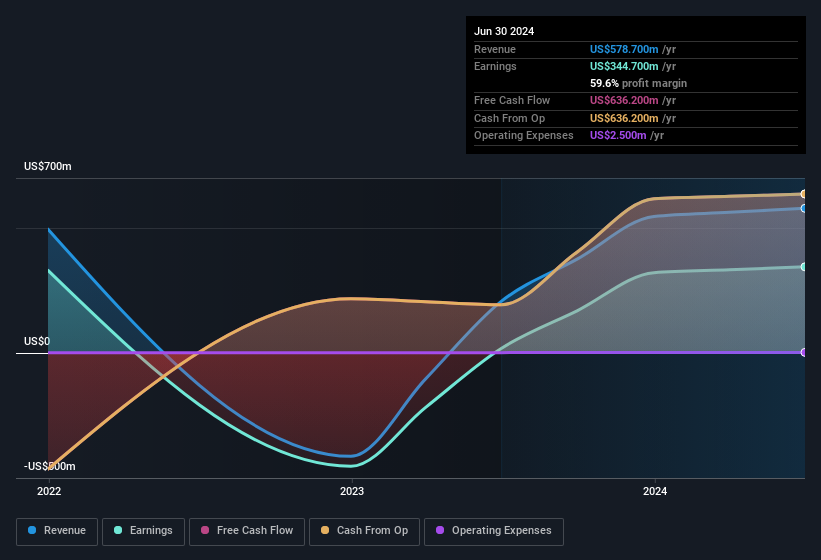

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Petershill Partners.

Are Petershill Partners Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The first bit of good news is that no Petershill Partners insiders reported share sales in the last twelve months. But the really good news is that Non-Executive Chairman Naguib Kheraj spent US$173k buying stock, at an average price of around US$2.31. Big buys like that may signal an opportunity; actions speak louder than words.

On top of the insider buying, it's good to see that Petershill Partners insiders have a valuable investment in the business. Indeed, they hold US$15m worth of its stock. This considerable investment should help drive long-term value in the business. Even though that's only about 0.5% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Should You Add Petershill Partners To Your Watchlist?

Petershill Partners' earnings per share growth have been climbing higher at an appreciable rate. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Petershill Partners belongs near the top of your watchlist. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Petershill Partners. You might benefit from giving it a glance today.

Keen growth investors love to see insider activity. Thankfully, Petershill Partners isn't the only one. You can see a a curated list of British companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:PHLL

Petershill Partners

Petershill Partners plc, formerly known as Delta Epsilon plc, is a private equity firm operating as general partner solutions firm.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives