- United Kingdom

- /

- Diversified Financial

- /

- LSE:PAG

Paragon Banking Group PLC (LON:PAG) Soars 42% But It's A Story Of Risk Vs Reward

The Paragon Banking Group PLC (LON:PAG) share price has done very well over the last month, posting an excellent gain of 42%. Taking a wider view, although not as strong as the last month, the full year gain of 23% is also fairly reasonable.

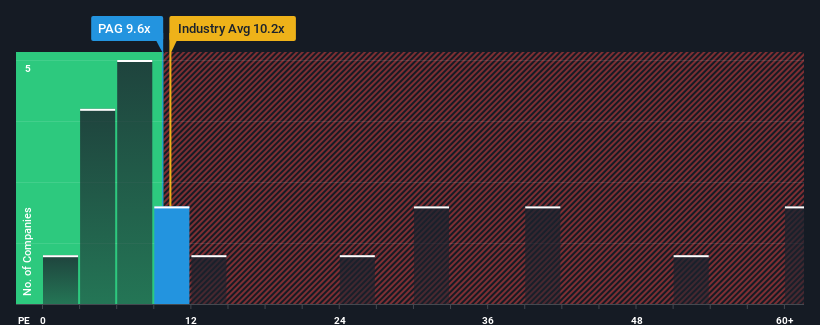

In spite of the firm bounce in price, Paragon Banking Group's price-to-earnings (or "P/E") ratio of 9.6x might still make it look like a buy right now compared to the market in the United Kingdom, where around half of the companies have P/E ratios above 16x and even P/E's above 29x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings that are retreating more than the market's of late, Paragon Banking Group has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Paragon Banking Group

Is There Any Growth For Paragon Banking Group?

There's an inherent assumption that a company should underperform the market for P/E ratios like Paragon Banking Group's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 47%. Even so, admirably EPS has lifted 99% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings should grow by 16% per year over the next three years. With the market only predicted to deliver 12% each year, the company is positioned for a stronger earnings result.

With this information, we find it odd that Paragon Banking Group is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Paragon Banking Group's P/E?

Despite Paragon Banking Group's shares building up a head of steam, its P/E still lags most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Paragon Banking Group's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Paragon Banking Group that you should be aware of.

If these risks are making you reconsider your opinion on Paragon Banking Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:PAG

Paragon Banking Group

Provides financial products and services in the United Kingdom.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives