- United Kingdom

- /

- Capital Markets

- /

- LSE:N91

I Built A List Of Growing Companies And Ninety One Group (LON:N91) Made The Cut

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like Ninety One Group (LON:N91). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Ninety One Group

How Fast Is Ninety One Group Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. Ninety One Group boosted its trailing twelve month EPS from UK£0.15 to UK£0.17, in the last year. I doubt many would complain about that 14% gain.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Ninety One Group maintained stable EBIT margins over the last year, all while growing revenue 20% to UK£608m. That's progress.

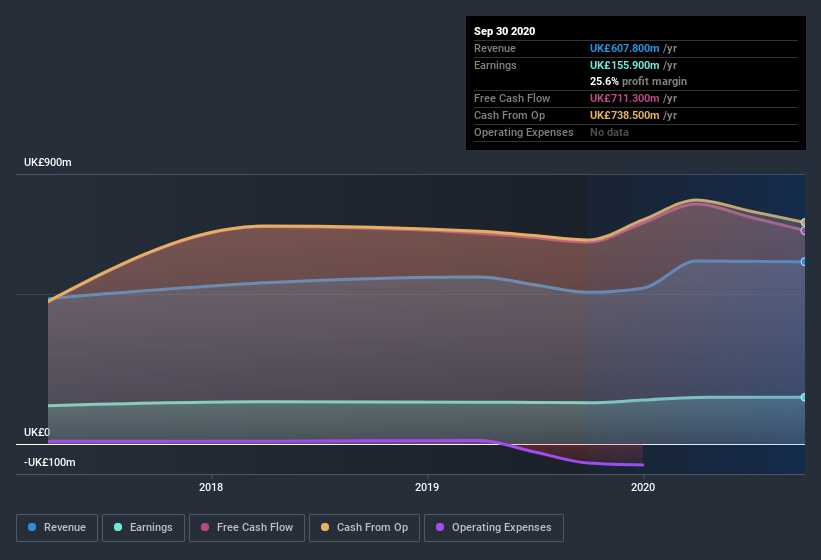

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Ninety One Group's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Ninety One Group Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We note that Ninety One Group insiders spent UK£50k on stock, over the last year; in contrast, we didn't see any selling. That puts the company in a nice light, as it makes me think its leaders are feeling confident.

It's reassuring that Ninety One Group insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. Specifically, the CEO is paid quite reasonably for a company of this size. For companies with market capitalizations between UK£1.4b and UK£4.6b, like Ninety One Group, the median CEO pay is around UK£1.4m.

The Ninety One Group CEO received total compensation of just UK£555k in the year to . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add Ninety One Group To Your Watchlist?

One positive for Ninety One Group is that it is growing EPS. That's nice to see. And that's not all, folks. We've also seen insiders buying stock, and noted modest executive pay. The sum of all that, for me, points to a quality business, and a genuine prospect for further research. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Ninety One Group that you should be aware of.

The good news is that Ninety One Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Ninety One Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Ninety One Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:N91

Ninety One Group

Operates as an independent global asset manager worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives