Stock Analysis

- United Kingdom

- /

- Capital Markets

- /

- LSE:LWDB

Exploring Undiscovered UK Stocks With Potential In July 2024

Reviewed by Simply Wall St

As recent data reveals a dip in the FTSE 100, largely influenced by disappointing trade figures from China, investors might find it prudent to look beyond the blue-chip giants for potential growth opportunities. In times of broader market downturns, uncovering lesser-known stocks that demonstrate resilience or unique business models could offer alternative avenues for portfolio diversification.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| Georgia Capital | NA | -27.80% | 18.94% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Fix Price Group | 43.59% | 12.53% | 23.49% | ★★★★★☆ |

| Ros Agro | 57.18% | 17.80% | 18.35% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 6.58% | 9.90% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Alpha Group International (LSE:ALPH)

Simply Wall St Value Rating: ★★★★★★

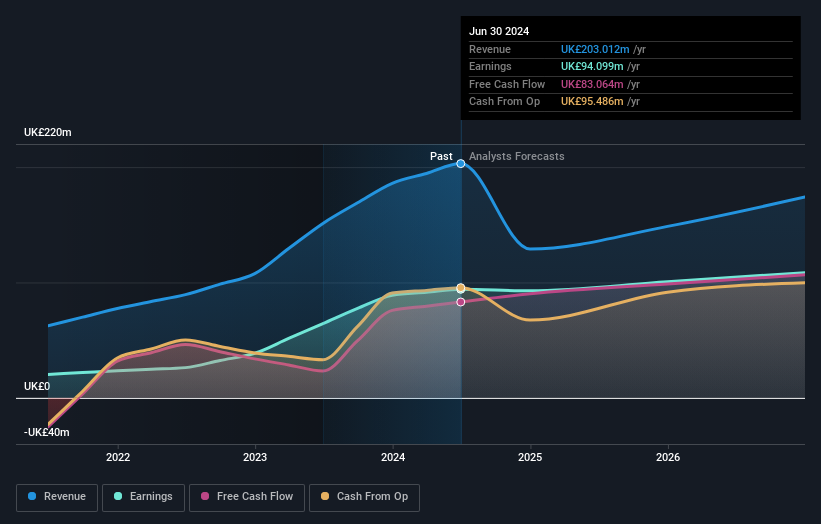

Overview: Alpha Group International plc specializes in foreign exchange risk management and alternative banking solutions, operating across the UK, Europe, Canada, and other international markets with a market cap of £1.09 billion.

Operations: Alpha Group International generates its revenue through a diversified portfolio, including payment solutions, institutional services, and corporate financial activities across multiple global locations. The company has shown significant growth in gross profit margins over the years, reaching 85.66% by the end of 2023. This indicates an efficient control over costs relative to revenue generation, particularly in sectors such as Alpha Pay and Institutional services which are major contributors to its income stream.

Alpha Group International, a standout in the UK market, boasts a robust earnings growth of 130% over the past year, significantly outpacing its industry's 0.3%. With a Price-To-Earnings ratio at 12.3x—below the UK average of 16.5x—it presents as an undervalued opportunity. The company is debt-free and has high-quality earnings with substantial non-cash components, suggesting strong underlying financial health. Recently added to several FTSE indices and initiating share repurchases underlines its growing recognition and strategic shareholder returns approach.

- Unlock comprehensive insights into our analysis of Alpha Group International stock in this health report.

Understand Alpha Group International's track record by examining our Past report.

Law Debenture (LSE:LWDB)

Simply Wall St Value Rating: ★★★★☆☆

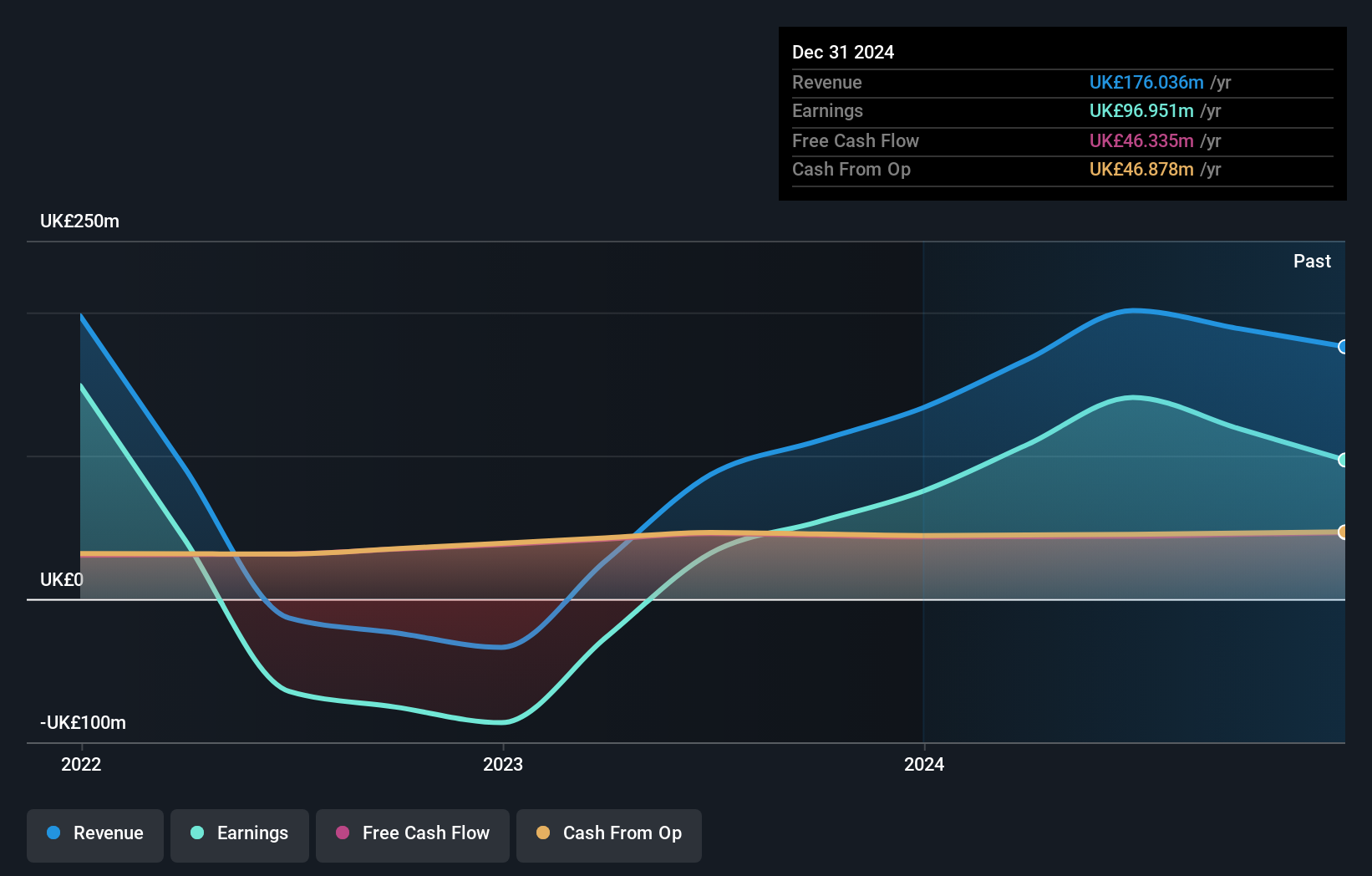

Overview: The Law Debenture Corporation p.l.c. is an investment trust that offers independent professional services globally, with a market capitalization of £1.19 billion.

Operations: The company generates its revenue through two primary segments: an investment portfolio valued at £35.62 million and independent professional services which contribute £61.55 million. It consistently achieves high gross profit margins, reflecting efficient cost management relative to its revenue generation.

Law Debenture, a notable performer within the UK's financial sector, has showcased remarkable earnings growth of 340.1% over the past year, significantly outpacing its industry's growth of just 0.3%. With a net debt to equity ratio at a manageable 15% and interest payments well covered by EBIT (21.9x), the company maintains robust financial health. Additionally, its recent half-year earnings report revealed a surge in revenue to GBP 111.97 million and net income to GBP 82 million, alongside an increased dividend payout, underscoring its strong market position and shareholder value enhancement.

- Dive into the specifics of Law Debenture here with our thorough health report.

Evaluate Law Debenture's historical performance by accessing our past performance report.

Wilmington (LSE:WIL)

Simply Wall St Value Rating: ★★★★★★

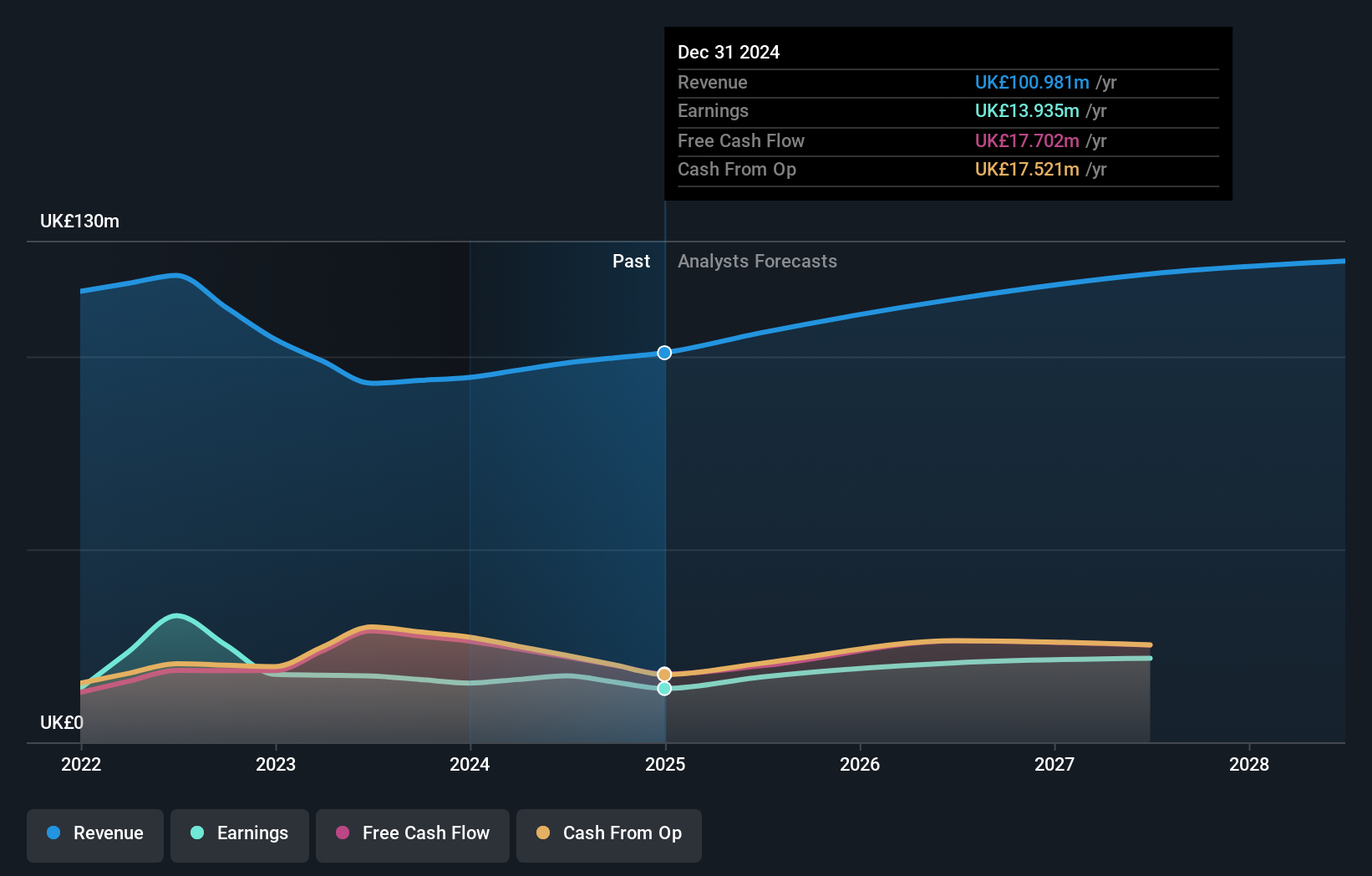

Overview: Wilmington plc operates globally, offering information, data, training, and education solutions to professional markets across the UK, Europe, North America, and other regions with a market capitalization of £352.41 million.

Operations: The company generates its revenue primarily from two segments: Intelligence and Training & Education, contributing £57.86 million and £67.13 million respectively. It incurs costs mainly through cost of goods sold (COGS) and operating expenses, impacting its net income margins which have shown variability over the periods observed.

Wilmington stands out as a noteworthy contender among UK's lesser-tapped stocks, trading 29.2% below its estimated fair value. With a robust earnings growth of 4.4% last year, surpassing the industry's 2%, Wilmington showcases its competitive edge. Despite expectations of an average earnings decline by 6.6% annually over the next three years, the company remains debt-free and maintains high-quality earnings—attributes that underscore its financial health and potential resilience in challenging markets.

- Take a closer look at Wilmington's potential here in our health report.

Gain insights into Wilmington's historical performance by reviewing our past performance report.

Seize The Opportunity

- Click this link to deep-dive into the 75 companies within our UK Undiscovered Gems With Strong Fundamentals screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LWDB

Law Debenture

An investment trust, provides independent professional services to companies, agencies, organizations, and individuals worldwide.

Solid track record with adequate balance sheet and pays a dividend.