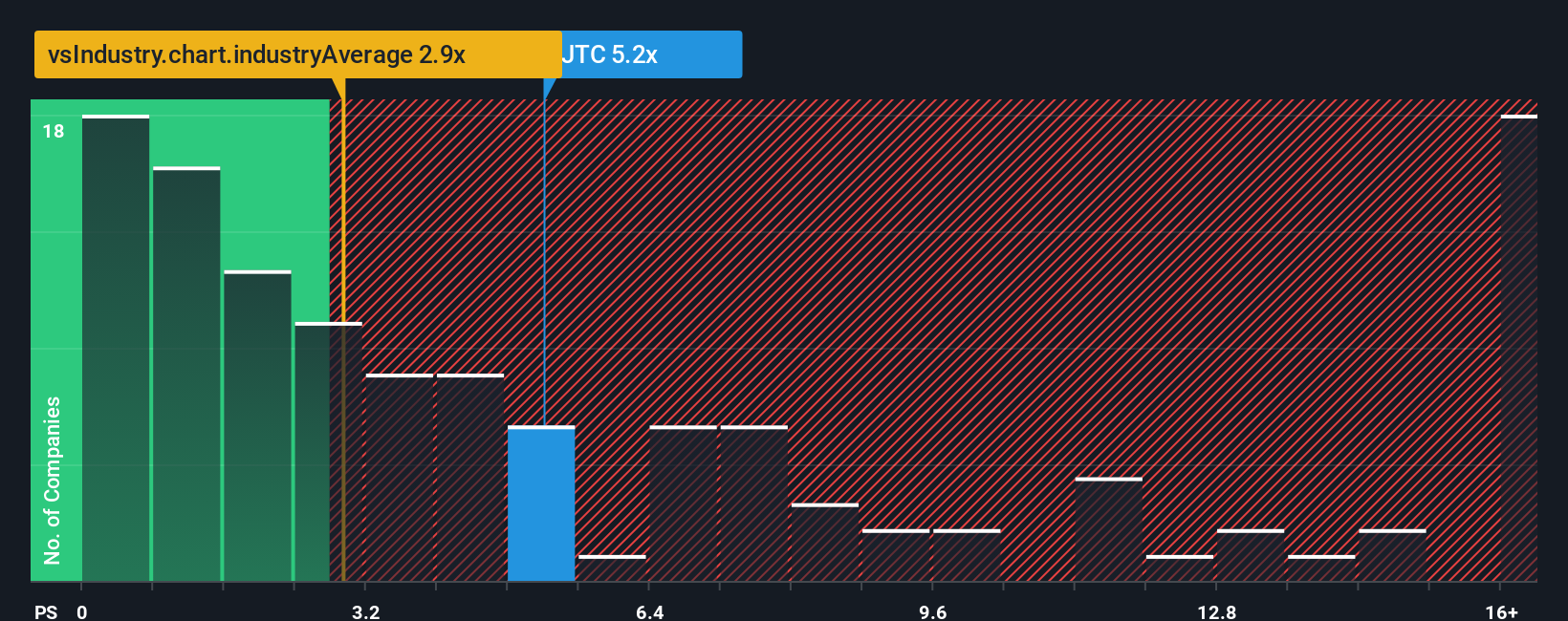

When you see that almost half of the companies in the Capital Markets industry in the United Kingdom have price-to-sales ratios (or "P/S") below 2.9x, JTC PLC (LON:JTC) looks to be giving off strong sell signals with its 5.2x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for JTC

How JTC Has Been Performing

Recent times have been advantageous for JTC as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on JTC.How Is JTC's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like JTC's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. The latest three year period has also seen an excellent 107% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 18% each year as estimated by the seven analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 6.8% each year, which is noticeably less attractive.

With this in mind, it's not hard to understand why JTC's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From JTC's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of JTC's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for JTC with six simple checks.

If these risks are making you reconsider your opinion on JTC, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:JTC

JTC

Provides fund, corporate, and private wealth services to institutional and private clients.

Reasonable growth potential with very low risk.

Similar Companies

Market Insights

Community Narratives