- United Kingdom

- /

- Capital Markets

- /

- LSE:EMG

UK's November 2025 Stocks Possibly Priced Below Estimated Value

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index experiences fluctuations influenced by weak trade data from China, investors are keenly observing the broader market dynamics. In this environment, identifying potentially undervalued stocks becomes crucial, as they may offer opportunities for growth despite global economic challenges.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vistry Group (LSE:VTY) | £6.442 | £12.63 | 49% |

| SigmaRoc (AIM:SRC) | £1.154 | £2.30 | 49.9% |

| PageGroup (LSE:PAGE) | £2.36 | £4.60 | 48.7% |

| Likewise Group (AIM:LIKE) | £0.26 | £0.51 | 48.6% |

| Gooch & Housego (AIM:GHH) | £5.74 | £11.10 | 48.3% |

| Fevertree Drinks (AIM:FEVR) | £8.34 | £16.18 | 48.5% |

| Essentra (LSE:ESNT) | £0.974 | £1.92 | 49.4% |

| Begbies Traynor Group (AIM:BEG) | £1.12 | £2.22 | 49.6% |

| AstraZeneca (LSE:AZN) | £124.70 | £248.46 | 49.8% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.15 | £4.29 | 49.9% |

Underneath we present a selection of stocks filtered out by our screen.

Man Group (LSE:EMG)

Overview: Man Group Limited is a publicly owned investment manager with a market cap of £2.35 billion.

Operations: The company's revenue from its Investment Management Business is $1.31 billion.

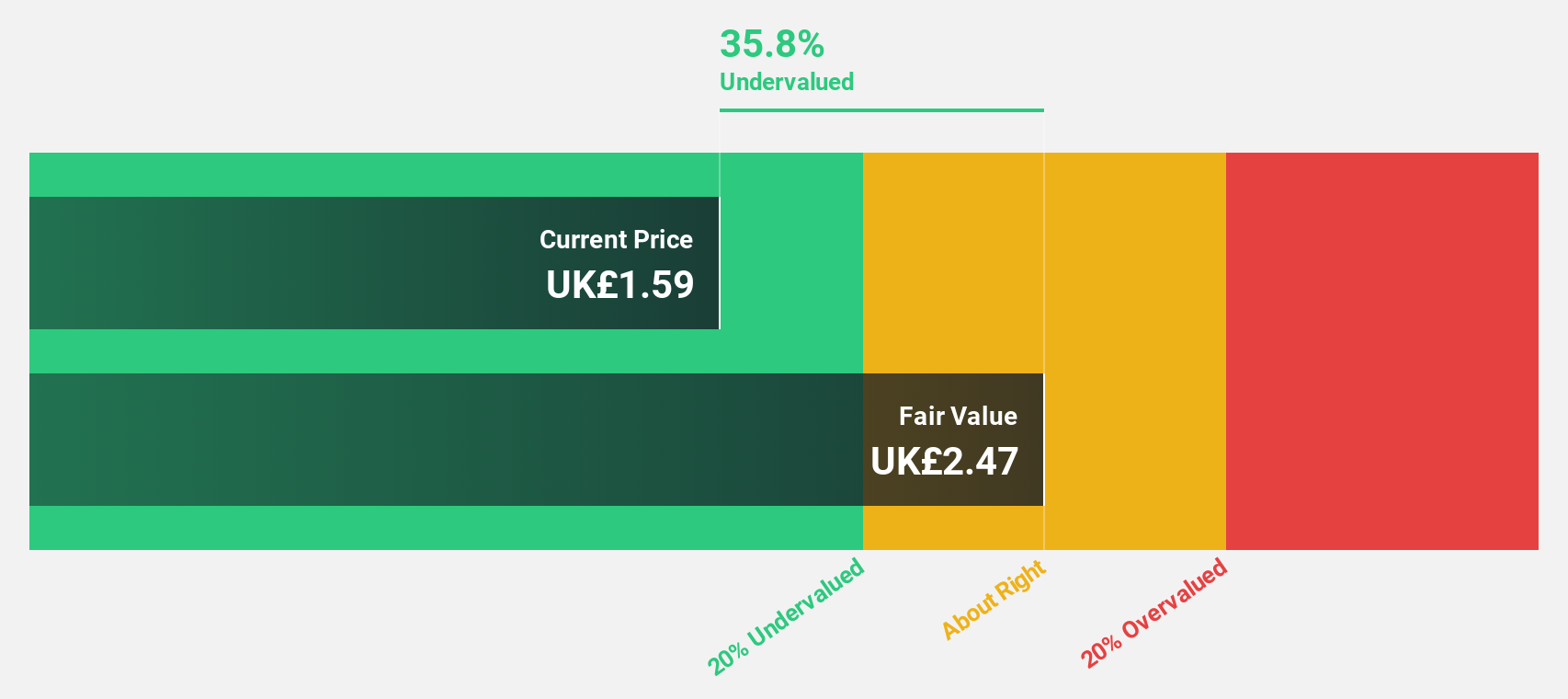

Estimated Discount To Fair Value: 38%

Man Group appears undervalued based on cash flows, trading 38% below its estimated fair value of £3.39. Despite a slower revenue growth forecast of 10.7% per year, earnings are expected to grow significantly at 35.74%, outpacing the UK market's average. However, profit margins have declined from last year and the dividend yield of 6.23% is not well covered by earnings. Recent board changes include Nicholas Peter Shires' appointment as Director in October 2025.

- According our earnings growth report, there's an indication that Man Group might be ready to expand.

- Take a closer look at Man Group's balance sheet health here in our report.

Just Group (LSE:JUST)

Overview: Just Group plc offers a range of retirement income products and services to individuals, homeowners, and corporate clients in the United Kingdom, with a market cap of £2.21 billion.

Operations: Just Group plc generates revenue through its diverse portfolio of retirement income products and services tailored for individual, homeowner, and corporate clients in the UK.

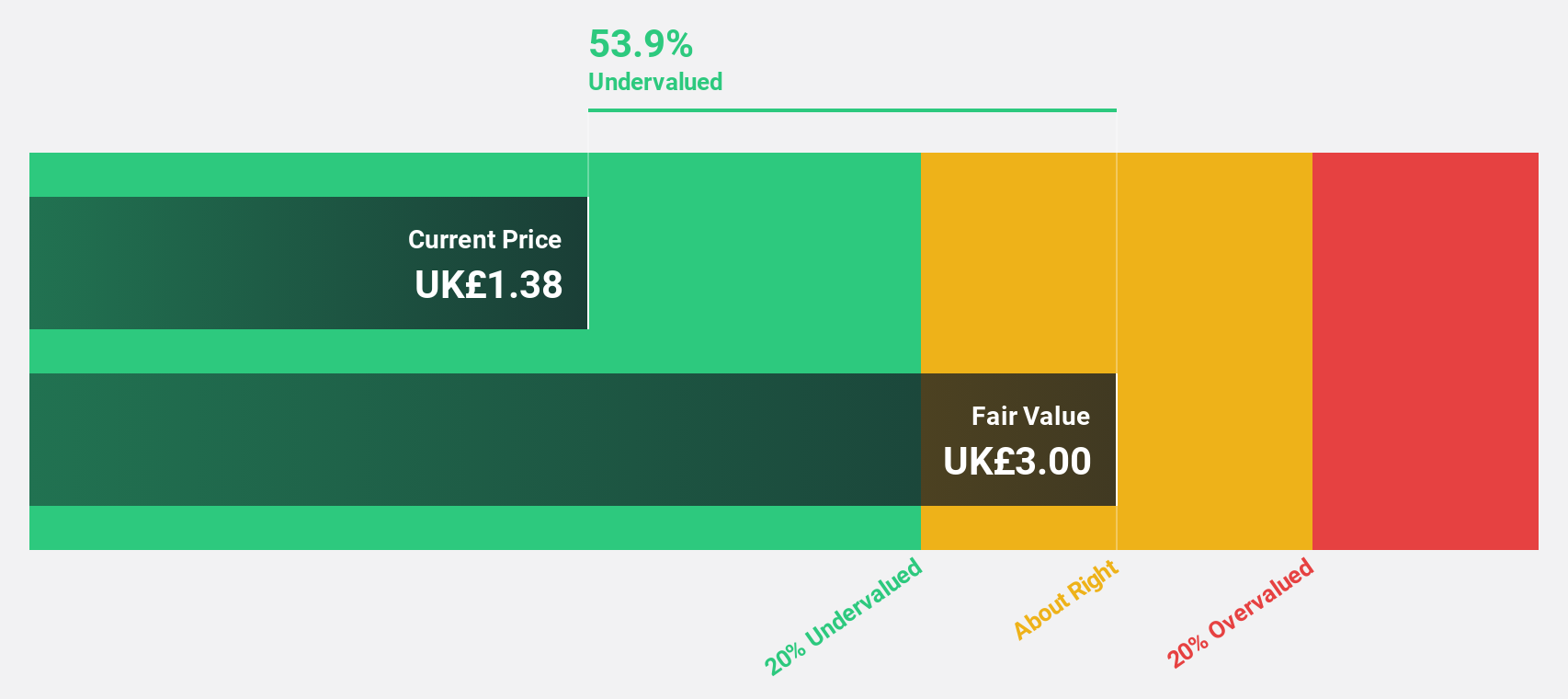

Estimated Discount To Fair Value: 19.8%

Just Group is trading 19.8% below its estimated fair value of £2.65, with revenue and earnings expected to grow significantly faster than the UK market at 24.3% and 21.4% per year, respectively. Despite this growth potential, profit margins have decreased from last year to 2.8%, and return on equity remains low at a forecasted 13.6%. The company recently increased its interim dividend for 2025 to £0.0084 per share, reflecting some confidence in future cash flows.

- In light of our recent growth report, it seems possible that Just Group's financial performance will exceed current levels.

- Click here to discover the nuances of Just Group with our detailed financial health report.

PageGroup (LSE:PAGE)

Overview: PageGroup plc operates as a recruitment consultancy offering services across the UK, Europe, the Middle East, Africa, Asia Pacific, and the Americas with a market cap of £736.38 million.

Operations: The company's revenue is primarily derived from recruitment services, amounting to £1.64 billion.

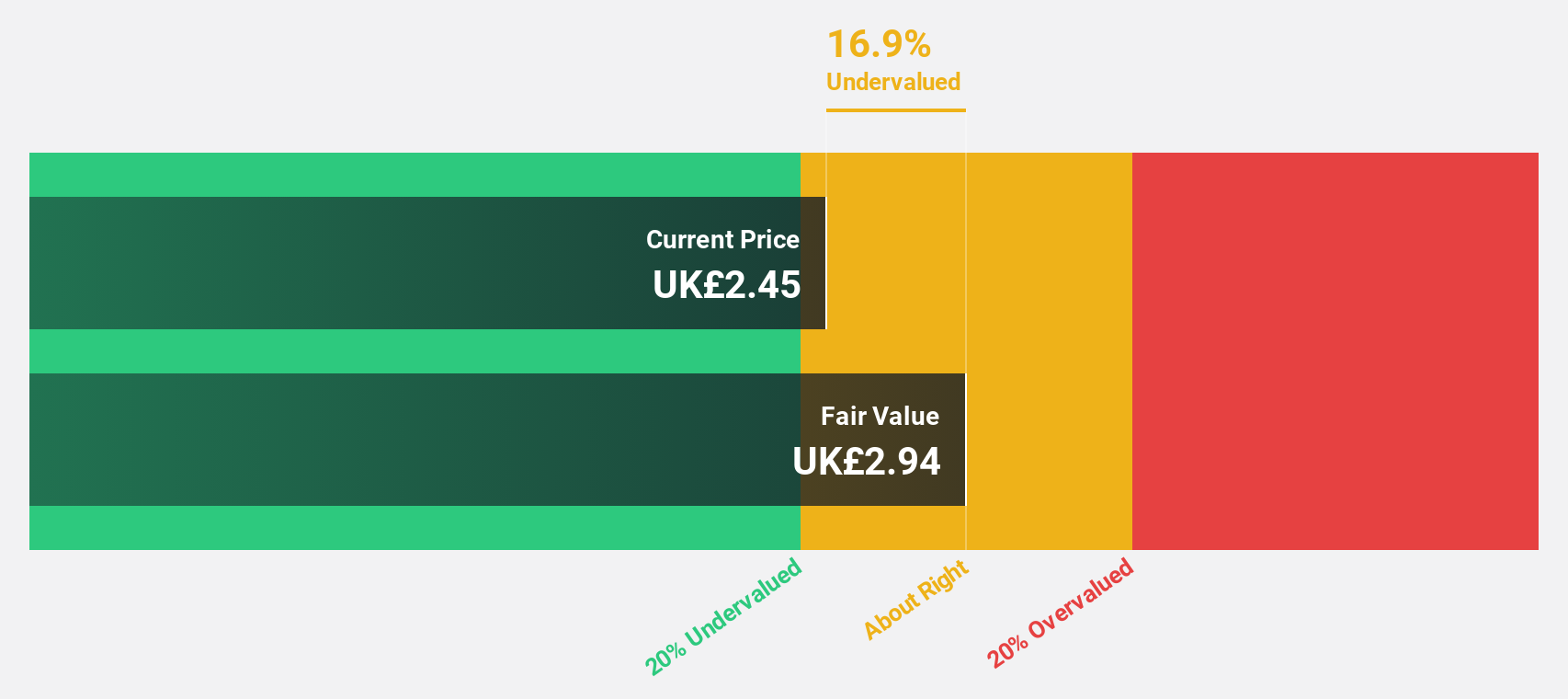

Estimated Discount To Fair Value: 48.7%

PageGroup is trading 48.7% below its estimated fair value of £4.6, despite earnings projected to grow significantly faster than the UK market at 69.8% annually over the next three years. However, profit margins have shrunk from last year to 0.7%, and its dividend yield of 7.25% isn't well covered by earnings or cash flows, raising sustainability concerns. Recent guidance adjustments indicate operating profits are expected to align closely with consensus forecasts at approximately £21 million for 2025.

- Our growth report here indicates PageGroup may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of PageGroup stock in this financial health report.

Make It Happen

- Unlock our comprehensive list of 52 Undervalued UK Stocks Based On Cash Flows by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:EMG

High growth potential, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives