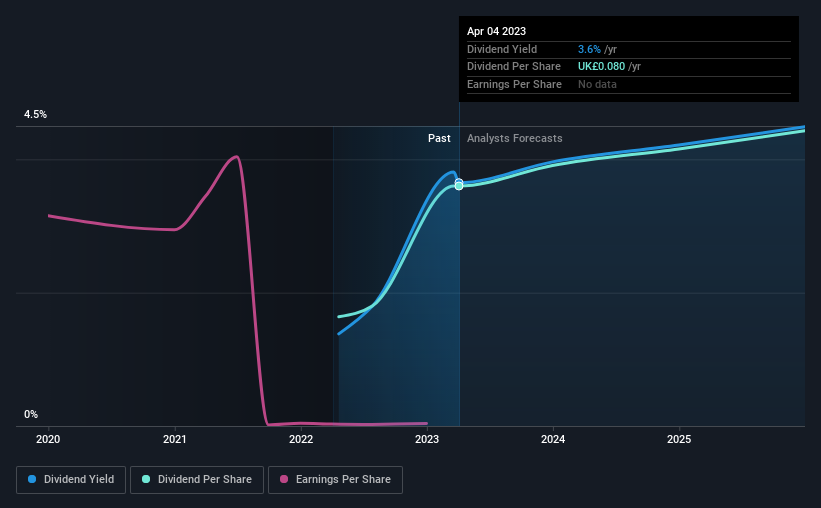

The board of Bridgepoint Group plc (LON:BPT) has announced that it will pay a dividend of £0.04 per share on the 23rd of May. Based on this payment, the dividend yield will be 3.6%, which is fairly typical for the industry.

See our latest analysis for Bridgepoint Group

Bridgepoint Group's Earnings Easily Cover The Distributions

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. Prior to this announcement, Bridgepoint Group's dividend was only 55% of earnings, however it was paying out 579% of free cash flows. The company might be more focused on returning cash to shareholders, but paying out this much of its cash flow could expose the dividend to being cut in the future.

The next year is set to see EPS grow by 16.2%. If the dividend continues along recent trends, we estimate the payout ratio will be 51%, which is in the range that makes us comfortable with the sustainability of the dividend.

Bridgepoint Group Is Still Building Its Track Record

Without a track record of dividend payments, we can't make a judgement on how stable it has been. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Dividend Has Limited Growth Potential

Investors could be attracted to the stock based on the quality of its payment history. Unfortunately things aren't as good as they seem. Bridgepoint Group's EPS has fallen by approximately 77% per year during the past three years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this becomes a long term trend.

The Dividend Could Prove To Be Unreliable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Bridgepoint Group's payments, as there could be some issues with sustaining them into the future. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've identified 3 warning signs for Bridgepoint Group (1 doesn't sit too well with us!) that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Bridgepoint Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:BPT

Bridgepoint Group

A private equity and private credit firm specializing in middle market, lower mid-market, small mid cap, small cap, growth capital, buyouts investments, syndicate debt, infrastructure, direct lending and credit opportunities in private credit investments.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives