- United Kingdom

- /

- Capital Markets

- /

- AIM:TAM

Getting In Cheap On Tatton Asset Management plc (LON:TAM) Is Unlikely

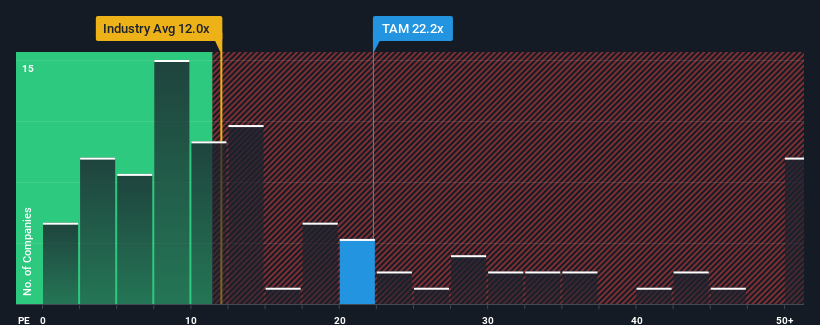

Tatton Asset Management plc's (LON:TAM) price-to-earnings (or "P/E") ratio of 22.2x might make it look like a sell right now compared to the market in the United Kingdom, where around half of the companies have P/E ratios below 15x and even P/E's below 8x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Tatton Asset Management as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Tatton Asset Management

How Is Tatton Asset Management's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Tatton Asset Management's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 14%. The latest three year period has also seen an excellent 99% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 8.8% per year as estimated by the five analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 13% per annum, which is noticeably more attractive.

In light of this, it's alarming that Tatton Asset Management's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Tatton Asset Management's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Tatton Asset Management's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Tatton Asset Management with six simple checks will allow you to discover any risks that could be an issue.

You might be able to find a better investment than Tatton Asset Management. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Tatton Asset Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:TAM

Tatton Asset Management

Through its subsidiaries, engages in the provision of discretionary fund management of investment on-platform and investment wrap services in the United Kingdom.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives