- United Kingdom

- /

- Diversified Financial

- /

- AIM:PCIP

Lacklustre Performance Is Driving PCI-PAL PLC's (LON:PCIP) Low P/S

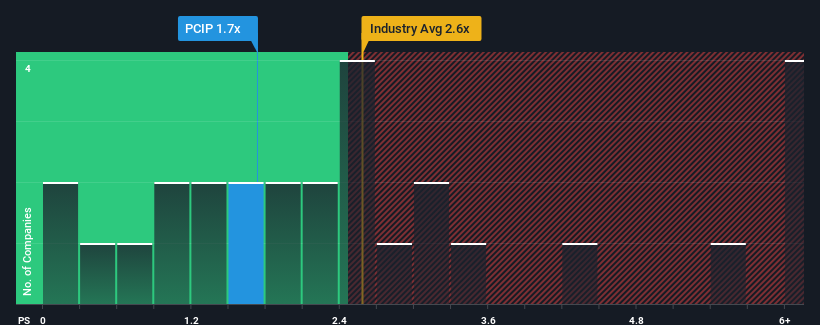

PCI-PAL PLC's (LON:PCIP) price-to-sales (or "P/S") ratio of 1.7x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Diversified Financial industry in the United Kingdom have P/S ratios greater than 2.6x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for PCI-PAL

How PCI-PAL Has Been Performing

Recent times have been pleasing for PCI-PAL as its revenue has risen in spite of the industry's average revenue going into reverse. One possibility is that the P/S ratio is low because investors think the company's revenue is going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think PCI-PAL's future stacks up against the industry? In that case, our free report is a great place to start.How Is PCI-PAL's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like PCI-PAL's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 25% last year. The latest three year period has also seen an excellent 240% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 28% over the next year. With the industry predicted to deliver 108% growth, the company is positioned for a weaker revenue result.

With this information, we can see why PCI-PAL is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From PCI-PAL's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of PCI-PAL's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 5 warning signs for PCI-PAL (1 is significant!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:PCIP

PCI-PAL

Through its subsidiaries, engages in the provision of payment card industry (PCI) compliance solutions and telephony services primarily in the United Kingdom, the United States, Canada, rest of Europe, and the Asia Pacific.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives