- United Kingdom

- /

- Diversified Financial

- /

- AIM:PCIP

A Piece Of The Puzzle Missing From PCI-PAL PLC's (LON:PCIP) Share Price

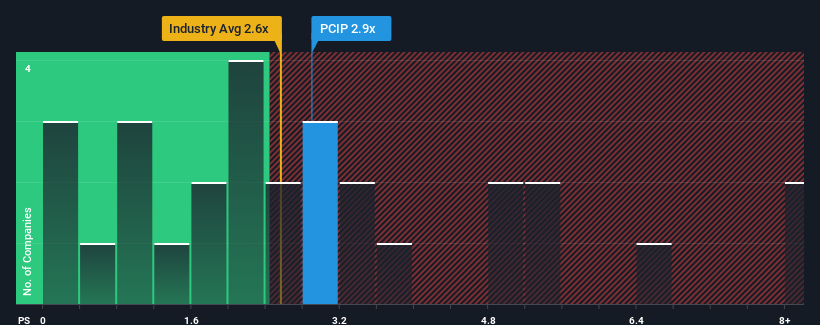

There wouldn't be many who think PCI-PAL PLC's (LON:PCIP) price-to-sales (or "P/S") ratio of 2.9x is worth a mention when the median P/S for the Diversified Financial industry in the United Kingdom is similar at about 2.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for PCI-PAL

How Has PCI-PAL Performed Recently?

With revenue growth that's inferior to most other companies of late, PCI-PAL has been relatively sluggish. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on PCI-PAL will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For PCI-PAL?

The only time you'd be comfortable seeing a P/S like PCI-PAL's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 20% last year. Pleasingly, revenue has also lifted 196% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 26% as estimated by the lone analyst watching the company. That would be an excellent outcome when the industry is expected to decline by 3.5%.

With this in mind, we find it intriguing that PCI-PAL's P/S trades in-line with its industry peers. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We note that even though PCI-PAL trades at a similar P/S as the rest of the industry, it far eclipses them in terms of forecasted revenue growth. Given the glowing revenue forecasts, we can only assume potential risks are what might be capping the P/S ratio at its current levels. The market could be pricing in the event that tough industry conditions will impact future revenues. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

And what about other risks? Every company has them, and we've spotted 4 warning signs for PCI-PAL (of which 1 is a bit concerning!) you should know about.

If these risks are making you reconsider your opinion on PCI-PAL, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:PCIP

PCI-PAL

Through its subsidiaries, engages in the provision of payment card industry (PCI) compliance solutions and telephony services primarily in the United Kingdom, the United States, Canada, rest of Europe, and the Asia Pacific.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives