- United Kingdom

- /

- Capital Markets

- /

- AIM:MERC

Mercia Asset Management (LON:MERC) Share Prices Have Dropped 43% In The Last Five Years

While not a mind-blowing move, it is good to see that the Mercia Asset Management PLC (LON:MERC) share price has gained 14% in the last three months. But if you look at the last five years the returns have not been good. You would have done a lot better buying an index fund, since the stock has dropped 43% in that half decade.

Check out our latest analysis for Mercia Asset Management

Given that Mercia Asset Management didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

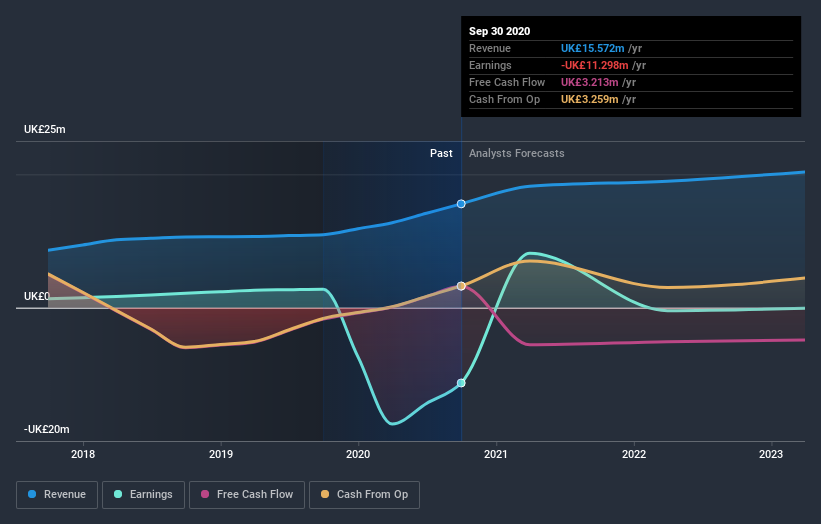

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Mercia Asset Management will earn in the future (free profit forecasts).

A Different Perspective

We regret to report that Mercia Asset Management shareholders are down 6.5% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 4.1%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, longer term shareholders are suffering worse, given the loss of 7% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Mercia Asset Management is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you decide to trade Mercia Asset Management, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:MERC

Mercia Asset Management

A private equity and venture capital firm specializing in incubation, venture debt, loan, mezzanine, seed EIS, early stage, emerging growth, mid venture, late venture, later stage, buyout, and growth capital investments.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives