- United Kingdom

- /

- Consumer Finance

- /

- AIM:MCL

Did You Manage To Avoid Morses Club's (LON:MCL) Painful 55% Share Price Drop?

This month, we saw the Morses Club PLC (LON:MCL) up an impressive 105%. But that doesn't change the fact that the returns over the last year have been disappointing. Like an arid lake in a warming world, shareholder value has evaporated, with the share price down 55% in that time. So the bounce should be viewed in that context. Arguably, the fall was overdone.

Check out our latest analysis for Morses Club

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

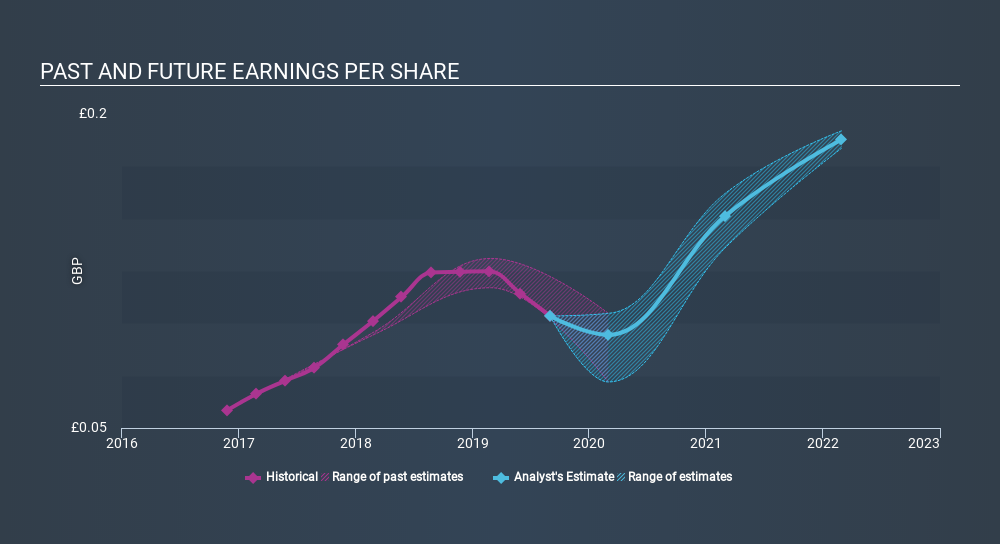

Unhappily, Morses Club had to report a 17% decline in EPS over the last year. The share price decline of 55% is actually more than the EPS drop. This suggests the EPS fall has made some shareholders are more nervous about the business. The less favorable sentiment is reflected in its current P/E ratio of 7.10.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Morses Club the TSR over the last year was -53%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

The last twelve months weren't great for Morses Club shares, which performed worse than the market, costing holders 53% , including dividends . The market shed around 15%, no doubt weighing on the stock price. The three-year loss of 14% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand Morses Club better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Morses Club you should know about.

Morses Club is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About AIM:MCL

Morses Club

Morses Club PLC provides non-standard financial services in the United Kingdom.

Good value with adequate balance sheet.

Market Insights

Community Narratives