- United Kingdom

- /

- Capital Markets

- /

- AIM:FEN

How Much Is Frenkel Topping Group's (LON:FEN) CEO Getting Paid?

The CEO of Frenkel Topping Group Plc (LON:FEN) is Richard Fraser, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also assess whether Frenkel Topping Group pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Check out our latest analysis for Frenkel Topping Group

How Does Total Compensation For Richard Fraser Compare With Other Companies In The Industry?

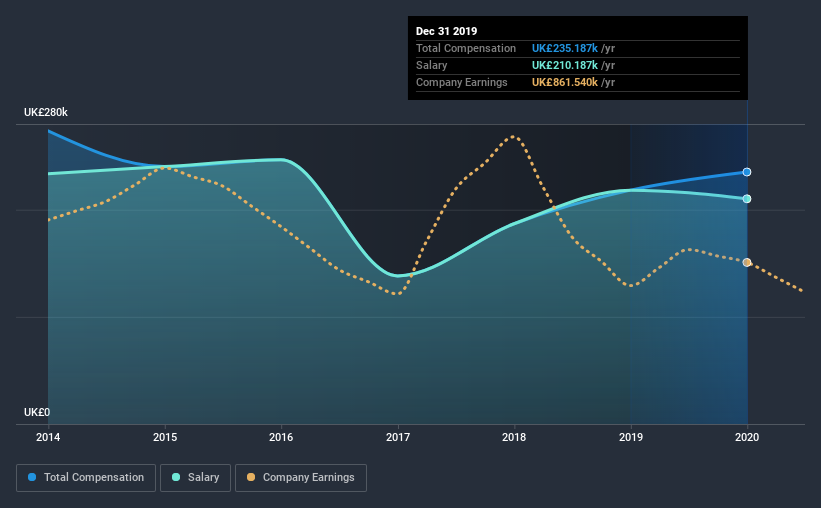

According to our data, Frenkel Topping Group Plc has a market capitalization of UK£44m, and paid its CEO total annual compensation worth UK£235k over the year to December 2019. That's a fairly small increase of 7.8% over the previous year. We note that the salary portion, which stands at UK£210.2k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below UK£149m, we found that the median total CEO compensation was UK£243k. This suggests that Frenkel Topping Group remunerates its CEO largely in line with the industry average. Moreover, Richard Fraser also holds UK£887k worth of Frenkel Topping Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | UK£210k | UK£218k | 89% |

| Other | UK£25k | - | 11% |

| Total Compensation | UK£235k | UK£218k | 100% |

Speaking on an industry level, nearly 49% of total compensation represents salary, while the remainder of 51% is other remuneration. According to our research, Frenkel Topping Group has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Frenkel Topping Group Plc's Growth

Over the last three years, Frenkel Topping Group Plc has shrunk its earnings per share by 16% per year. In the last year, its revenue is up 10%.

The decline in EPS is a bit concerning. And while it's good to see some good revenue growth recently, the growth isn't really fast enough for us to put aside my concerns around EPS. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Frenkel Topping Group Plc Been A Good Investment?

Since shareholders would have lost about 8.3% over three years, some Frenkel Topping Group Plc investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

As we touched on above, Frenkel Topping Group Plc is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. On the other hand, EPS growth and total shareholder return have been negative for the last three years. Considering overall performance, shareholders will likely hold off support for a raise until results improve.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 4 warning signs for Frenkel Topping Group that investors should be aware of in a dynamic business environment.

Important note: Frenkel Topping Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade Frenkel Topping Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:FEN

Frenkel Topping Group

Provides professional and financial services in the personal injury and clinical negligence field in the United Kingdom.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success