- United Kingdom

- /

- Diversified Financial

- /

- AIM:CIN

A Look At City of London Group's (LON:CIN) Share Price Returns

City of London Group plc (LON:CIN) shareholders should be happy to see the share price up 15% in the last quarter. But in truth the last year hasn't been good for the share price. After all, the share price is down 37% in the last year, significantly under-performing the market.

See our latest analysis for City of London Group

City of London Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

City of London Group grew its revenue by 21% over the last year. We think that is pretty nice growth. Meanwhile, the share price is down 37% over twelve months, which is disappointing given the progress made. This implies the market was expecting better growth. But if revenue keeps growing, then at a certain point the share price would likely follow.

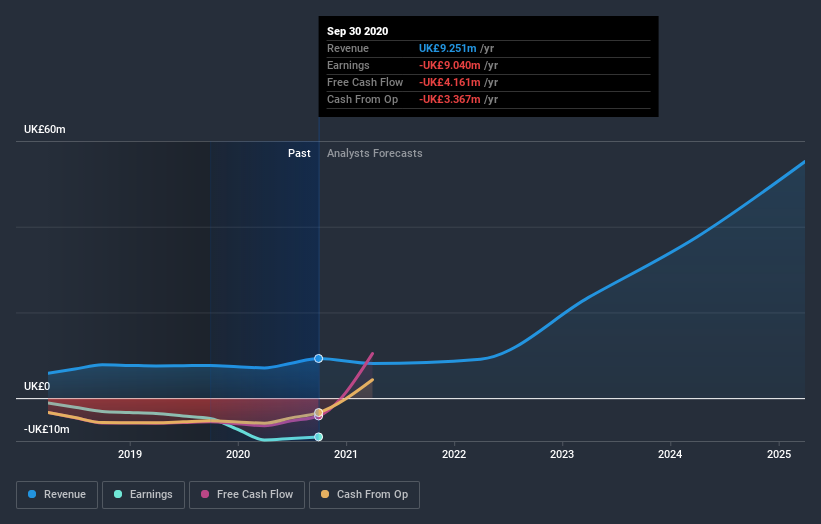

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

The last twelve months weren't great for City of London Group shares, which performed worse than the market, costing holders 37%. Meanwhile, the broader market slid about 2.8%, likely weighing on the stock. The three-year loss of 5% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that City of London Group is showing 4 warning signs in our investment analysis , and 2 of those don't sit too well with us...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you’re looking to trade City of London Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:CIN

City of London Group

City of London Group plc primarily focuses on the provision of finance to the SME sector in the United Kingdom and internationally.

Adequate balance sheet and slightly overvalued.