- United Kingdom

- /

- IT

- /

- AIM:MTEC

Cavendish Financial Leads 3 Prominent Penny Stocks On UK Exchange

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic concerns. Amid such market conditions, investors often seek opportunities in less conventional areas like penny stocks. Despite being an outdated term, penny stocks can still offer potential growth opportunities for those interested in smaller or newer companies with strong financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| FRP Advisory Group (AIM:FRP) | £1.42 | £348.23M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.14 | £806.26M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.915 | £473.73M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.29 | £426.67M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.42 | £121.23M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.57 | £183.08M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.08 | £194.41M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.398 | £215.61M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.48 | £188.48M | ★★★★★☆ |

| Character Group (AIM:CCT) | £2.74 | £51.44M | ★★★★★★ |

Click here to see the full list of 474 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Cavendish Financial (AIM:CAV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cavendish Financial plc offers a range of financial services to growth companies in the United Kingdom, with a market cap of £39.33 million.

Operations: The company generates £47.37 million in revenue from its services in corporate advisory, mergers and acquisitions advisory, and institutional stockbroking.

Market Cap: £39.33M

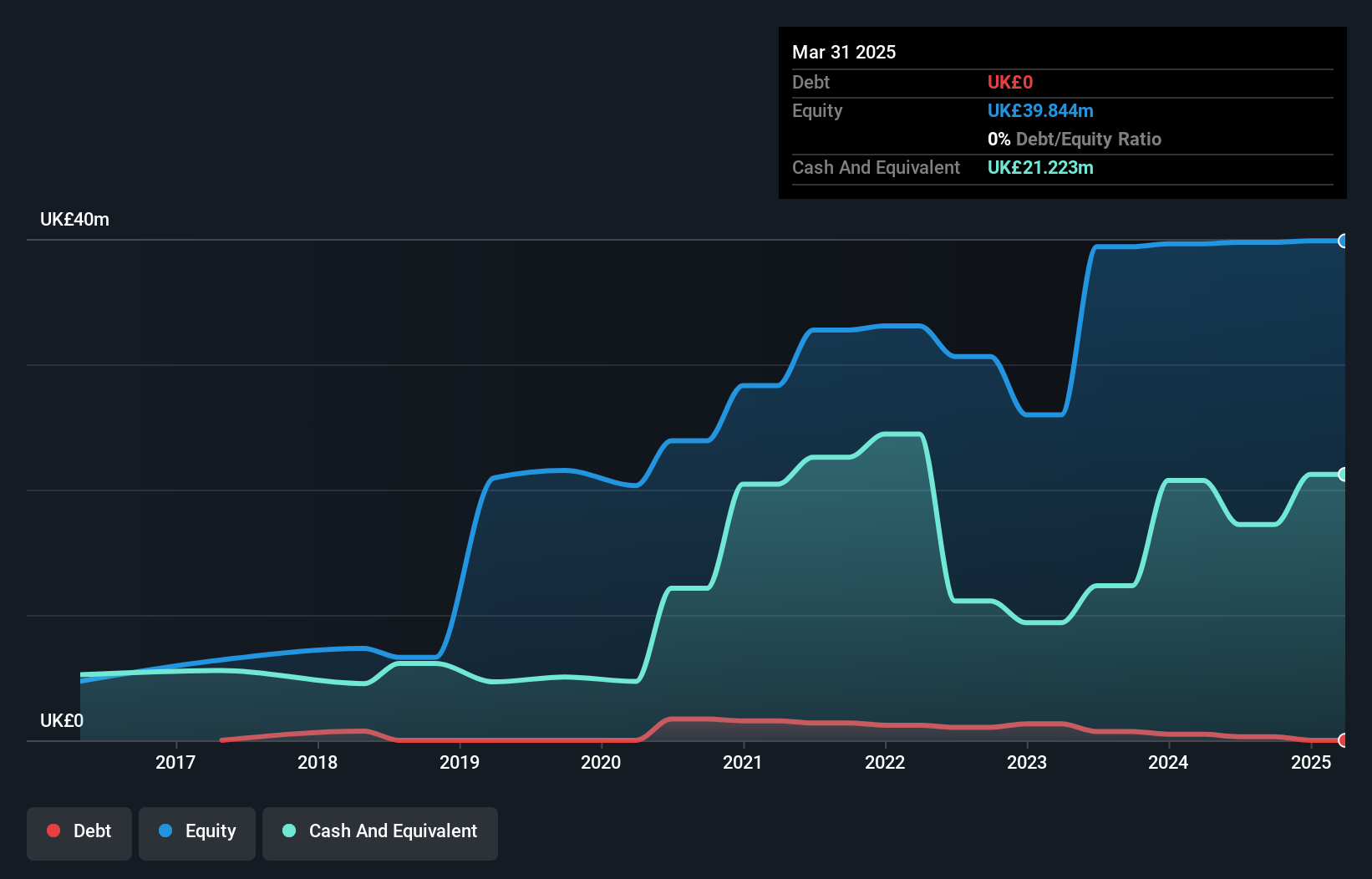

Cavendish Financial plc, with a market cap of £39.33 million and revenue of £47.37 million, offers financial services including corporate advisory and institutional stockbroking. The company is currently unprofitable, experiencing increased losses over the past five years at a rate of 42.8% per year. Despite having more cash than total debt and short-term assets exceeding both short and long-term liabilities, shareholders faced dilution with shares outstanding growing by 6.7%. The management team and board are relatively new, averaging 1.1 years in tenure, while the dividend yield of 2.38% is not well covered by earnings.

- Dive into the specifics of Cavendish Financial here with our thorough balance sheet health report.

- Assess Cavendish Financial's previous results with our detailed historical performance reports.

Made Tech Group (AIM:MTEC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Made Tech Group Plc is a holding company that offers digital, data, and technology services to the public sector in the United Kingdom, with a market cap of £27.23 million.

Operations: The company generates revenue of £38.57 million from its Computer Graphics segment.

Market Cap: £27.23M

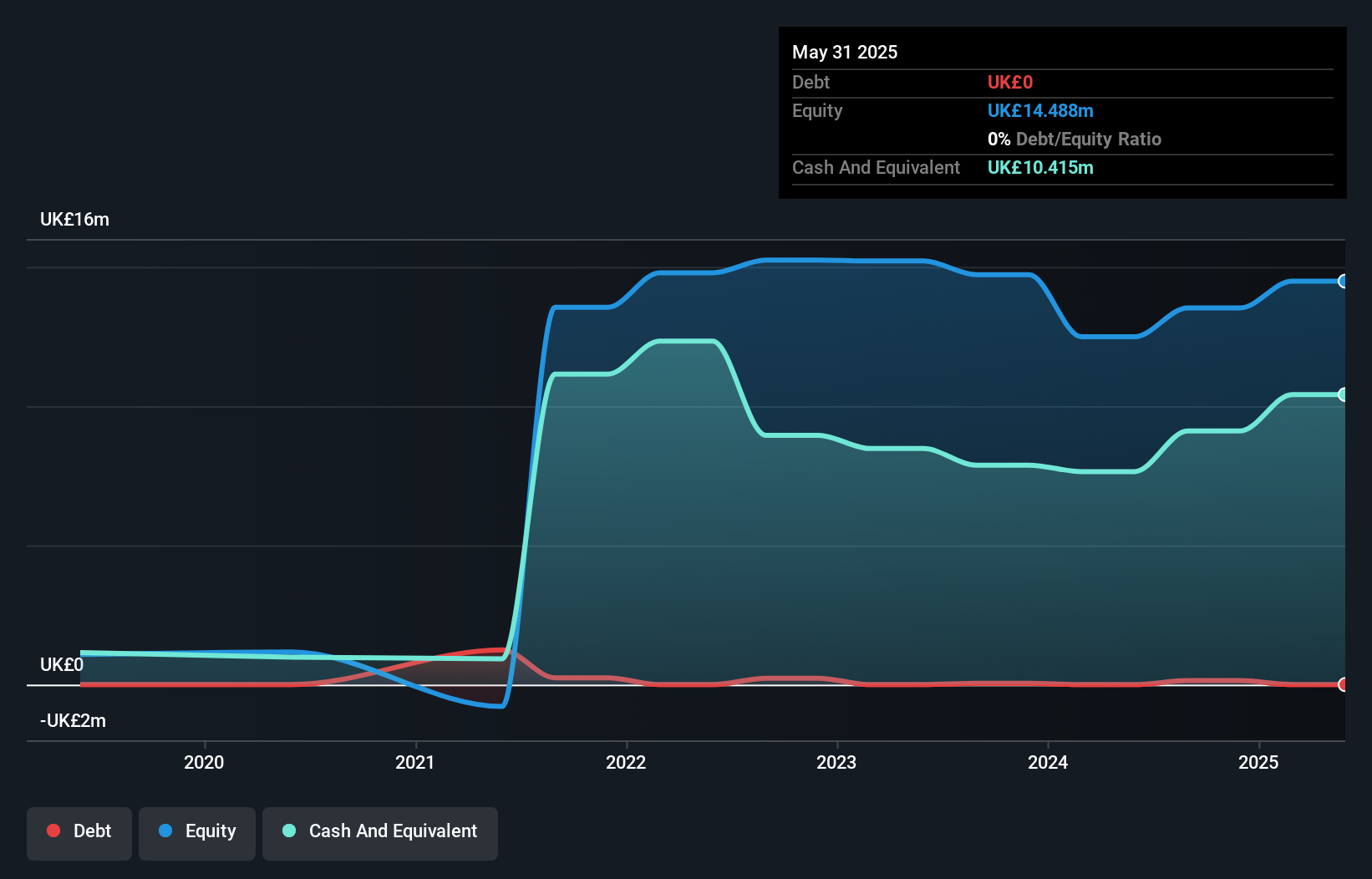

Made Tech Group Plc, with a market cap of £27.23 million, is currently unprofitable and has seen its losses grow by 49.4% annually over the past five years. Despite trading at a discount to its estimated fair value and having no debt, the company's negative return on equity reflects ongoing financial challenges. However, Made Tech's short-term assets significantly exceed both its short- and long-term liabilities, providing some financial stability. Recent developments include securing a £13.2 million contract with the Department for Education to enhance digital services for national curriculum assessments, potentially boosting future revenue streams.

- Take a closer look at Made Tech Group's potential here in our financial health report.

- Understand Made Tech Group's track record by examining our performance history report.

TPXimpact Holdings (AIM:TPX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: TPXimpact Holdings plc, along with its subsidiaries, offers digital native technology services across various countries including the United Kingdom, Norway, Switzerland, Germany, the United States, and Malaysia; it has a market capitalization of £31.52 million.

Operations: The company's revenue is derived from several segments: KITS (£8.03 million), Redcortex (£4.40 million), Consulting (£60.55 million), Data and Insights (£7.81 million), and Digital Experience (£11.58 million).

Market Cap: £31.52M

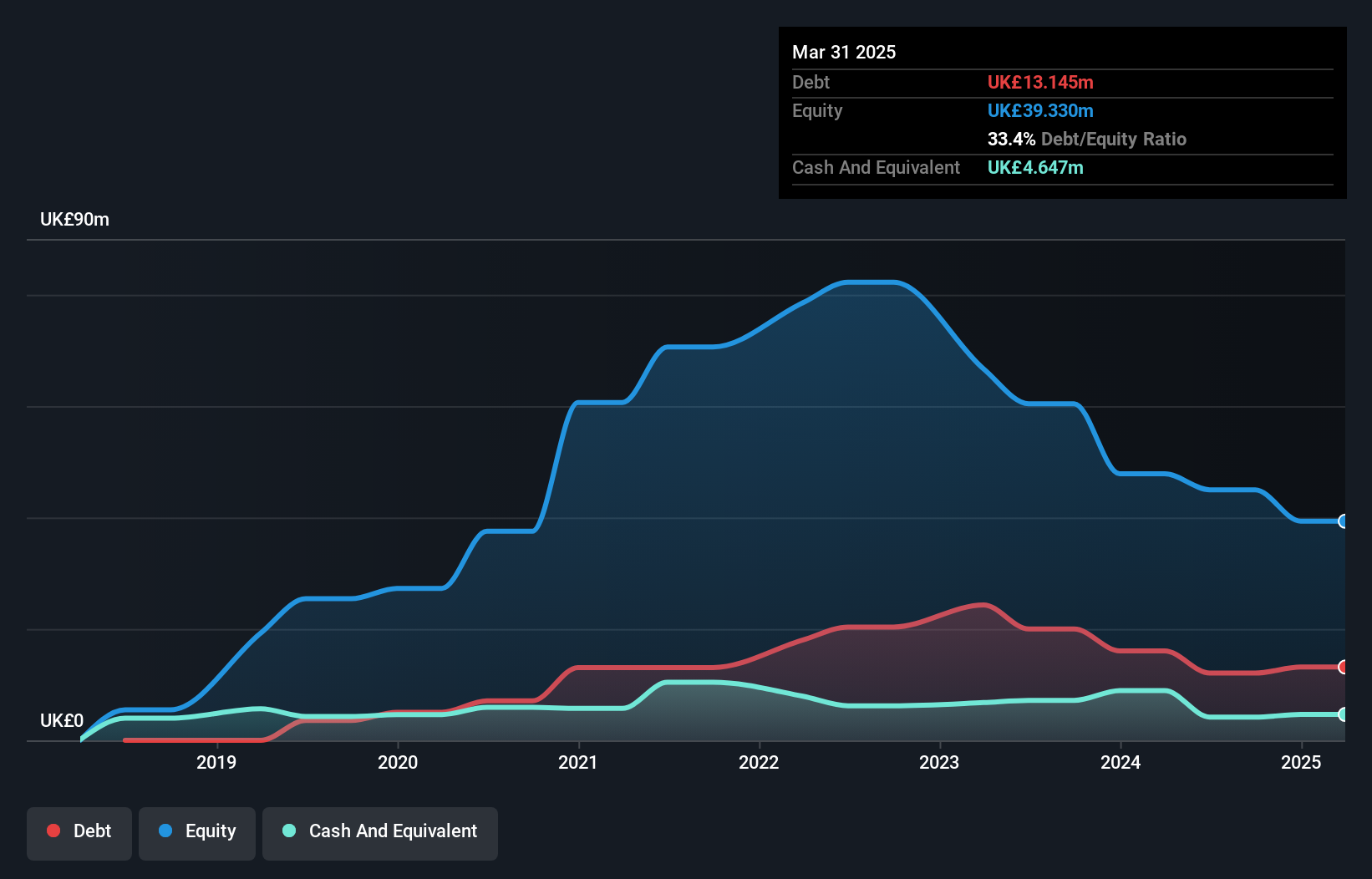

TPXimpact Holdings, with a market cap of £31.52 million, remains unprofitable despite having sufficient cash runway for over three years due to positive free cash flow. The company trades at a significant discount to its estimated fair value and maintains a satisfactory net debt to equity ratio of 14.9%. While short-term assets exceed both short- and long-term liabilities, losses have increased by 60.7% annually over the past five years. Recent guidance indicates flat revenue growth for FY25, following FY24's revenue of £84.3 million, highlighting ongoing financial challenges despite stable weekly volatility.

- Click here to discover the nuances of TPXimpact Holdings with our detailed analytical financial health report.

- Evaluate TPXimpact Holdings' prospects by accessing our earnings growth report.

Seize The Opportunity

- Take a closer look at our UK Penny Stocks list of 474 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MTEC

Made Tech Group

Through its subsidiaries, provides digital, data, and technology services to the public sector in the United Kingdom.

Excellent balance sheet and good value.