- United Kingdom

- /

- Capital Markets

- /

- AIM:BPM

B.P. Marsh & Partners PLC's (LON:BPM) CEO Compensation Looks Acceptable To Us And Here's Why

The performance at B.P. Marsh & Partners PLC (LON:BPM) has been rather lacklustre of late and shareholders may be wondering what CEO Alice Hannah Foulk is planning to do about this. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 14 July 2021. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

See our latest analysis for B.P. Marsh & Partners

Comparing B.P. Marsh & Partners PLC's CEO Compensation With the industry

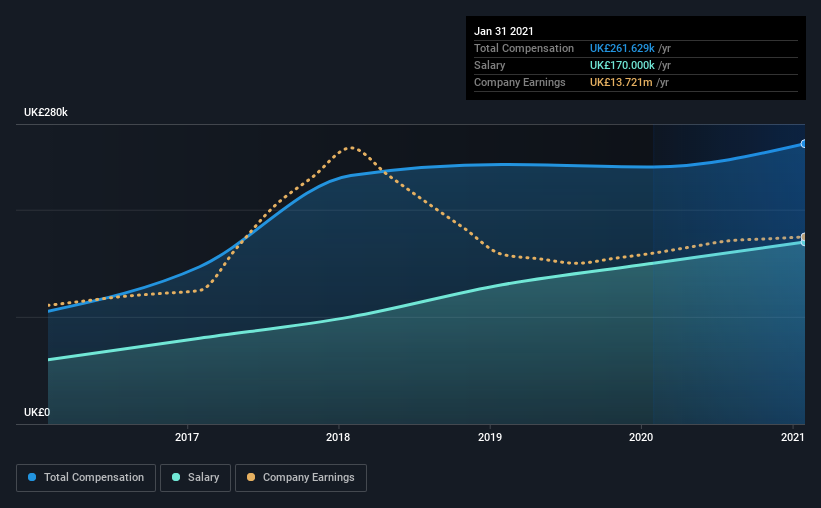

Our data indicates that B.P. Marsh & Partners PLC has a market capitalization of UK£122m, and total annual CEO compensation was reported as UK£262k for the year to January 2021. That's a notable increase of 9.0% on last year. Notably, the salary which is UK£170.0k, represents most of the total compensation being paid.

For comparison, other companies in the same industry with market capitalizations ranging between UK£73m and UK£290m had a median total CEO compensation of UK£465k. In other words, B.P. Marsh & Partners pays its CEO lower than the industry median. Furthermore, Alice Hannah Foulk directly owns UK£700k worth of shares in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | UK£170k | UK£150k | 65% |

| Other | UK£92k | UK£90k | 35% |

| Total Compensation | UK£262k | UK£240k | 100% |

Talking in terms of the industry, salary represented approximately 47% of total compensation out of all the companies we analyzed, while other remuneration made up 53% of the pie. According to our research, B.P. Marsh & Partners has allocated a higher percentage of pay to salary in comparison to the wider industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at B.P. Marsh & Partners PLC's Growth Numbers

Over the last three years, B.P. Marsh & Partners PLC has shrunk its earnings per share by 18% per year. In the last year, its revenue is up 4.3%.

Overall this is not a very positive result for shareholders. And the modest revenue growth over 12 months isn't much comfort against the reduced EPS. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has B.P. Marsh & Partners PLC Been A Good Investment?

B.P. Marsh & Partners PLC has generated a total shareholder return of 22% over three years, so most shareholders would be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

Shareholder returns while positive, need to be looked at along with earnings, which have failed to grow and this could mean that the current momentum may not continue. Shareholders might want to question the board about these concerns, and revisit their investment thesis for the company.

So you may want to check if insiders are buying B.P. Marsh & Partners shares with their own money (free access).

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading B.P. Marsh & Partners or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if B.P. Marsh & Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:BPM

B.P. Marsh & Partners

Invests in early-stage and SME financial services intermediary businesses in the United Kingdom and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success