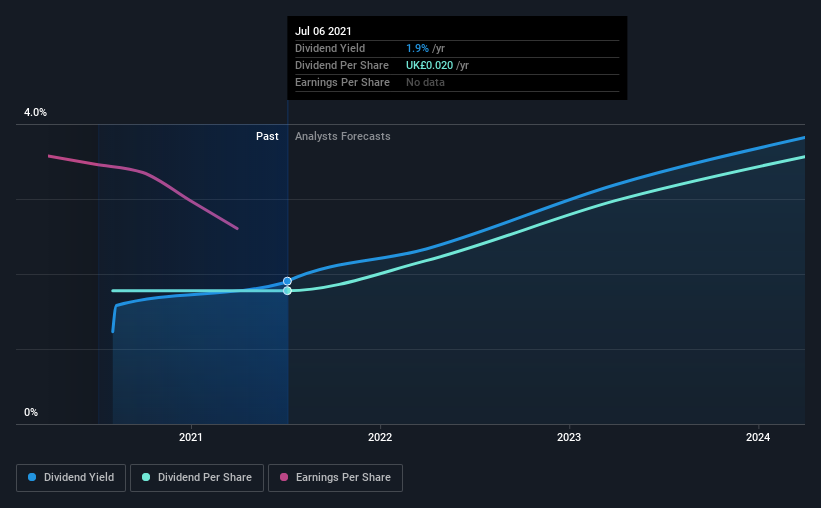

Argentex Group Plc (LON:AGFX) will pay a dividend of UK£0.02 on the 13th of September. Including this payment, the dividend yield on the stock will be 1.9%, which is a modest boost for shareholders' returns.

View our latest analysis for Argentex Group

Argentex Group's Earnings Easily Cover the Distributions

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Based on the last payment, Argentex Group was earning enough to cover the dividend, but free cash flows weren't positive. We think that cash flows should take priority over earnings, so this is definitely a worry for the dividend going forward.

Unless the company can turn things around, EPS could fall by 27.1% over the next year. If the dividend continues along recent trends, we estimate the payout ratio could be 53%, which we consider to be quite comfortable, with most of the company's earnings left over to grow the business in the future.

Argentex Group Doesn't Have A Long Payment History

Without a track record of dividend payments, we can't make a judgement on how stable it has been. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

Dividend Growth Potential Is Shaky

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. However, things aren't all that rosy. Over the last 12 months, earnings are down by 27%. That's not great to see, but there could be a number of reasons for this. Should the decline continue, we would become concerned. Any one year of performance can be misleading for a variety of reasons, so we wouldn't like to form any strong conclusions based on these numbers alone.

The Dividend Could Prove To Be Unreliable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. While the low payout ratio is redeeming feature, this is offset by the minimal cash to cover the payments. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 2 warning signs for Argentex Group that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you decide to trade Argentex Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:AGFX

Argentex Group

Provides currency risk management, payment, and alternative banking solutions in the United Kingdom, the Netherlands, the United Arab Emirates, and Australia.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives