It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like ADVFN (LON:AFN). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide ADVFN with the means to add long-term value to shareholders.

Check out the opportunities and risks within the GB Capital Markets industry.

ADVFN's Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So for many budding investors, improving EPS is considered a good sign. It is awe-striking that ADVFN's EPS went from UK£0.017 to UK£0.059 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

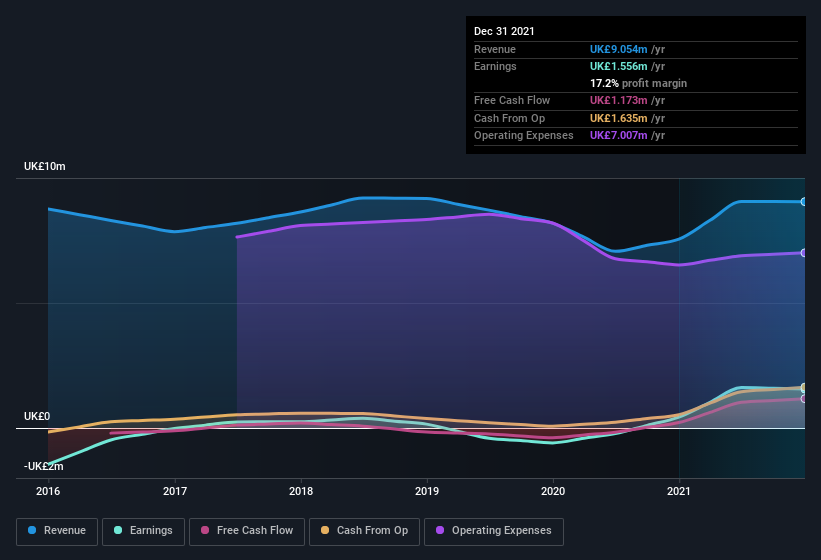

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. ADVFN reported flat revenue and EBIT margins over the last year. That's not bad, but it doesn't point to ongoing future growth, either.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since ADVFN is no giant, with a market capitalisation of UK£9.9m, you should definitely check its cash and debt before getting too excited about its prospects.

Are ADVFN Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So those who are interested in ADVFN will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Owning 40% of the company, insiders have plenty riding on the performance of the the share price. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. Although, with ADVFN being valued at UK£9.9m, this is a small company we're talking about. So this large proportion of shares owned by insiders only amounts to UK£4.0m. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

Is ADVFN Worth Keeping An Eye On?

ADVFN's earnings have taken off in quite an impressive fashion. This level of EPS growth does wonders for attracting investment, and the large insider investment in the company is just the cherry on top. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So based on this quick analysis, we do think it's worth considering ADVFN for a spot on your watchlist. Before you take the next step you should know about the 2 warning signs for ADVFN that we have uncovered.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:AFN

ADVFN

Together with subsidiaries, develops and provides financial information through the internet and research services in the United Kingdom and internationally.

Excellent balance sheet low.

Market Insights

Community Narratives