Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that The Restaurant Group plc (LON:RTN) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Restaurant Group

How Much Debt Does Restaurant Group Carry?

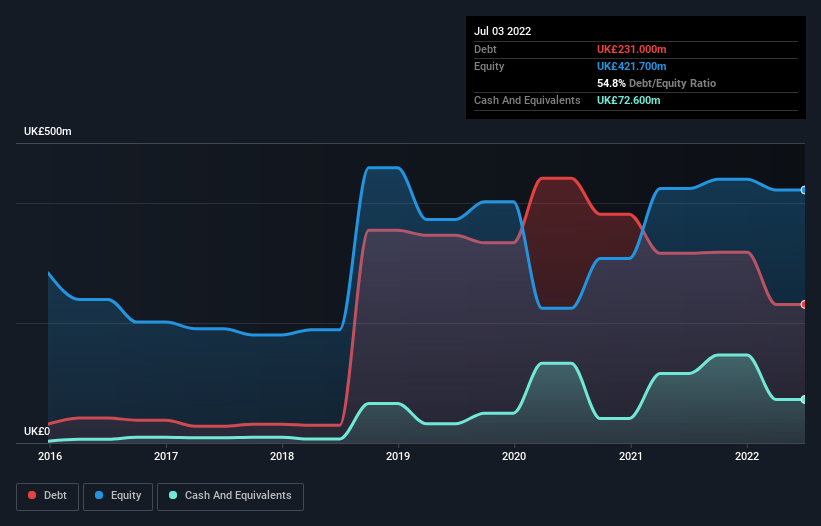

You can click the graphic below for the historical numbers, but it shows that Restaurant Group had UK£231.0m of debt in July 2022, down from UK£316.0m, one year before. However, because it has a cash reserve of UK£72.6m, its net debt is less, at about UK£158.4m.

How Healthy Is Restaurant Group's Balance Sheet?

According to the last reported balance sheet, Restaurant Group had liabilities of UK£212.7m due within 12 months, and liabilities of UK£616.9m due beyond 12 months. On the other hand, it had cash of UK£72.6m and UK£17.7m worth of receivables due within a year. So it has liabilities totalling UK£739.3m more than its cash and near-term receivables, combined.

This deficit casts a shadow over the UK£237.9m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Restaurant Group would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Given net debt is only 1.2 times EBITDA, it is initially surprising to see that Restaurant Group's EBIT has low interest coverage of 2.3 times. So while we're not necessarily alarmed we think that its debt is far from trivial. Notably, Restaurant Group made a loss at the EBIT level, last year, but improved that to positive EBIT of UK£92m in the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Restaurant Group can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Over the last year, Restaurant Group actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

We'd go so far as to say Restaurant Group's level of total liabilities was disappointing. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Restaurant Group stock a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. Given our hesitation about the stock, it would be good to know if Restaurant Group insiders have sold any shares recently. You click here to find out if insiders have sold recently.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:RTN

Restaurant Group

The Restaurant Group plc operates restaurants and pubs in the United Kingdom.

Fair value with moderate growth potential.

Market Insights

Community Narratives