- United Kingdom

- /

- IT

- /

- LSE:KNOS

UK Stocks Trading Up To 43.9% Below Intrinsic Value Estimates

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently faced downward pressure, influenced by weak trade data from China, a key trading partner, highlighting the interconnectedness of global markets. Despite these challenges, opportunities may arise for investors seeking undervalued stocks that are trading below their intrinsic value estimates. In such uncertain times, identifying stocks with strong fundamentals and potential for growth can be crucial for navigating market volatility effectively.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Victrex (LSE:VCT) | £7.99 | £15.61 | 48.8% |

| Velocity Composites (AIM:VEL) | £0.27 | £0.49 | 44.9% |

| SDI Group (AIM:SDI) | £0.715 | £1.34 | 46.8% |

| Just Group (LSE:JUST) | £1.486 | £2.95 | 49.7% |

| Informa (LSE:INF) | £8.008 | £14.47 | 44.7% |

| Huddled Group (AIM:HUD) | £0.0335 | £0.06 | 44% |

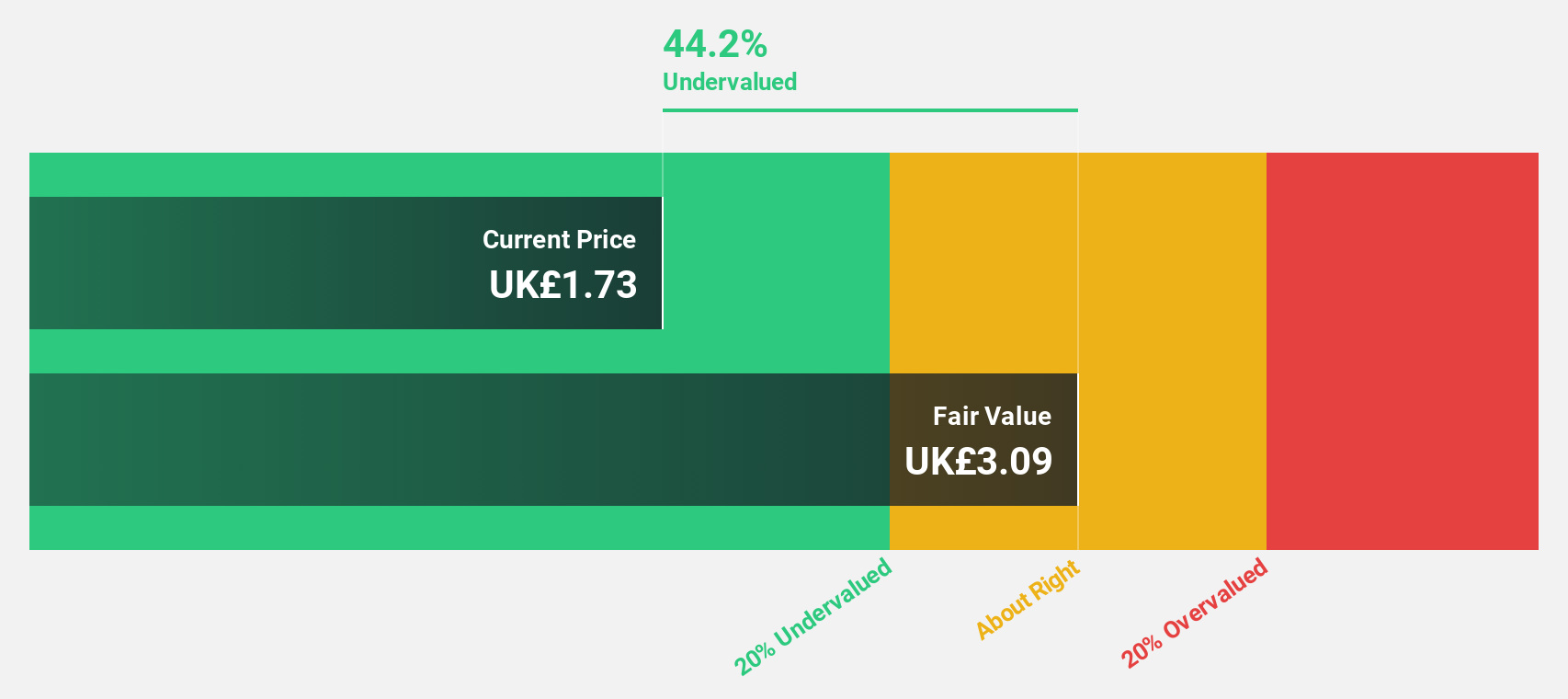

| GlobalData (AIM:DATA) | £1.74 | £3.10 | 43.9% |

| Entain (LSE:ENT) | £7.504 | £13.70 | 45.2% |

| Duke Capital (AIM:DUKE) | £0.2875 | £0.53 | 46.1% |

| Deliveroo (LSE:ROO) | £1.757 | £3.13 | 43.8% |

Let's uncover some gems from our specialized screener.

GlobalData (AIM:DATA)

Overview: GlobalData Plc, along with its subsidiaries, offers business information through proprietary data, analytics, and insights across Europe, North America, and the Asia Pacific regions with a market cap of £1.32 billion.

Operations: The company's revenue segments include £109.40 million from Data, Analytics and Insights in Healthcare and £176.10 million from Non-Healthcare sectors.

Estimated Discount To Fair Value: 43.9%

GlobalData is trading at £1.74, significantly below its estimated fair value of £3.10, indicating potential undervaluation based on discounted cash flow analysis. Earnings are projected to grow 23.68% annually over the next three years, outpacing both revenue growth and the broader UK market's earnings growth rate. Despite recent acquisition interest from KKR being terminated due to unmet terms, discussions with ICG continue, potentially impacting future valuations and strategic direction.

- In light of our recent growth report, it seems possible that GlobalData's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of GlobalData stock in this financial health report.

Kainos Group (LSE:KNOS)

Overview: Kainos Group plc provides digital technology services across the United Kingdom, Ireland, North America, Central Europe, and internationally with a market capitalization of £893.02 million.

Operations: Kainos Group's revenue is primarily derived from three segments: Digital Services (£197.17 million), Workday Products (£71.35 million), and Workday Services (£98.72 million).

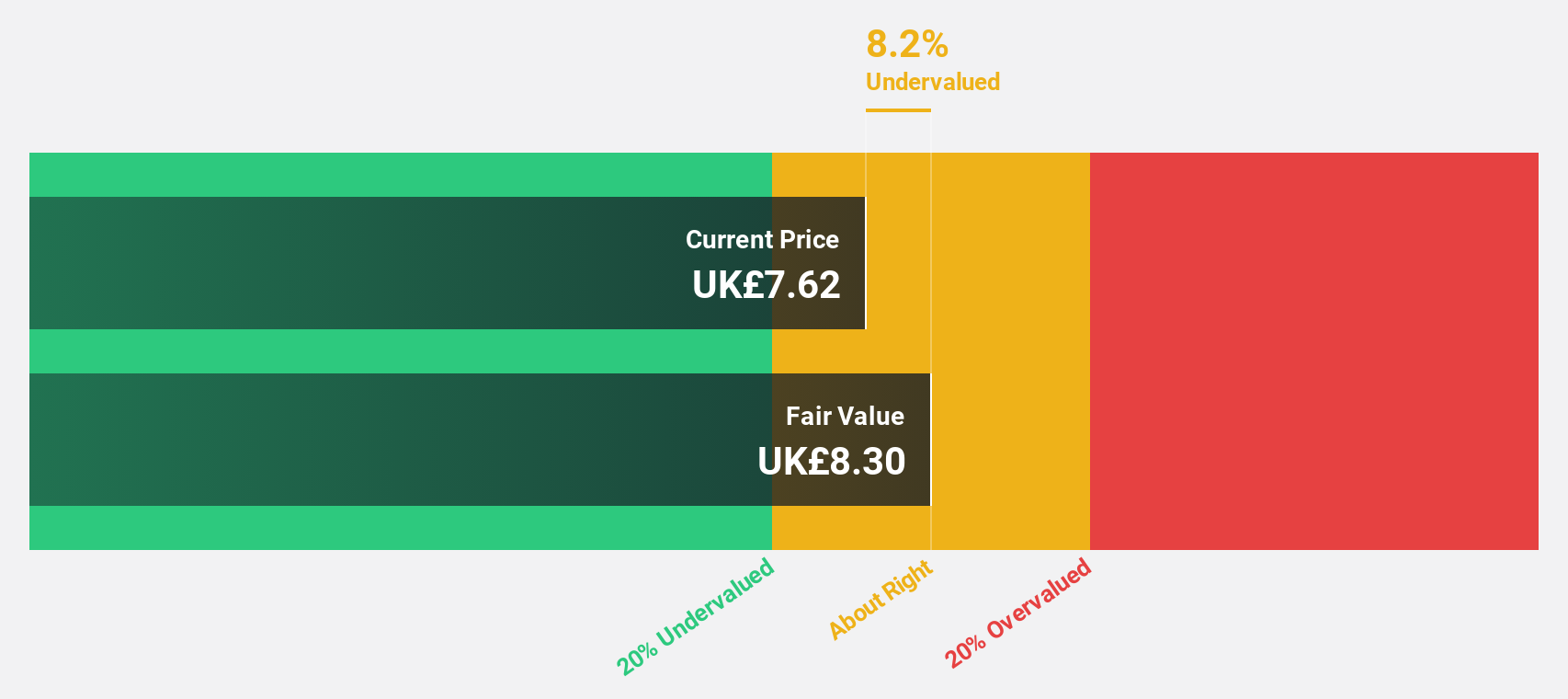

Estimated Discount To Fair Value: 12.1%

Kainos Group is trading at £7.31, slightly below its estimated fair value of £8.31, suggesting some undervaluation based on cash flows. The company's earnings are forecast to grow 16.9% annually, surpassing the UK market's growth rate of 14.5%. Despite a recent decline in sales and net income for the year ended March 2025, Kainos announced a £30 million share buyback program to reduce share capital and proposed a final dividend of 19.1p per share pending shareholder approval.

- The analysis detailed in our Kainos Group growth report hints at robust future financial performance.

- Take a closer look at Kainos Group's balance sheet health here in our report.

Playtech (LSE:PTEC)

Overview: Playtech plc is a technology company that provides gambling software, services, content, and platform technologies across various regions including Italy, Mexico, the UK, Europe, Latin America, and internationally with a market cap of approximately £945.60 million.

Operations: Playtech's revenue is derived from segments including Gaming B2B (€754.30 million) and B2C operations such as HAPPYBET (€18.90 million) and Sun Bingo along with other B2C activities (€78.90 million).

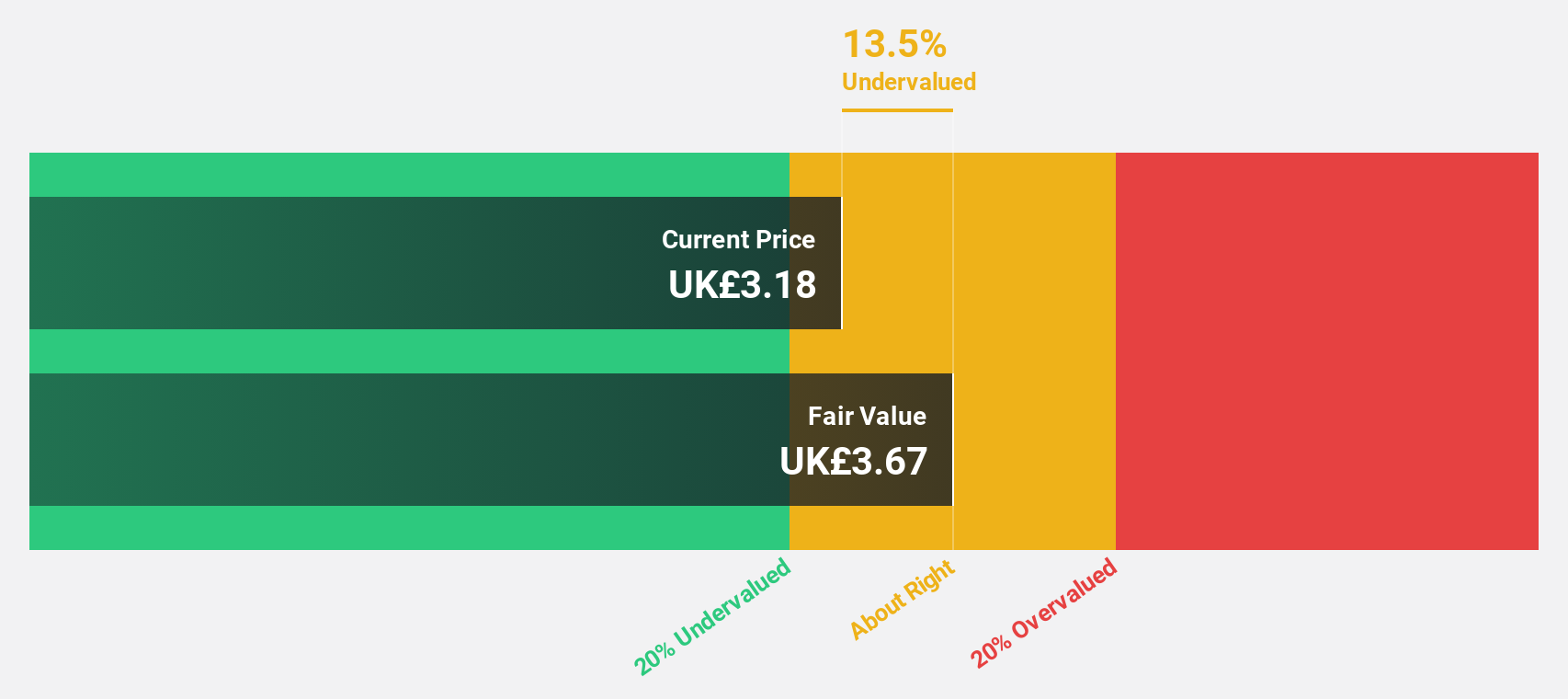

Estimated Discount To Fair Value: 15.8%

Playtech, trading at £3.08, is undervalued based on cash flows with a fair value estimate of £3.65. Despite recent volatility and a net loss of €23.9 million in 2024, earnings are expected to grow significantly by 69.29% annually and become profitable within three years. The company recently completed the sale of Snaitech, enabling it to redeem €150 million in debt and announce a substantial special dividend funded by the sale proceeds.

- Our earnings growth report unveils the potential for significant increases in Playtech's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Playtech.

Summing It All Up

- Click here to access our complete index of 51 Undervalued UK Stocks Based On Cash Flows.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kainos Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:KNOS

Kainos Group

Engages in the provision of digital technology services in the United Kingdom, Ireland, the Americas, Central Europe, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives