- United Kingdom

- /

- Consumer Services

- /

- LSE:MEGP

Here's Why Shareholders May Want To Be Cautious With Increasing ME Group International plc's (LON:MEGP) CEO Pay Packet

Key Insights

- ME Group International will host its Annual General Meeting on 25th of April

- CEO Serge Crasnianski's total compensation includes salary of UK£560.2k

- Total compensation is 236% above industry average

- Over the past three years, ME Group International's EPS grew by 36% and over the past three years, the total shareholder return was 231%

Under the guidance of CEO Serge Crasnianski, ME Group International plc (LON:MEGP) has performed reasonably well recently. As shareholders go into the upcoming AGM on 25th of April, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders will still be cautious of paying the CEO excessively.

Check out our latest analysis for ME Group International

Comparing ME Group International plc's CEO Compensation With The Industry

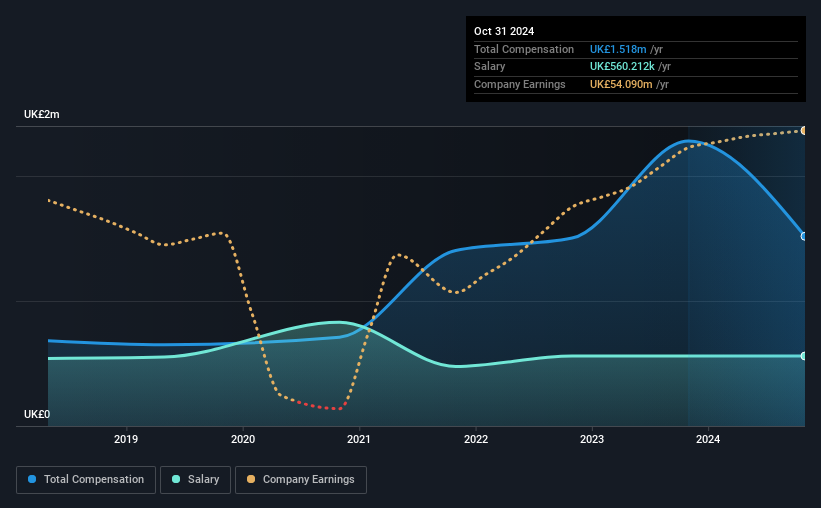

According to our data, ME Group International plc has a market capitalization of UK£735m, and paid its CEO total annual compensation worth UK£1.5m over the year to October 2024. Notably, that's a decrease of 33% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at UK£560k.

In comparison with other companies in the British Consumer Services industry with market capitalizations ranging from UK£301m to UK£1.2b, the reported median CEO total compensation was UK£452k. This suggests that Serge Crasnianski is paid more than the median for the industry. Furthermore, Serge Crasnianski directly owns UK£269m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | UK£560k | UK£560k | 37% |

| Other | UK£958k | UK£1.7m | 63% |

| Total Compensation | UK£1.5m | UK£2.3m | 100% |

On an industry level, around 33% of total compensation represents salary and 67% is other remuneration. ME Group International is paying a higher share of its remuneration through a salary in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at ME Group International plc's Growth Numbers

ME Group International plc's earnings per share (EPS) grew 36% per year over the last three years. It achieved revenue growth of 3.4% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has ME Group International plc Been A Good Investment?

Most shareholders would probably be pleased with ME Group International plc for providing a total return of 231% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 1 warning sign for ME Group International that investors should be aware of in a dynamic business environment.

Switching gears from ME Group International, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:MEGP

ME Group International

Operates, sells, and services a range of instant-service equipment in the United Kingdom.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion