- United Kingdom

- /

- Hospitality

- /

- LSE:MARS

Foresight Group Holdings And 2 Other Undervalued Small Caps On UK With Insider Activity

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 and FTSE 250 indices experience downward pressure due to weak trade data from China and global economic uncertainties, small-cap stocks are navigating a challenging landscape. In this environment, identifying promising small-cap opportunities often involves looking for companies with strong fundamentals and insider activity, which can signal confidence in their potential despite broader market volatility.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 20.8x | 5.3x | 22.25% | ★★★★★★ |

| Warpaint London | 19.3x | 3.3x | 34.49% | ★★★★★☆ |

| Stelrad Group | 11.7x | 0.6x | 18.61% | ★★★★★☆ |

| Speedy Hire | NA | 0.2x | 25.65% | ★★★★★☆ |

| NCC Group | NA | 1.3x | 20.20% | ★★★★★☆ |

| Telecom Plus | 17.8x | 0.7x | 26.58% | ★★★★☆☆ |

| Gamma Communications | 23.4x | 2.4x | 31.87% | ★★★★☆☆ |

| Franchise Brands | 40.5x | 2.1x | 22.22% | ★★★★☆☆ |

| CVS Group | 29.2x | 1.2x | 37.35% | ★★★★☆☆ |

| Optima Health | NA | 1.5x | 47.73% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

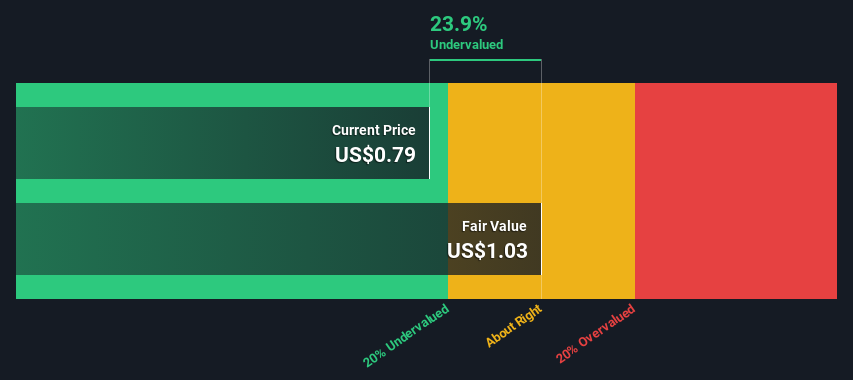

Foresight Group Holdings (LSE:FSG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Foresight Group Holdings is an investment management firm specializing in infrastructure, private equity, and capital management, with a market cap of approximately £0.56 billion.

Operations: Revenue is primarily generated from infrastructure and private equity segments, with a smaller contribution from capital management. The gross profit margin has shown an upward trend, reaching 94.88% by the latest period. Operating expenses are significant, driven largely by general and administrative costs.

PE: 14.7x

Foresight Group Holdings, a smaller player in the UK market, reported impressive financial growth with sales rising to £73.19 million and net income at £12.65 million for the half-year ending September 2024. Their earnings per share increased significantly, showcasing strong performance despite reliance on external borrowing for funding. Insider confidence is reflected through recent purchases, while their role as sub-investment manager for Liontrust's fund highlights strategic positioning in asset management. The company's enhanced £15 million buyback plan indicates robust shareholder engagement and potential future value creation.

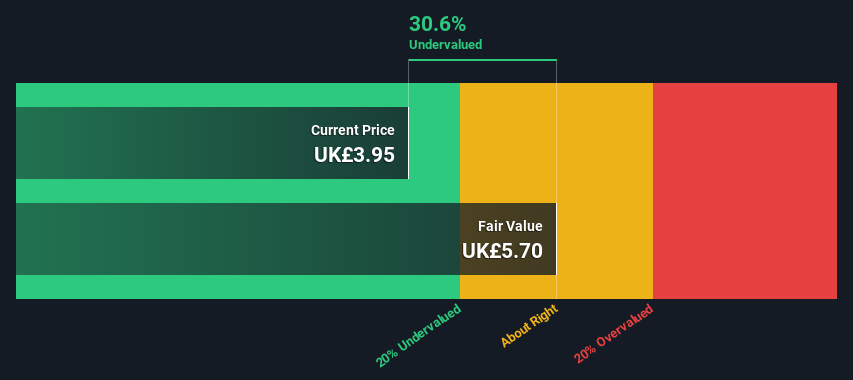

Marston's (LSE:MARS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Marston's operates a network of pubs and bars, with a focus on providing hospitality services, and has a market capitalization of approximately £0.42 billion.

Operations: The company generates revenue primarily from its Pubs and Bars segment, with recent figures reaching £898.6 million. Over time, the gross profit margin has shown an upward trend, reaching 51.87% in recent periods, indicating improved cost management relative to sales.

PE: 14.9x

Marston's, a UK-based pub operator, has shown resilience with a 3% rise in retail sales over the 16-week period to January 2025, despite challenging weather. The company's community-focused approach and product offerings have bolstered its appeal. Insider confidence is evident as Justin Platt increased their stake by over 42% recently. However, financial challenges persist with interest payments not fully covered by earnings and net losses rising to £18.5 million for the year ending September 2024.

- Click to explore a detailed breakdown of our findings in Marston's valuation report.

Assess Marston's past performance with our detailed historical performance reports.

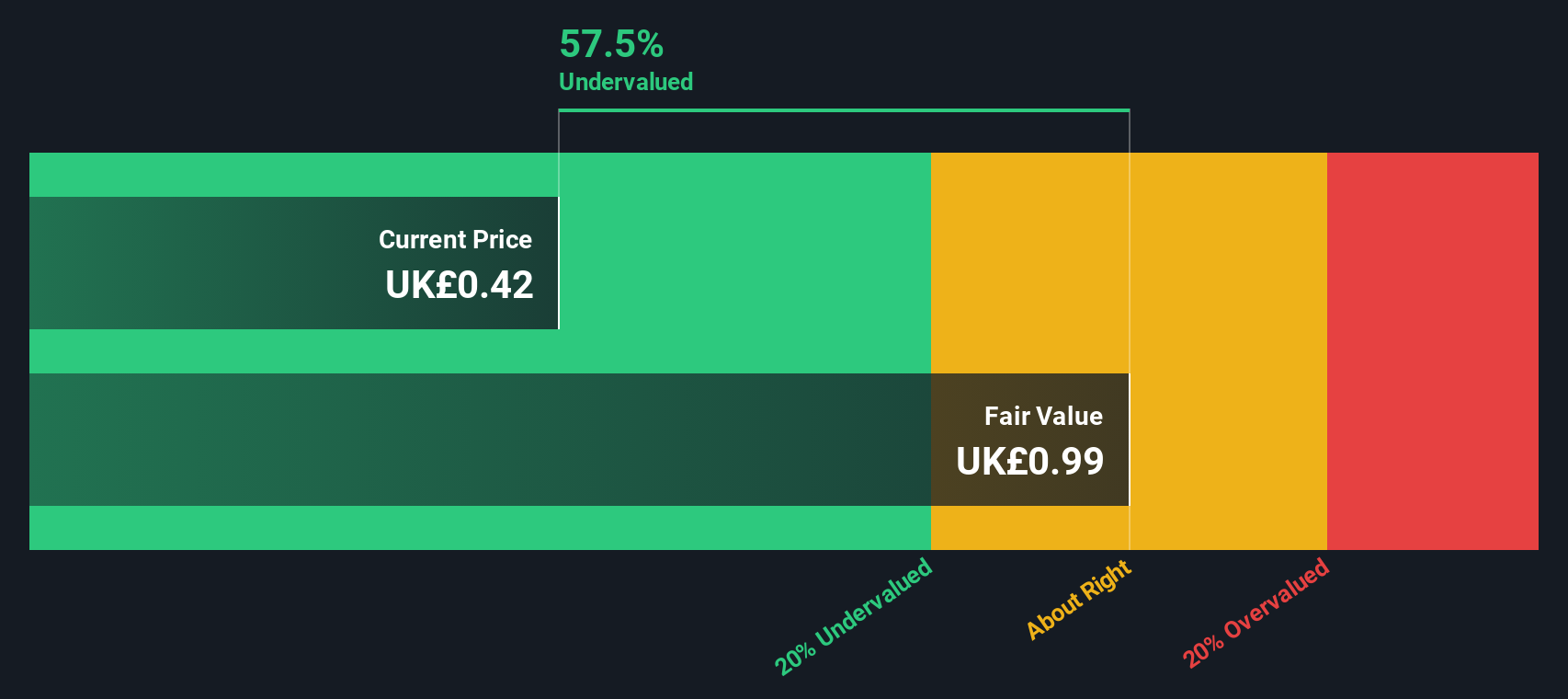

Taylor Maritime (LSE:TMI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Taylor Maritime is a company focused on generating investment returns through shipping vessels, with a market capitalization of £0.35 billion.

Operations: The company generates revenue through shipping vessels aimed at investment returns, with a notable gross profit margin of 100%. Operating expenses have shown a gradual increase over time, impacting net income margins. Recent figures indicate fluctuations in revenue and net income, reflecting varying financial performance across periods.

PE: 3.3x

Taylor Maritime, a shipping-focused company in the UK, is drawing attention for its potential value. Recent executive appointments bring seasoned industry expertise, which could steer strategic growth. The company reported significant financial turnaround with $13.83 million net income for the half-year ending September 2024, compared to a loss previously. A special dividend of $0.04 per share highlights shareholder returns focus. Despite relying on external borrowing, insider confidence through purchases suggests belief in future prospects amidst ongoing industry challenges.

Seize The Opportunity

- Unlock our comprehensive list of 33 Undervalued UK Small Caps With Insider Buying by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MARS

Marston's

Operates managed, franchised, tenanted, partnership, and leased pubs in the United Kingdom.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives