- United Kingdom

- /

- Hospitality

- /

- LSE:GRG

Has Greggs Recent Share Price Recovery Changed the Outlook for 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Greggs shares? You are not alone, especially as the bakery giant's stock has shown a bit of both sizzle and slump this year. If you have been watching the chart, you probably noticed the share price climbed 5.0% in just the past week and 4.8% over the last month, hinting at renewed optimism or perhaps a shift in how investors are weighing up Greggs's future potential. However, zooming out, it is clear this has been a tough year with the stock still down over 40% year-to-date and nearly as much over the past twelve months. Even so, the long-term picture is more encouraging, with gains visible over three and five years, which is evidence that there could be rewarding stretches for investors who stick around.

Why the bumpy ride? It is not just about sausage rolls and vegan bakes flying off the shelves. Broader market dynamics have played their part, with consumer trends and sentiment toward the high street shifting in fits and starts. Greggs, always in the news for its ambitious store expansion and evolving menu, keeps finding ways to attract attention, sometimes giving its stock price a helpful nudge. But is the current price a bargain, or is it fully baked in?

That is where valuation comes in. By our own yardstick, Greggs scores a 3 out of 6 for being undervalued, which is a solid showing but not a slam dunk. In the next section, we will dig into what these valuation checks really say about the stock. Keep reading, because we will wrap up with an even smarter way to think about valuation that goes beyond just the numbers.

Why Greggs is lagging behind its peers

Approach 1: Greggs Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the value of a business by projecting its future cash flows and then discounting those projections back to today's value. This method helps investors understand what a company could be worth based on its ability to generate cash in the years to come.

For Greggs, cash flow trends provide a mixed picture. The company generated Free Cash Flow (FCF) of £39.9 Million over the last twelve months. Analyst estimates take a somewhat bullish stance, projecting that annual FCF could reach as high as £126.6 Million by 2029. These growth forecasts use five years of detailed analyst estimates; later years are extrapolated based on industry norms and company performance. All calculations are made in pounds sterling, aligning with Greggs’s reporting and trading currency.

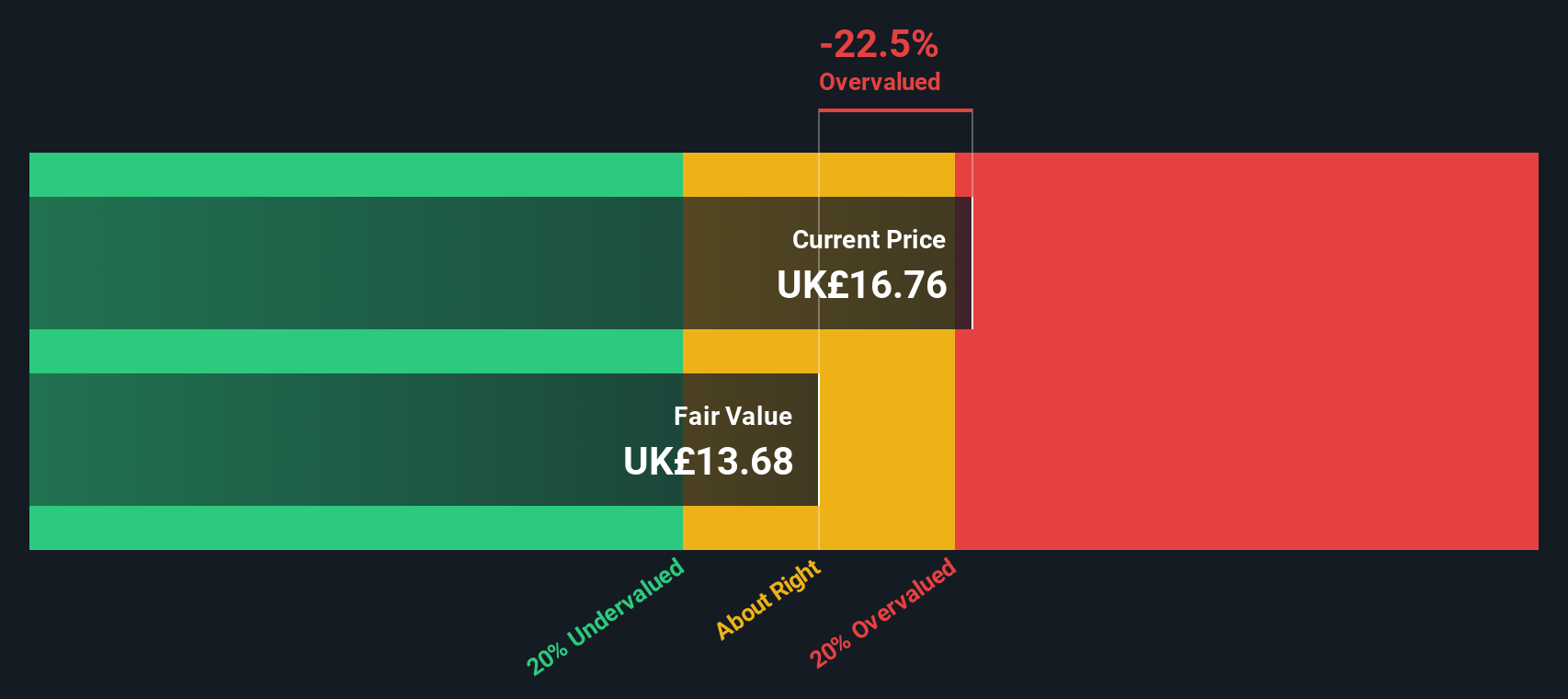

The DCF analysis estimates Greggs’s intrinsic value at £13.66 per share. Comparing this to the current market price, the model suggests the stock is roughly 22.7% overvalued at present. In plain terms, the market may be a little too optimistic about how much future cash Greggs can generate.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Greggs may be overvalued by 22.7%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Greggs Price vs Earnings

For established and profitable companies like Greggs, the Price-to-Earnings (PE) ratio is a widely used and useful valuation metric. It allows investors to assess how much they are paying for every pound of the company's earnings. When a business consistently generates profits, the PE ratio helps provide a snapshot of both current performance and market expectations.

Interpreting PE ratios is not as simple as picking the lowest number. Growth prospects, risk profile and prevailing market sentiment all influence what counts as a "normal" or "fair" PE ratio. Higher growth and lower risk often mean investors are willing to pay a bit more for those future earnings, so the PE ratio can be higher. Conversely, a riskier or slower-growth business might warrant a lower multiple.

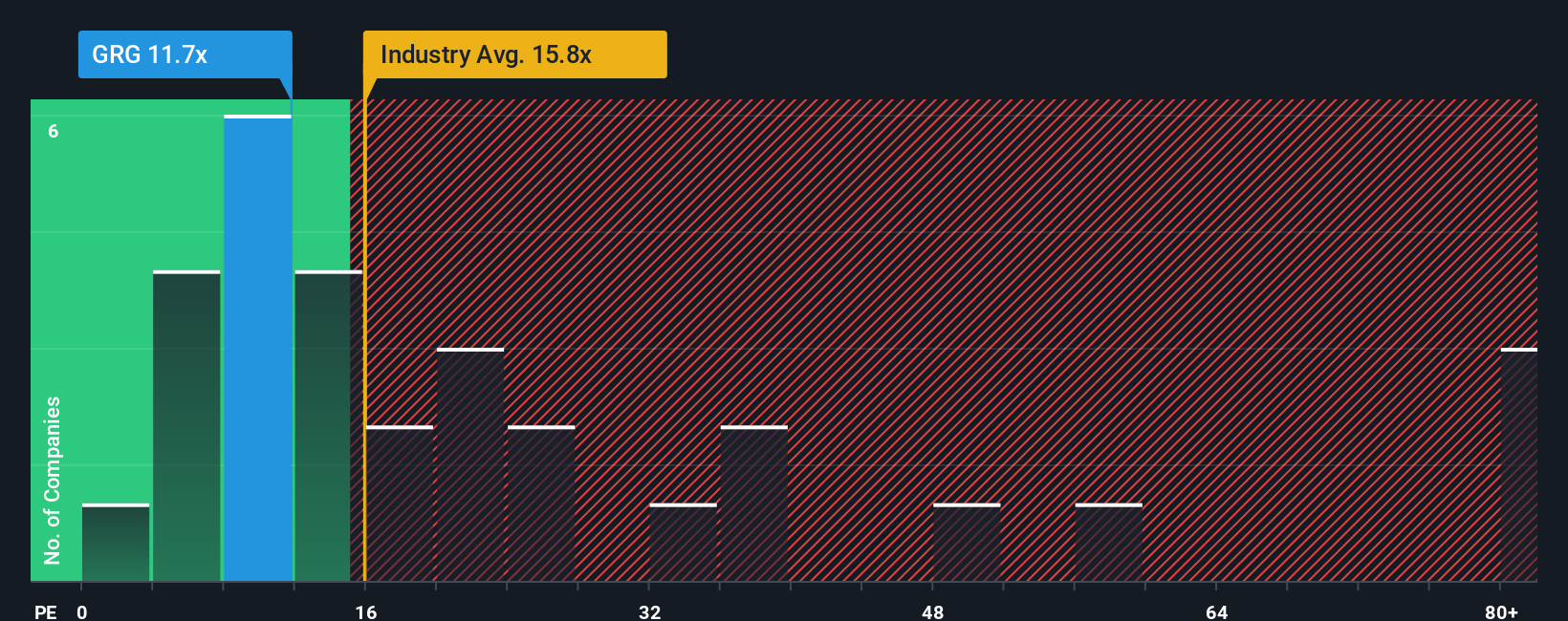

Currently, Greggs trades at a PE ratio of 11.7x. For context, the Hospitality industry average stands at 16.0x, while Greggs' peers average an even loftier 20.0x. However, Simply Wall St’s proprietary “Fair Ratio” for Greggs is 14.0x. This Fair Ratio estimates what a reasonable PE should be after considering factors like its earnings growth, profit margins, industry, market cap and risk profile. It gives a more rounded view than simply comparing against averages, which can ignore specific strengths and weaknesses of a business.

Comparing Greggs’ current PE of 11.7x to the Fair Ratio of 14.0x, the stock appears modestly undervalued by this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Greggs Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, user-friendly tool that lets you tell your "story" about a company, capturing your view of its future revenue, profit margins, and fair value, and links that story directly to a financial forecast and estimated valuation.

Narratives take investing beyond just numbers by letting you blend everything you know about Greggs, from its menu innovations to market risks, into a living, breathing investment case. Available right on Simply Wall St’s Community page, Narratives are dynamic and are updated automatically whenever new news or company results are released so your thesis always reflects the latest information.

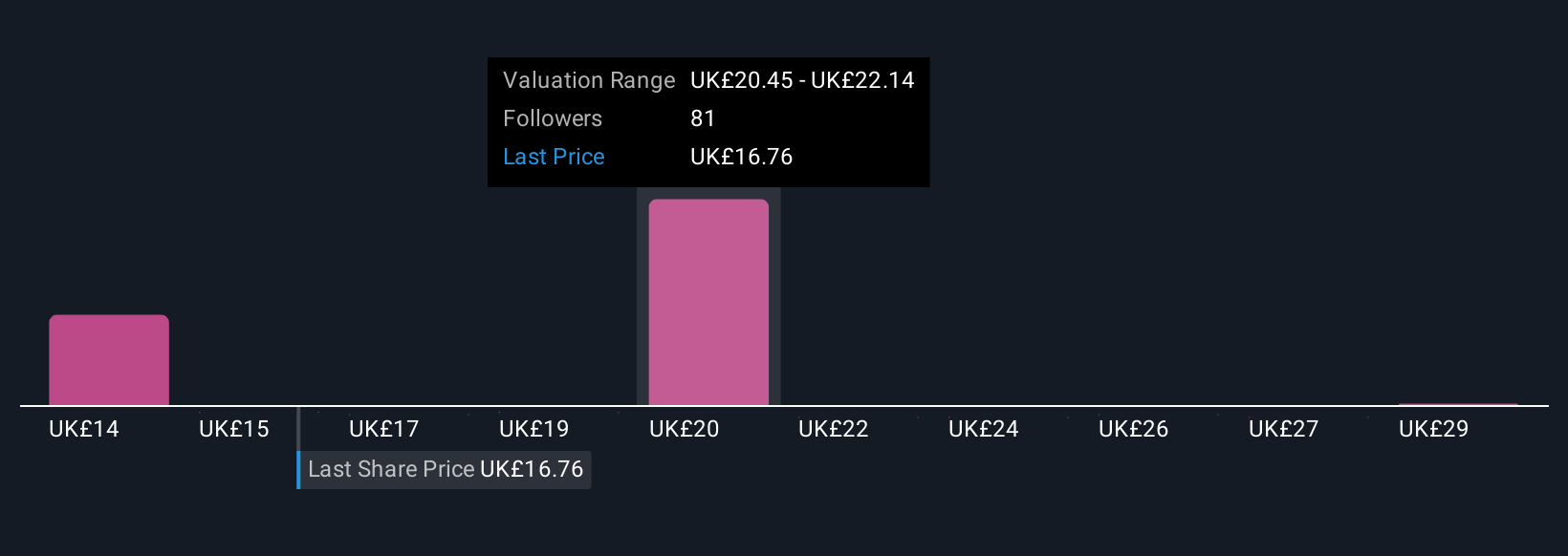

With Narratives, you can easily compare your own Fair Value to the current market price, helping you decide if Greggs is a buy, hold, or sell based on your unique outlook. For example, some investors see promise in expanding convenience channels and digital sales, valuing Greggs as high as £30.60 per share, while others worried about rising costs and stagnant demand set a fair value as low as £13.30.

Do you think there's more to the story for Greggs? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GRG

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives