- United States

- /

- Hospitality

- /

- NasdaqGS:SABR

Top Undervalued Small Caps With Insider Action For October 2024

Reviewed by Simply Wall St

As global markets navigate a dynamic landscape, small-cap stocks have shown resilience with the Russell 2000 Index outperforming larger counterparts amid shifting economic indicators. The recent strength in consumer spending and easing industrial output highlight the mixed signals facing investors, creating opportunities for those seeking value in smaller companies. In this context, identifying promising small-cap stocks involves looking at factors such as market positioning and insider activities that align with current economic conditions.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Senior | 17.7x | 0.5x | 38.38% | ★★★★★★ |

| Trican Well Service | 6.9x | 0.9x | 22.24% | ★★★★★★ |

| Franklin Financial Services | 9.5x | 1.9x | 38.51% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | 19.61% | ★★★★☆☆ |

| Optima Health | NA | 1.2x | 39.64% | ★★★★☆☆ |

| Robert Walters | 42.4x | 0.2x | 41.00% | ★★★☆☆☆ |

| Citizens & Northern | 13.6x | 2.9x | 43.50% | ★★★☆☆☆ |

| Studsvik | 21.7x | 1.3x | 39.96% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Sabre | NA | 0.5x | -46.70% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

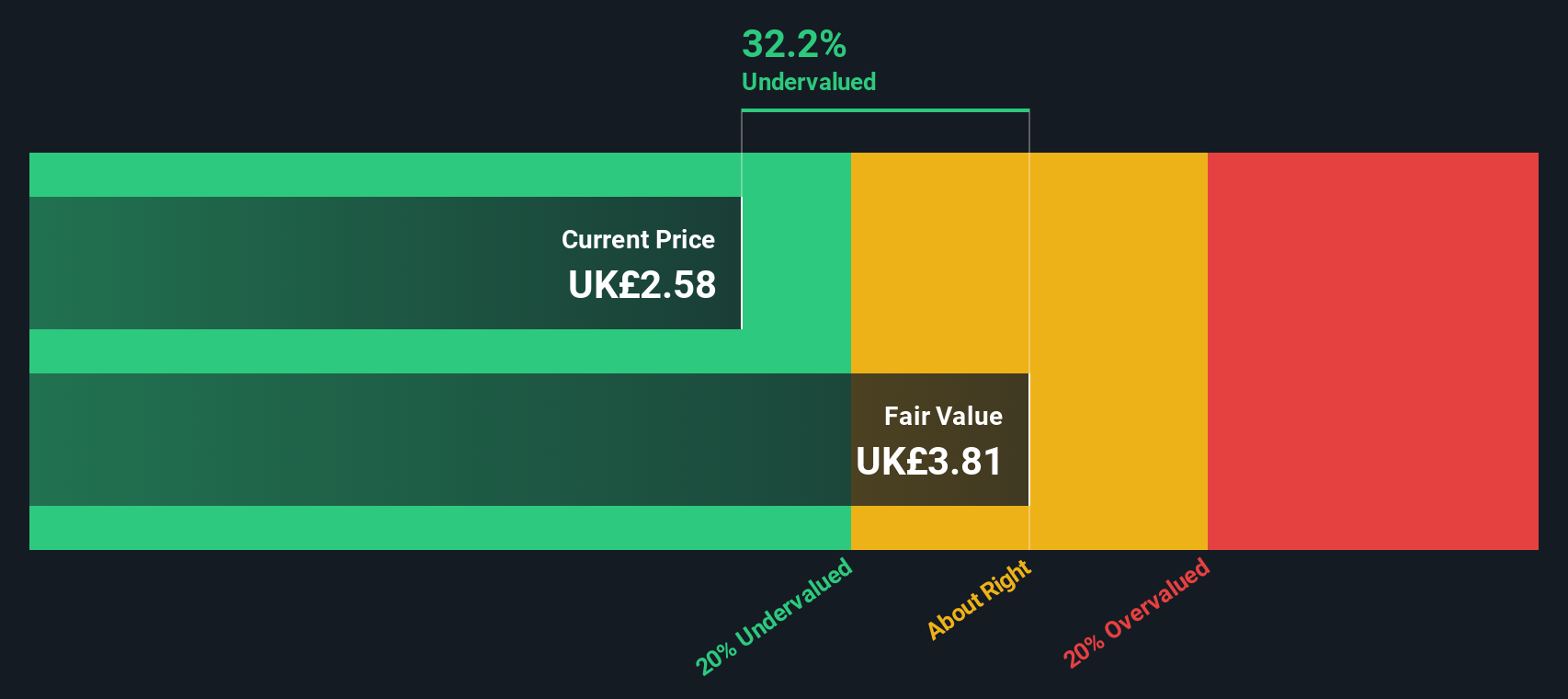

Domino's Pizza Group (LSE:DOM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Domino's Pizza Group operates as a leading pizza delivery and carryout chain, generating income through sales to franchisees, corporate stores, advertising and ecommerce, property rentals, and franchise-related fees; it has a market capitalization of £1.75 billion.

Operations: The company's revenue streams primarily include sales to franchisees, royalties, and advertising income. Over the observed periods, the gross profit margin has shown variability, reaching 47.48% by mid-2024. Operating expenses have consistently increased alongside revenue growth, impacting net income margins which peaked at 18.28% in mid-2023 before declining to 11.44% by mid-2024 due to rising non-operating expenses and operating costs.

PE: 16.0x

Domino's Pizza Group, a smaller company in the market, is navigating financial challenges with strategic initiatives. Their recent share repurchase program, initiated on August 6, 2024, highlights insider confidence as they aim to buy back up to 10% of their shares. Despite a dip in net income from £80.2 million to £42.3 million year-over-year for H1 2024 and declining profit margins from 18.2% to 11.4%, the company remains optimistic about maintaining trading momentum and achieving growth in order count and sales for the fiscal year amidst an uncertain market environment.

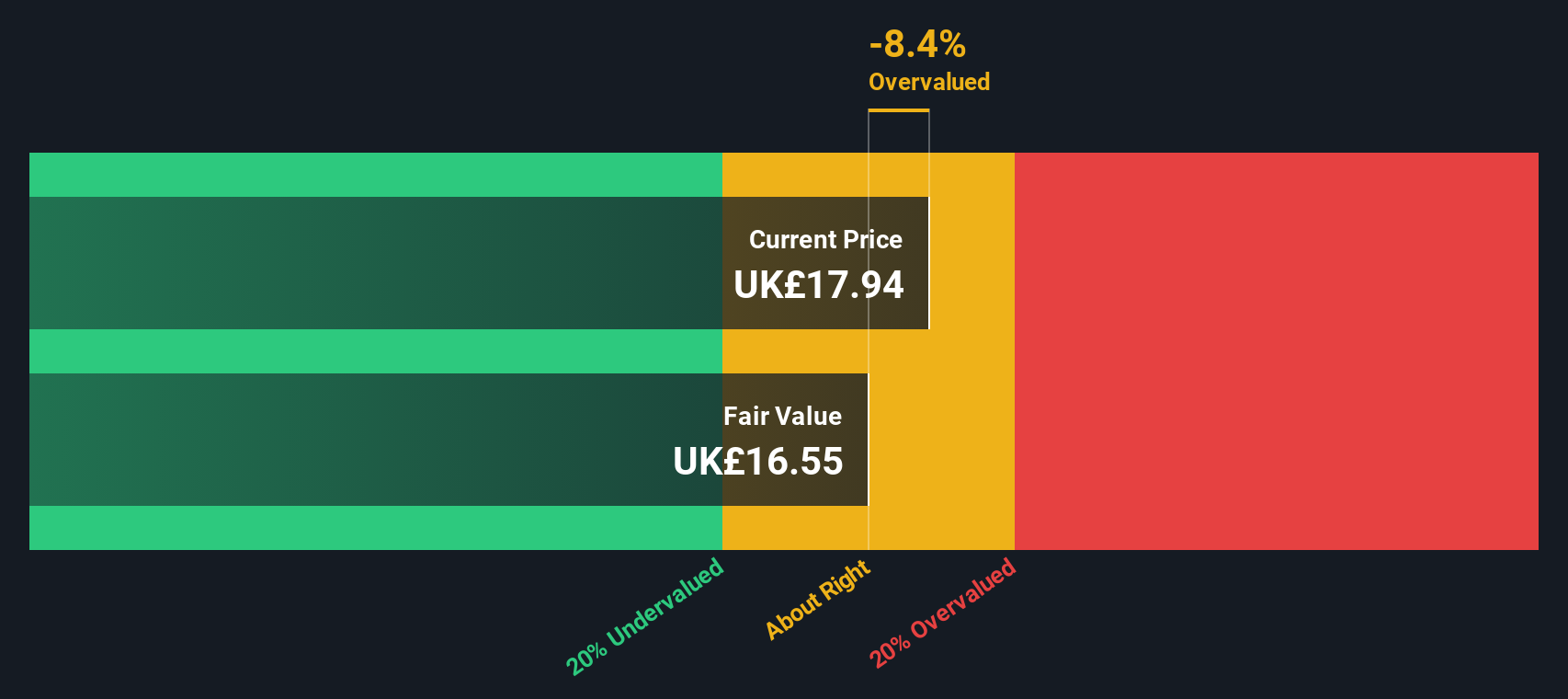

Oxford Instruments (LSE:OXIG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Oxford Instruments is a company specializing in advanced instrumentation and technologies for research, discovery, service, healthcare, and materials characterization with a market capitalization of approximately £1.50 billion.

Operations: Oxford Instruments generates revenue primarily from Materials & Characterisation (£252.20 million), Research & Discovery (£142.10 million), and Service & Healthcare (£76.10 million). The company's gross profit margin has shown an upward trend, reaching 52.24% as of September 2023, indicating effective management of production costs relative to sales revenue over time.

PE: 24.2x

Oxford Instruments, a company known for its innovative scientific instruments, is currently perceived as undervalued within the small-cap segment. Despite relying solely on external borrowing for funding, which poses higher risks compared to customer deposits, the company's earnings are projected to grow by 10% annually. Insider confidence is evident with recent share purchases in August 2024. Active participation in several high-profile conferences underscores their commitment to industry engagement and potential growth opportunities.

- Click here to discover the nuances of Oxford Instruments with our detailed analytical valuation report.

Examine Oxford Instruments' past performance report to understand how it has performed in the past.

Sabre (NasdaqGS:SABR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sabre is a technology company that provides software and services for the travel industry, with operations primarily in travel solutions and hospitality solutions, and has a market capitalization of approximately $1.72 billion.

Operations: Sabre generates revenue primarily from its Travel Solutions and Hospitality Solutions segments, with the former contributing significantly more to the total. The company's cost of goods sold (COGS) has fluctuated over time, impacting its gross profit margin, which reached a high of 81.41% in 2020 but later stabilized around 59-60% by late 2024. Operating expenses have been substantial, with research and development being a significant component. Despite these costs, Sabre's net income margins have remained negative in recent periods.

PE: -3.1x

Sabre Corporation, a technology solutions provider in the travel industry, is gaining attention for its potential value amidst recent strategic developments. The appointment of Eric L. Kelly to the board signals a strong focus on tech innovation and strategic growth. Notably, insider confidence is evident with insiders purchasing shares over the past six months, suggesting belief in future prospects. Recent partnerships with Riyadh Air and Arajet highlight Sabre's expanding influence in airline retailing through advanced AI-driven technologies. Despite facing challenges like negative equity and reliance on external borrowing, Sabre's earnings are forecasted to grow significantly at 90% annually, indicating promising potential for investors seeking opportunities within this sector.

- Take a closer look at Sabre's potential here in our valuation report.

Evaluate Sabre's historical performance by accessing our past performance report.

Where To Now?

- Reveal the 192 hidden gems among our Undervalued Small Caps With Insider Buying screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SABR

Sabre

Operates as software and technology company for travel industry in the United States, Europe, Asia-Pacific, and internationally.

Fair value with moderate growth potential.