- United Kingdom

- /

- Consumer Services

- /

- AIM:CODE

Slammed 25% Northcoders Group PLC (LON:CODE) Screens Well Here But There Might Be A Catch

Unfortunately for some shareholders, the Northcoders Group PLC (LON:CODE) share price has dived 25% in the last thirty days, prolonging recent pain. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 21%.

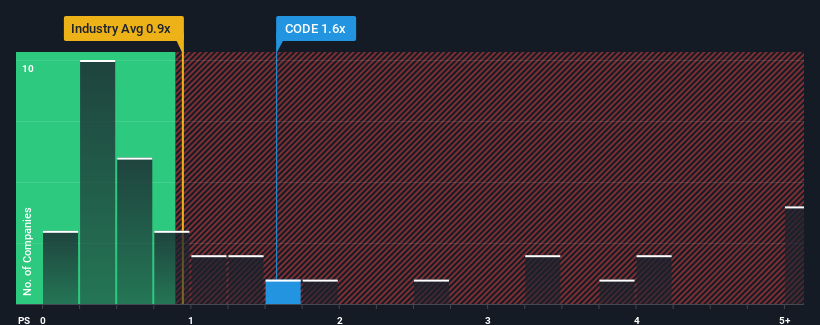

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Northcoders Group's P/S ratio of 1.6x, since the median price-to-sales (or "P/S") ratio for the Consumer Services industry in the United Kingdom is also close to 2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Northcoders Group

How Northcoders Group Has Been Performing

Recent times have been pleasing for Northcoders Group as its revenue has risen in spite of the industry's average revenue going into reverse. It might be that many expect the strong revenue performance to deteriorate like the rest, which has kept the P/S ratio from rising. Those who are bullish on Northcoders Group will be hoping that this isn't the case, so that they can pick up the stock at a slightly lower valuation.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Northcoders Group.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Northcoders Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 20%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 19% per year as estimated by the only analyst watching the company. With the industry only predicted to deliver 7.0% per year, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Northcoders Group's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Northcoders Group's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Northcoders Group looks to be in line with the rest of the Consumer Services industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, Northcoders Group's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You always need to take note of risks, for example - Northcoders Group has 2 warning signs we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Northcoders Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:CODE

Northcoders Group

Provides training programs for software coding to individual and corporate customers in the United Kingdom.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

METHODE ELECTRONICS (MEI): A Short Circuit or Just a Blown Fuse?

Titan Cement International S.A. (TITC.AT): Greece's Leading Cement and Building Materials Producer

QDay is coming - 01 Quantum hold the key

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!