- United Kingdom

- /

- Consumer Services

- /

- AIM:CODE

Positive Sentiment Still Eludes Northcoders Group PLC (LON:CODE) Following 28% Share Price Slump

Northcoders Group PLC (LON:CODE) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 27% in that time.

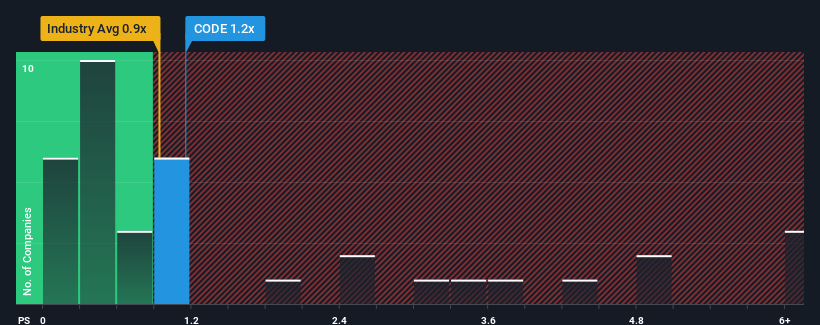

Since its price has dipped substantially, when close to half the companies operating in the United Kingdom's Consumer Services industry have price-to-sales ratios (or "P/S") above 2.5x, you may consider Northcoders Group as an enticing stock to check out with its 1.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Northcoders Group

How Northcoders Group Has Been Performing

Recent times have been pleasing for Northcoders Group as its revenue has risen in spite of the industry's average revenue going into reverse. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. Those who are bullish on Northcoders Group will be hoping that this isn't the case and the company continues to beat out the industry.

Keen to find out how analysts think Northcoders Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is Northcoders Group's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Northcoders Group's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 20%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 19% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 7.9% per annum, which is noticeably less attractive.

In light of this, it's peculiar that Northcoders Group's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Northcoders Group's P/S?

Northcoders Group's recently weak share price has pulled its P/S back below other Consumer Services companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at Northcoders Group's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Northcoders Group that you should be aware of.

If these risks are making you reconsider your opinion on Northcoders Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Northcoders Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:CODE

Northcoders Group

Provides training programs for software coding to individual and corporate customers in the United Kingdom.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Asset-Light but Valuation-Heavy: A Fundamental Breakdown of Marriott ($MAR)

Why did Novo Nordisk flop?

Xero: Growth Was Priced In — Execution Is Not

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks