- United Kingdom

- /

- Consumer Services

- /

- AIM:ANX

If You Had Bought Anexo Group's (LON:ANX) Shares A Year Ago You Would Be Down 24%

While not a mind-blowing move, it is good to see that the Anexo Group Plc (LON:ANX) share price has gained 13% in the last three months. But in truth the last year hasn't been good for the share price. The cold reality is that the stock has dropped 24% in one year, under-performing the market.

View our latest analysis for Anexo Group

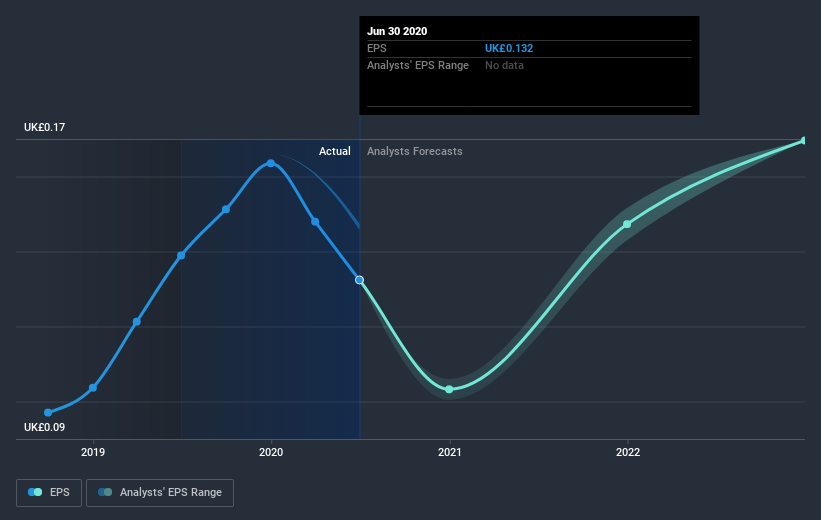

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Unfortunately Anexo Group reported an EPS drop of 4.8% for the last year. This reduction in EPS is not as bad as the 24% share price fall. This suggests the EPS fall has made some shareholders are more nervous about the business. The P/E ratio of 9.89 also points to the negative market sentiment.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Anexo Group's earnings, revenue and cash flow.

A Different Perspective

We doubt Anexo Group shareholders are happy with the loss of 23% over twelve months (even including dividends). That falls short of the market, which lost 6.8%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. It's great to see a nice little 13% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Anexo Group you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

When trading Anexo Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:ANX

Anexo Group

Anexo Group Plc, along with its subsidiaries, provides integrated credit hire and legal services in the United Kingdom.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives