- United Kingdom

- /

- Food and Staples Retail

- /

- LSE:TSCO

Tesco (LSE:TSCO) Reports Group Sales Of £16,383 Million For First Quarter 2025

Reviewed by Simply Wall St

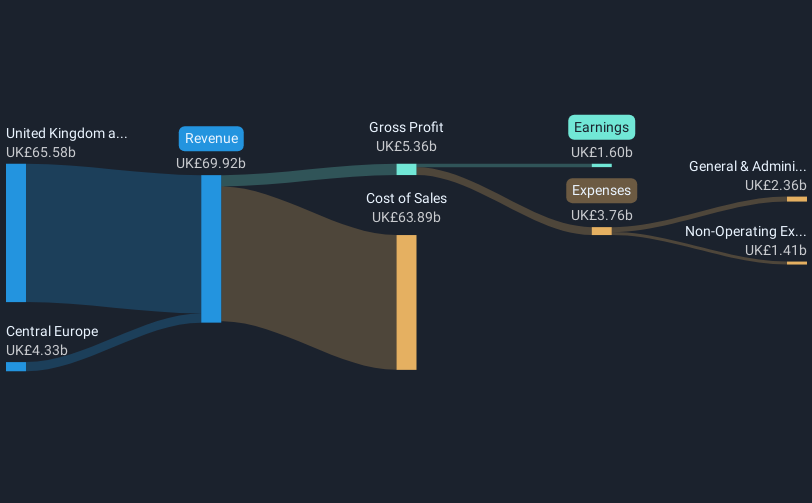

Tesco (LSE:TSCO) reported strong Q1 2026 sales results on June 12, 2025, with group sales totaling £16,383 million, a significant performance driver over the last month. Additionally, recent executive leadership changes, such as Ashwin Prasad taking over as Chief Executive of Tesco UK, also invited attention. These developments occurred against a backdrop of overall market positivity, as indices like the S&P 500 continued their upward trajectory. Tesco's 4.5% share price increase over the month aligns with broader market trends, although the company's solid performance and leadership adjustments likely contributed additional confidence for investors.

Every company has risks, and we've spotted 1 weakness for Tesco you should know about.

Tesco's recent strong Q1 2026 sales performance and leadership changes could bolster its narrative focused on digital investments and personalized offerings. The company's aim to enhance customer satisfaction and expand its digital footprint aligns with its innovation strategy. This strategic direction, including services like Tesco Whoosh and Clubcard personalization, could contribute positively to revenue and earnings forecasts. However, challenges such as intense competition and economic uncertainty remain key considerations for future growth trajectories.

Over the past five years, Tesco has achieved a total shareholder return of 108.77%, demonstrating robust long-term performance. In comparison, the company exceeded the broader UK market's return of 5.4% and the UK Consumer Retailing industry's return of 19% over the past year. This indicates Tesco's ability to outperform its peers and the market in recent periods, despite a negative earnings growth over the past year. The recent 4.5% share price increase aligns well with these factors and contributes to its overall strong performance.

Considering Tesco's current share price of £3.71 against the analyst consensus price target of £3.80, the 2.5% difference suggests moderate upside potential. The comprehensive integration of its revenue growth initiatives within its operational model may enhance its earnings capabilities further. Continued execution of these strategies will be crucial for realizing the projected revenue growth of 2.6% annually, as well as the anticipated earnings target of £1.9 billion within the next few years.

Evaluate Tesco's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tesco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:TSCO

Tesco

Operates as a grocery retailer in the United Kingdom, Republic of Ireland, the Czech Republic, Slovakia, and Hungary.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives