- United Kingdom

- /

- Food and Staples Retail

- /

- LSE:OCDO

Ocado Group plc's (LON:OCDO) 26% Cheaper Price Remains In Tune With Revenues

To the annoyance of some shareholders, Ocado Group plc (LON:OCDO) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 43% in that time.

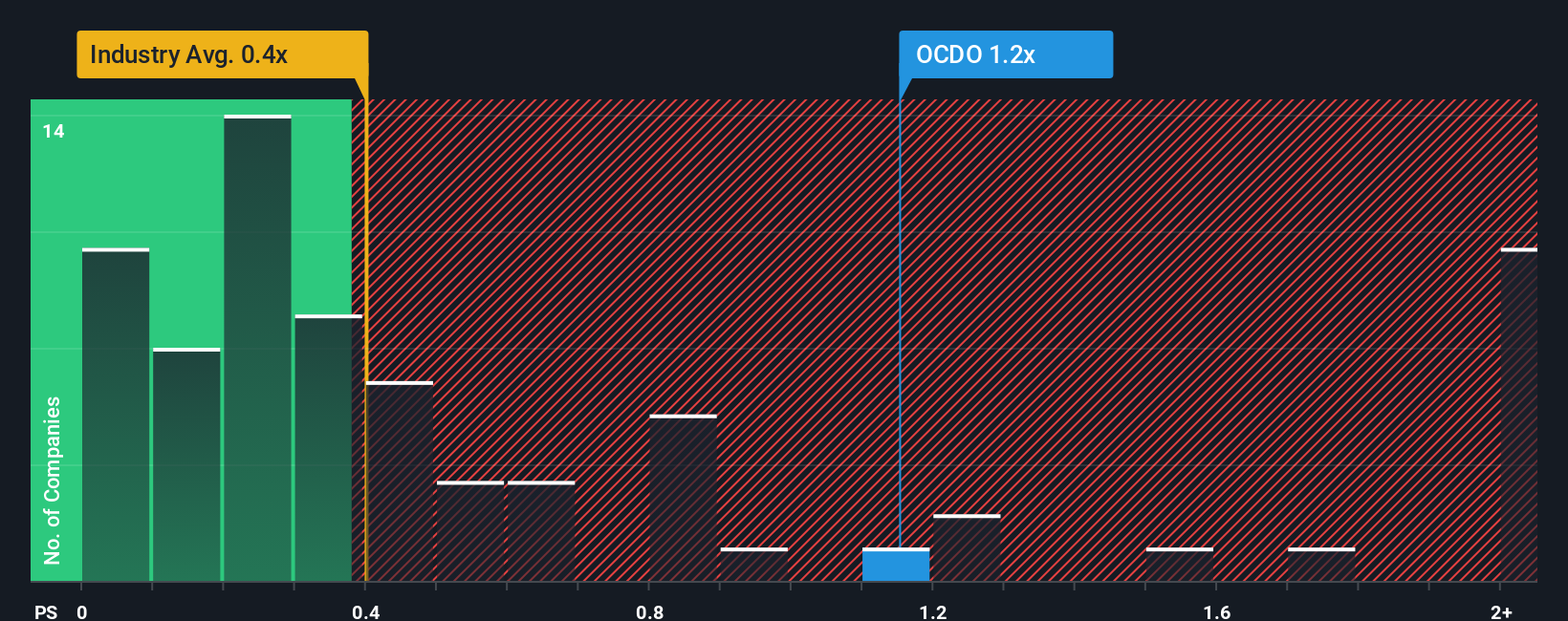

Even after such a large drop in price, you could still be forgiven for thinking Ocado Group is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.2x, considering almost half the companies in the United Kingdom's Consumer Retailing industry have P/S ratios below 0.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Ocado Group

How Has Ocado Group Performed Recently?

Recent times have been advantageous for Ocado Group as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Ocado Group will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

Ocado Group's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 47% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 8.4% per annum during the coming three years according to the eight analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 2.9% per annum, which is noticeably less attractive.

With this information, we can see why Ocado Group is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Ocado Group's P/S Mean For Investors?

Despite the recent share price weakness, Ocado Group's P/S remains higher than most other companies in the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Ocado Group maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Consumer Retailing industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Ocado Group is showing 2 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

If these risks are making you reconsider your opinion on Ocado Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:OCDO

Ocado Group

Operates as an online grocery retailer in the United Kingdom and internationally.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives