- United Kingdom

- /

- Food and Staples Retail

- /

- LSE:OCDO

Ocado Group plc (LON:OCDO) Shares Slammed 25% But Getting In Cheap Might Be Difficult Regardless

Ocado Group plc (LON:OCDO) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 49% share price drop.

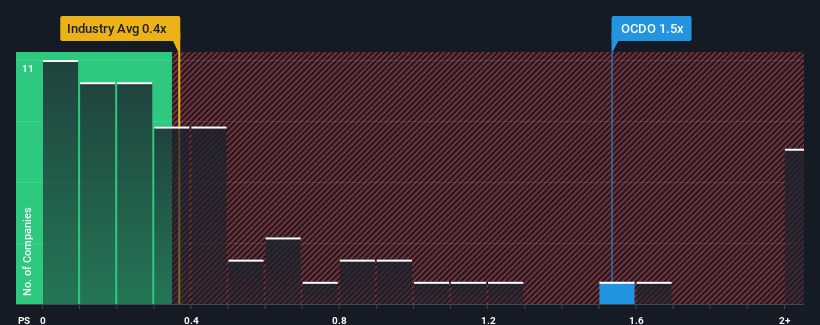

Although its price has dipped substantially, when almost half of the companies in the United Kingdom's Consumer Retailing industry have price-to-sales ratios (or "P/S") below 0.4x, you may still consider Ocado Group as a stock probably not worth researching with its 1.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Ocado Group

What Does Ocado Group's Recent Performance Look Like?

Ocado Group could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Ocado Group will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as Ocado Group's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 57% decrease to the company's top line. As a result, revenue from three years ago have also fallen 51% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 49% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 5.7% each year, which is noticeably less attractive.

With this in mind, it's not hard to understand why Ocado Group's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Ocado Group's P/S

Despite the recent share price weakness, Ocado Group's P/S remains higher than most other companies in the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Ocado Group maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Consumer Retailing industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Ocado Group, and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Ocado Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:OCDO

Ocado Group

Operates as an online grocery retailer in the United Kingdom and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives