- United Kingdom

- /

- Food and Staples Retail

- /

- AIM:VINO

Virgin Wines UK PLC's (LON:VINO) Share Price Could Signal Some Risk

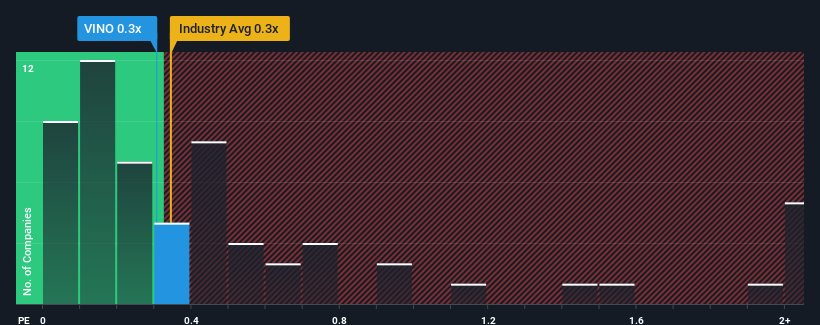

With a median price-to-sales (or "P/S") ratio of close to 0.3x in the Consumer Retailing industry in the United Kingdom, you could be forgiven for feeling indifferent about Virgin Wines UK PLC's (LON:VINO) P/S ratio, which comes in at about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Virgin Wines UK

How Has Virgin Wines UK Performed Recently?

While the industry has experienced revenue growth lately, Virgin Wines UK's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Virgin Wines UK.Is There Some Revenue Growth Forecasted For Virgin Wines UK?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Virgin Wines UK's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 9.9% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 0.7% as estimated by the one analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 5.4%, which is noticeably more attractive.

With this in mind, we find it intriguing that Virgin Wines UK's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Virgin Wines UK's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

When you consider that Virgin Wines UK's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Virgin Wines UK (1 is a bit concerning!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:VINO

Virgin Wines UK

Operates as a direct-to-consumer online wine retailer in the United Kingdom.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives