- United Kingdom

- /

- Insurance

- /

- LSE:SBRE

Exploring 3 Undervalued Small Caps In The European Market With Insider Buying

Reviewed by Simply Wall St

Amid renewed uncertainty about U.S. trade policy and escalating geopolitical tensions in the Middle East, the European market has faced notable challenges, with the pan-European STOXX Europe 600 Index ending 1.57% lower recently. Despite these headwinds, opportunities may arise for investors willing to explore small-cap stocks that exhibit potential resilience and growth prospects in such volatile environments.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 11.8x | 0.5x | 34.53% | ★★★★★☆ |

| AKVA group | 17.2x | 0.8x | 49.65% | ★★★★★☆ |

| Tristel | 28.8x | 4.1x | 10.54% | ★★★★☆☆ |

| Close Brothers Group | NA | 0.6x | 38.51% | ★★★★☆☆ |

| Absolent Air Care Group | 22.1x | 1.7x | 49.77% | ★★★☆☆☆ |

| Italmobiliare | 11.4x | 1.5x | -205.70% | ★★★☆☆☆ |

| Fuller Smith & Turner | 12.0x | 0.9x | -32.15% | ★★★☆☆☆ |

| H+H International | 32.9x | 0.8x | 45.69% | ★★★☆☆☆ |

| Eastnine | 18.9x | 9.1x | 37.30% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.2x | 46.62% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

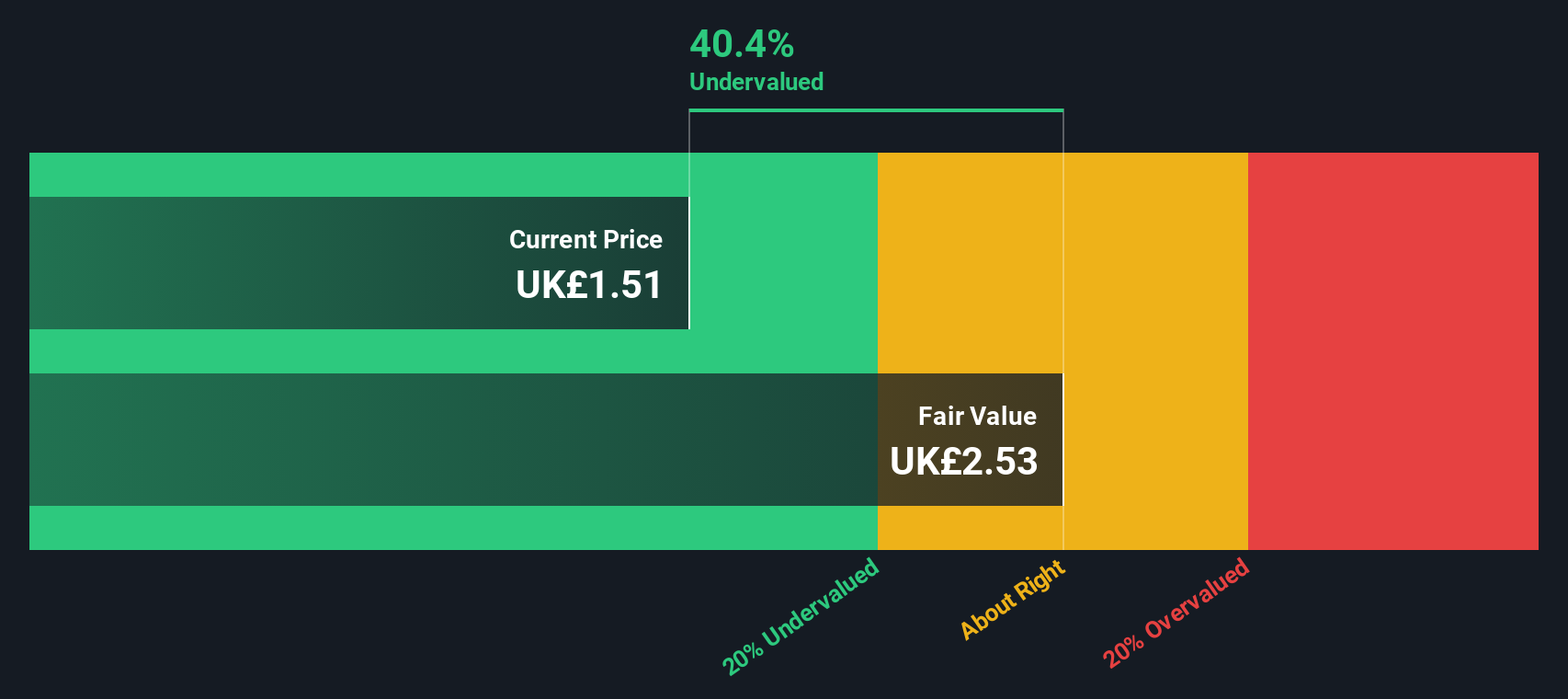

Sabre Insurance Group (LSE:SBRE)

Simply Wall St Value Rating: ★★★★☆☆

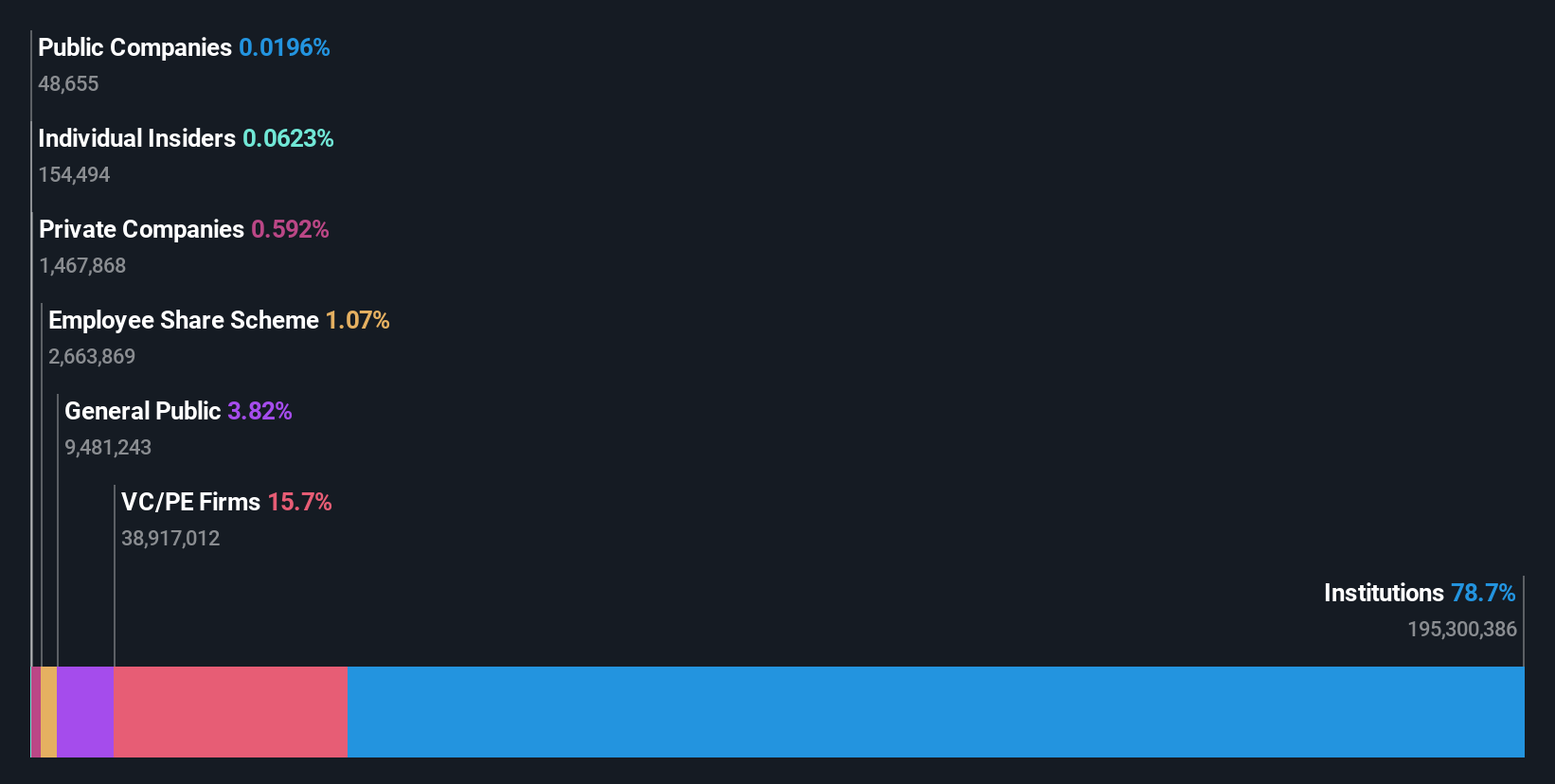

Overview: Sabre Insurance Group is a UK-based company specializing in underwriting motor insurance, including segments such as taxis, motorcycles, and other motor vehicles, with a market capitalization of approximately £0.19 billion.

Operations: Sabre Insurance Group's revenue primarily comes from the motor vehicle segment, excluding taxis, which significantly outweighs its taxi and motorcycle segments. The company has experienced fluctuations in its gross profit margin, with a notable decline to 14.01% in late 2022 before recovering to 44.10% by mid-2024. Operating expenses have varied over time, impacting net income margins as well.

PE: 9.6x

Sabre Insurance Group, a smaller player in the European market, recently reported a significant rise in net income to £36 million for 2024, doubling from the previous year. They declared both a special dividend of 2.9 pence and an increased final dividend of 8.4 pence per share on May 22, 2025. Despite relying solely on external borrowing for funding, their earnings are projected to grow by over 9% annually. The company maintains confidence with an anticipated insurance margin between 18% and 22%, focusing on profit over volume amid challenging conditions this year.

Stelrad Group (LSE:SRAD)

Simply Wall St Value Rating: ★★★★★★

Overview: Stelrad Group is primarily engaged in the manufacture and distribution of radiators, with a market capitalization of approximately £0.16 billion.

Operations: Stelrad Group generates revenue primarily from the manufacture and distribution of radiators, with recent figures showing a gross profit margin of 30.61%. The company's cost structure includes significant operating expenses, notably in sales and marketing, which amounted to £41.73 million in the latest period. Net income has shown improvement over time, reaching £16.52 million with a net income margin of 5.68%.

PE: 11.5x

Stelrad Group, a smaller European company, has caught attention with insider confidence reflected in share purchases from March to May 2025. Despite grappling with high debt levels due to reliance on external borrowing, the company shows potential with earnings projected to grow by nearly 10% annually. Recently announcing a final dividend of £0.0481 per share for 2024, Stelrad demonstrates commitment to shareholder returns while navigating financial challenges.

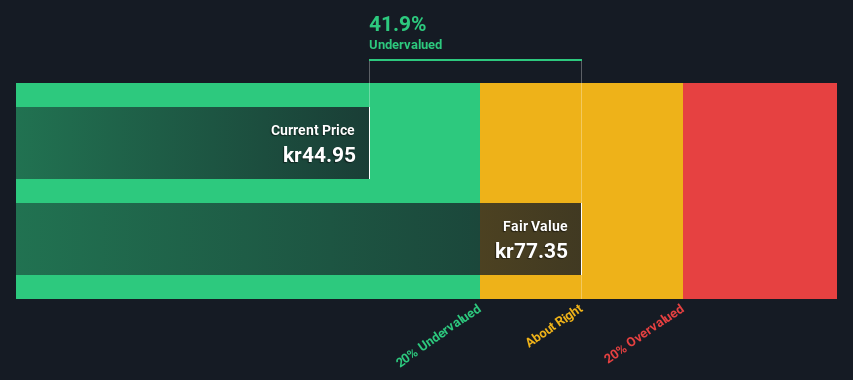

Eastnine (OM:EAST)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Eastnine is a real estate company focused on property investments in Poland and the Baltic region, with a market capitalization of €0.21 billion.

Operations: Eastnine's revenue streams primarily come from properties in Vilnius, Lithuania, Poland and Riga, Latvia. The company has experienced fluctuations in its net income margin over time, with notable instances of both positive and negative margins. Operating expenses are a consistent part of the cost structure, with general and administrative expenses being a significant component. Gross profit margin remains consistently high at 92.45% or above across various periods analyzed.

PE: 18.9x

Eastnine, a European small-cap, showcases potential for growth despite certain financial challenges. Recent insider confidence is evident as the CEO acquired 110,000 shares valued at €5.17 million, signaling trust in the company's trajectory. In Q1 2025, Eastnine's sales rose to €15.61 million from €9.06 million year-over-year, with net income jumping to €22.3 million from €5.03 million previously. However, reliance on external borrowing poses risks due to higher funding costs without customer deposits backing them up.

- Navigate through the intricacies of Eastnine with our comprehensive valuation report here.

-

Gain insights into Eastnine's past trends and performance with our Past report.

Summing It All Up

- Explore the 77 names from our Undervalued European Small Caps With Insider Buying screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

- Find companies with promising cash flow potential yet trading below their fair value .

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SBRE

Sabre Insurance Group

Through its subsidiaries, engages in writing of general insurance for motor vehicles in the United Kingdom.

Excellent balance sheet and good value.

Market Insights

Community Narratives