- United Kingdom

- /

- Consumer Services

- /

- LSE:MEGP

Does Photo-Me International's (LON:PHTM) Statutory Profit Adequately Reflect Its Underlying Profit?

Broadly speaking, profitable businesses are less risky than unprofitable ones. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. This article will consider whether Photo-Me International's (LON:PHTM) statutory profits are a good guide to its underlying earnings.

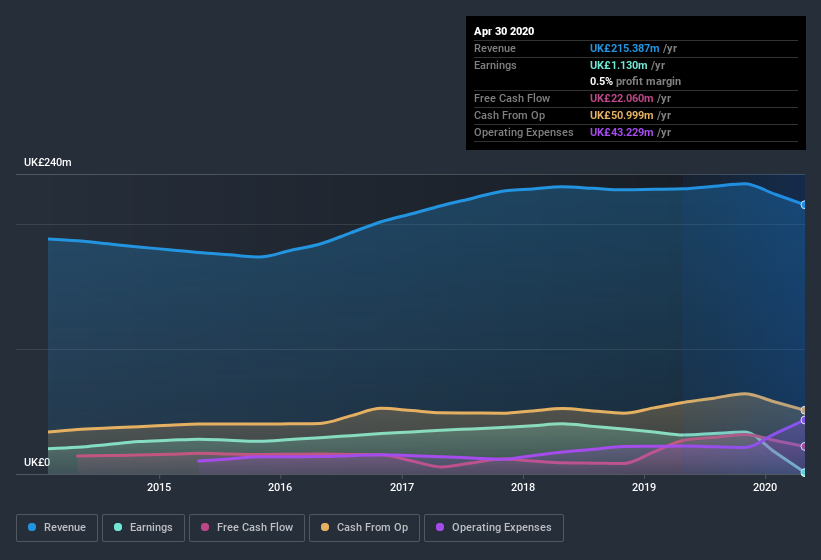

It's good to see that over the last twelve months Photo-Me International made a profit of UK£1.13m on revenue of UK£215.4m. As you can see below, its profit has actually declined over the last three years, even though its revenue was flat.

See our latest analysis for Photo-Me International

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. As a result, we think it's well worth considering what Photo-Me International's cashflow (when compared to its earnings) can tell us about the nature of its statutory profit. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

A Closer Look At Photo-Me International's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

Over the twelve months to April 2020, Photo-Me International recorded an accrual ratio of -0.18. That indicates that its free cash flow quite significantly exceeded its statutory profit. To wit, it produced free cash flow of UK£22m during the period, dwarfing its reported profit of UK£1.13m. Photo-Me International did see its free cash flow drop year on year, which is less than ideal, like a Simpson's episode without Groundskeeper Willie.

Our Take On Photo-Me International's Profit Performance

Happily for shareholders, Photo-Me International produced plenty of free cash flow to back up its statutory profit numbers. Because of this, we think Photo-Me International's underlying earnings potential is as good as, or possibly even better, than the statutory profit makes it seem! On the other hand, its EPS actually shrunk in the last twelve months. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Case in point: We've spotted 4 warning signs for Photo-Me International you should be mindful of and 1 of them is potentially serious.

This note has only looked at a single factor that sheds light on the nature of Photo-Me International's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you decide to trade Photo-Me International, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About LSE:MEGP

ME Group International

Operates, sells, and services a range of instant-service equipment in the United Kingdom.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion