- United Kingdom

- /

- Consumer Durables

- /

- LSE:GLE

UK Stock Market: 3 Companies Estimated To Be Undervalued In September 2025

Reviewed by Simply Wall St

In recent weeks, the UK stock market has faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China and its impact on companies closely tied to Chinese fortunes. As global economic uncertainties continue to influence market dynamics, identifying undervalued stocks becomes crucial for investors seeking potential opportunities amidst broader market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TBC Bank Group (LSE:TBCG) | £45.65 | £89.60 | 49.1% |

| SigmaRoc (AIM:SRC) | £1.25 | £2.42 | 48.4% |

| PageGroup (LSE:PAGE) | £2.242 | £4.43 | 49.4% |

| LSL Property Services (LSE:LSL) | £2.84 | £5.55 | 48.8% |

| Likewise Group (AIM:LIKE) | £0.27 | £0.52 | 48% |

| Hollywood Bowl Group (LSE:BOWL) | £2.53 | £4.87 | 48% |

| Gym Group (LSE:GYM) | £1.47 | £2.93 | 49.8% |

| Essentra (LSE:ESNT) | £0.983 | £1.95 | 49.6% |

| Burberry Group (LSE:BRBY) | £11.40 | £21.24 | 46.3% |

| AstraZeneca (LSE:AZN) | £112.48 | £223.60 | 49.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Burberry Group (LSE:BRBY)

Overview: Burberry Group plc is a luxury goods company involved in manufacturing, retail, and wholesale operations under the Burberry brand across various regions including Asia Pacific, Europe, the Middle East, India, Africa, and the Americas; it has a market cap of £4.08 billion.

Operations: The company's revenue is primarily derived from its Retail/Wholesale segment, which accounts for £2.40 billion, and Licensing, contributing £67 million.

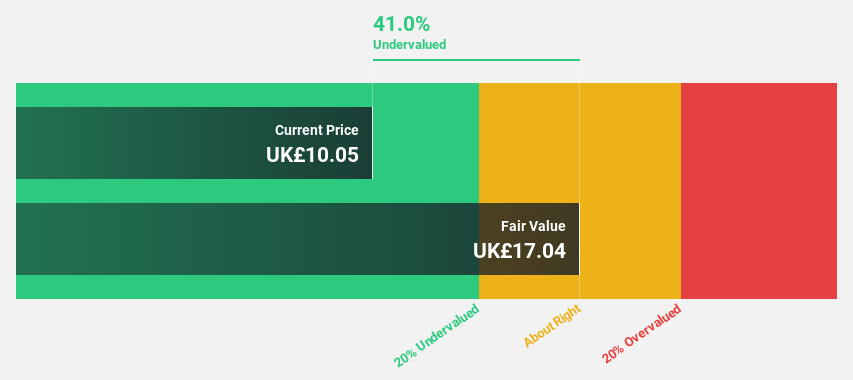

Estimated Discount To Fair Value: 46.3%

Burberry Group is trading at £11.4, significantly below its estimated fair value of £21.24, representing a 46.3% discount based on discounted cash flow analysis. Despite recent challenges with retail revenue declining to £433 million from £458 million, Burberry's earnings are projected to grow by 49.41% annually and surpass the UK market's average growth rate over the next three years, indicating potential for improved profitability and valuation recovery.

- Our comprehensive growth report raises the possibility that Burberry Group is poised for substantial financial growth.

- Take a closer look at Burberry Group's balance sheet health here in our report.

MJ Gleeson (LSE:GLE)

Overview: MJ Gleeson plc operates in the United Kingdom, focusing on house building and land promotion and sales, with a market cap of £224.97 million.

Operations: The company's revenue is primarily derived from Gleeson Homes, contributing £348.25 million, and Gleeson Land, which adds £17.57 million.

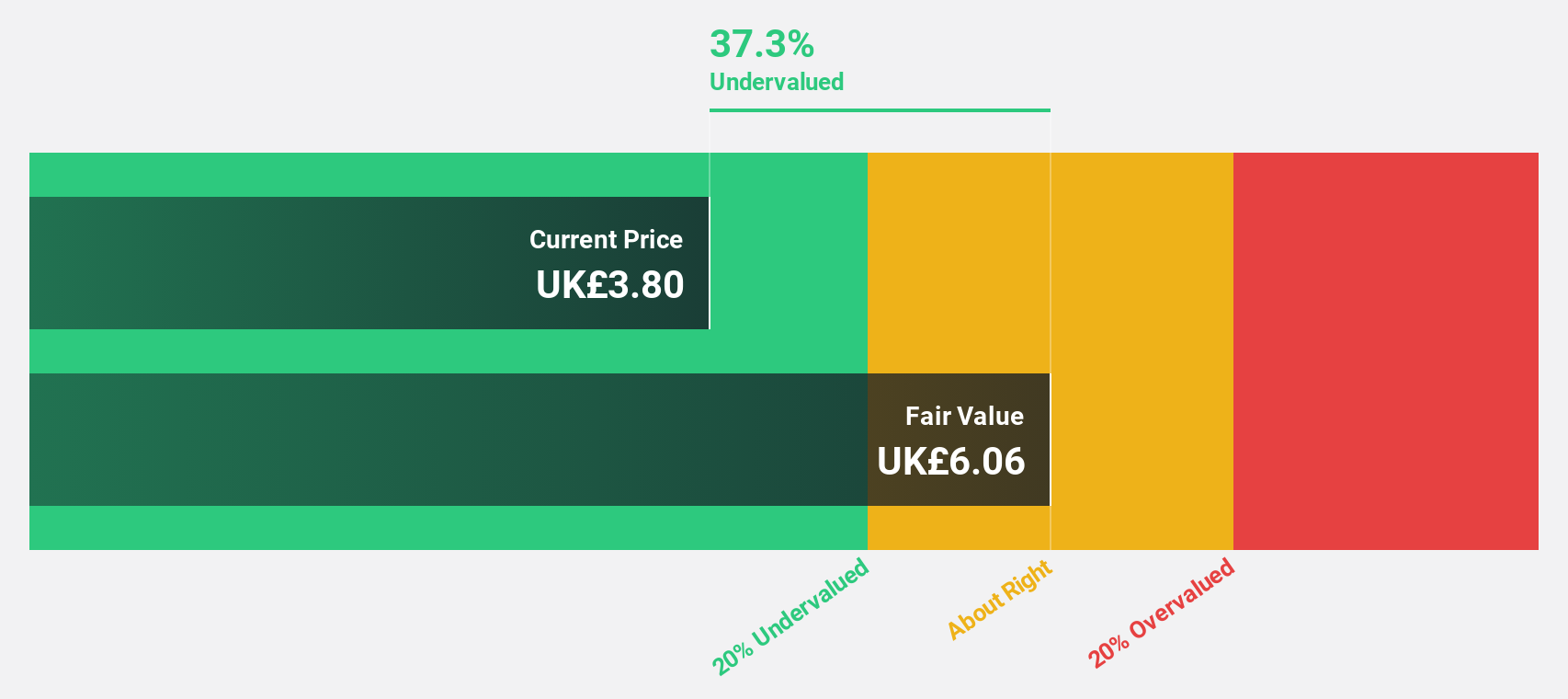

Estimated Discount To Fair Value: 36.3%

MJ Gleeson is trading at £3.85, below its estimated fair value of £6.04, indicating a 36.3% discount based on discounted cash flow analysis. With earnings growth projected at 20.8% per year, outpacing the UK market's average, and revenue expected to rise by 11.9% annually, the company shows potential for improved valuation despite recent net income decline to £15.82 million from £19.31 million last year and weak dividend coverage by free cash flows.

- The growth report we've compiled suggests that MJ Gleeson's future prospects could be on the up.

- Navigate through the intricacies of MJ Gleeson with our comprehensive financial health report here.

LSL Property Services (LSE:LSL)

Overview: LSL Property Services plc operates in the United Kingdom, providing business-to-business services to mortgage intermediaries and estate agent franchisees, as well as valuation services to lenders, with a market cap of £291.72 million.

Operations: The company generates revenue through its business-to-business services for mortgage intermediaries and estate agent franchisees, along with offering valuation services to lenders in the UK.

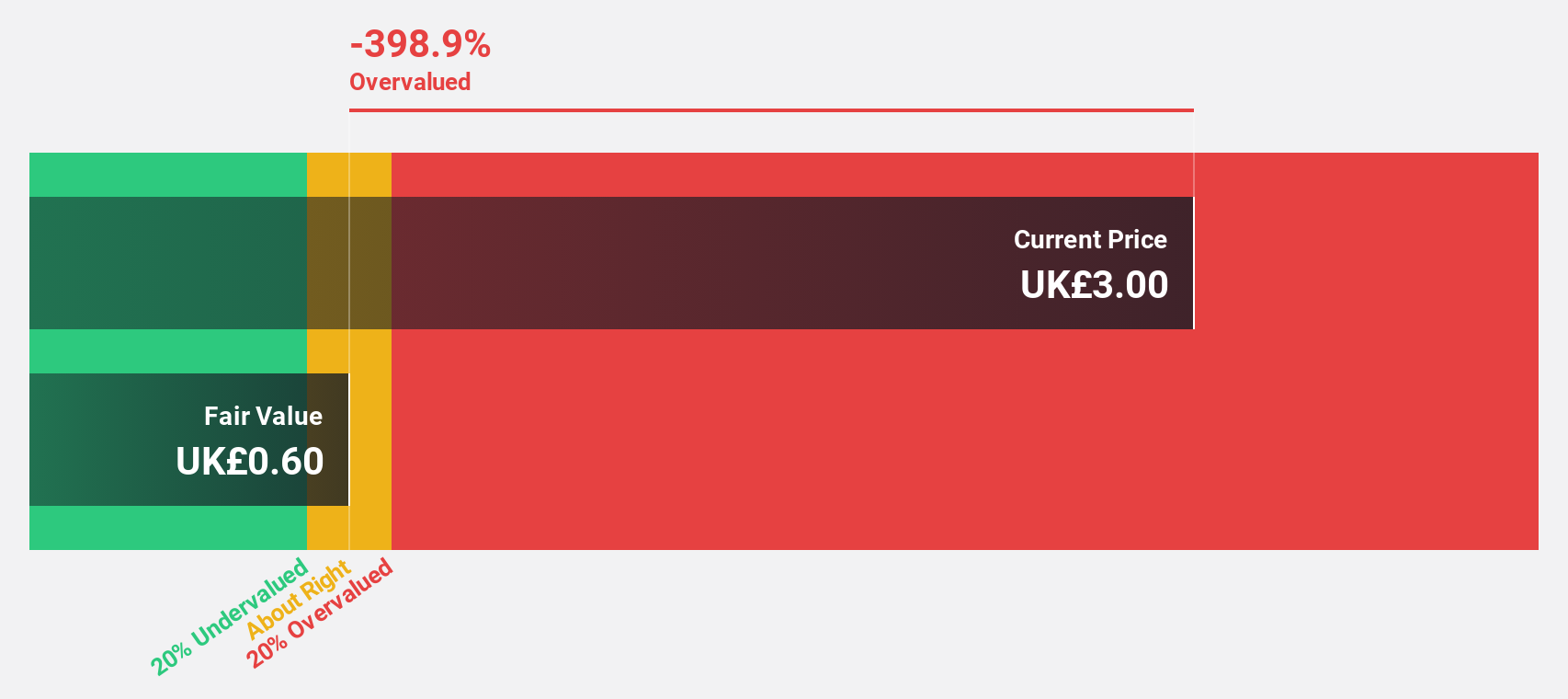

Estimated Discount To Fair Value: 48.8%

LSL Property Services is trading at £2.84, significantly below its estimated fair value of £5.55, reflecting a substantial discount based on discounted cash flow analysis. Despite a decline in net income to £8.19 million from last year's £9.95 million, earnings are projected to grow 21.15% annually, surpassing the UK market average. However, the dividend yield of 4% isn't well covered by free cash flows and revenue growth remains modest at 4.2% yearly.

- Insights from our recent growth report point to a promising forecast for LSL Property Services' business outlook.

- Dive into the specifics of LSL Property Services here with our thorough financial health report.

Key Takeaways

- Click through to start exploring the rest of the 52 Undervalued UK Stocks Based On Cash Flows now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GLE

MJ Gleeson

Engages in house building, and land promotion and sale businesses in the United Kingdom.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success