- United Kingdom

- /

- Specialty Stores

- /

- LSE:DNLM

UK Dividend Stocks Featuring Dunelm Group And Two More For Income Growth

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China and falling commodity prices impacting major companies. As economic uncertainties persist, investors often turn to dividend stocks for their potential to provide a steady income stream, making them an attractive option in volatile markets.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 7.31% | ★★★★★★ |

| Man Group (LSE:EMG) | 8.14% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.59% | ★★★★★☆ |

| Treatt (LSE:TET) | 3.48% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.81% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.68% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.20% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 7.65% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 7.52% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.48% | ★★★★★☆ |

Click here to see the full list of 64 stocks from our Top UK Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

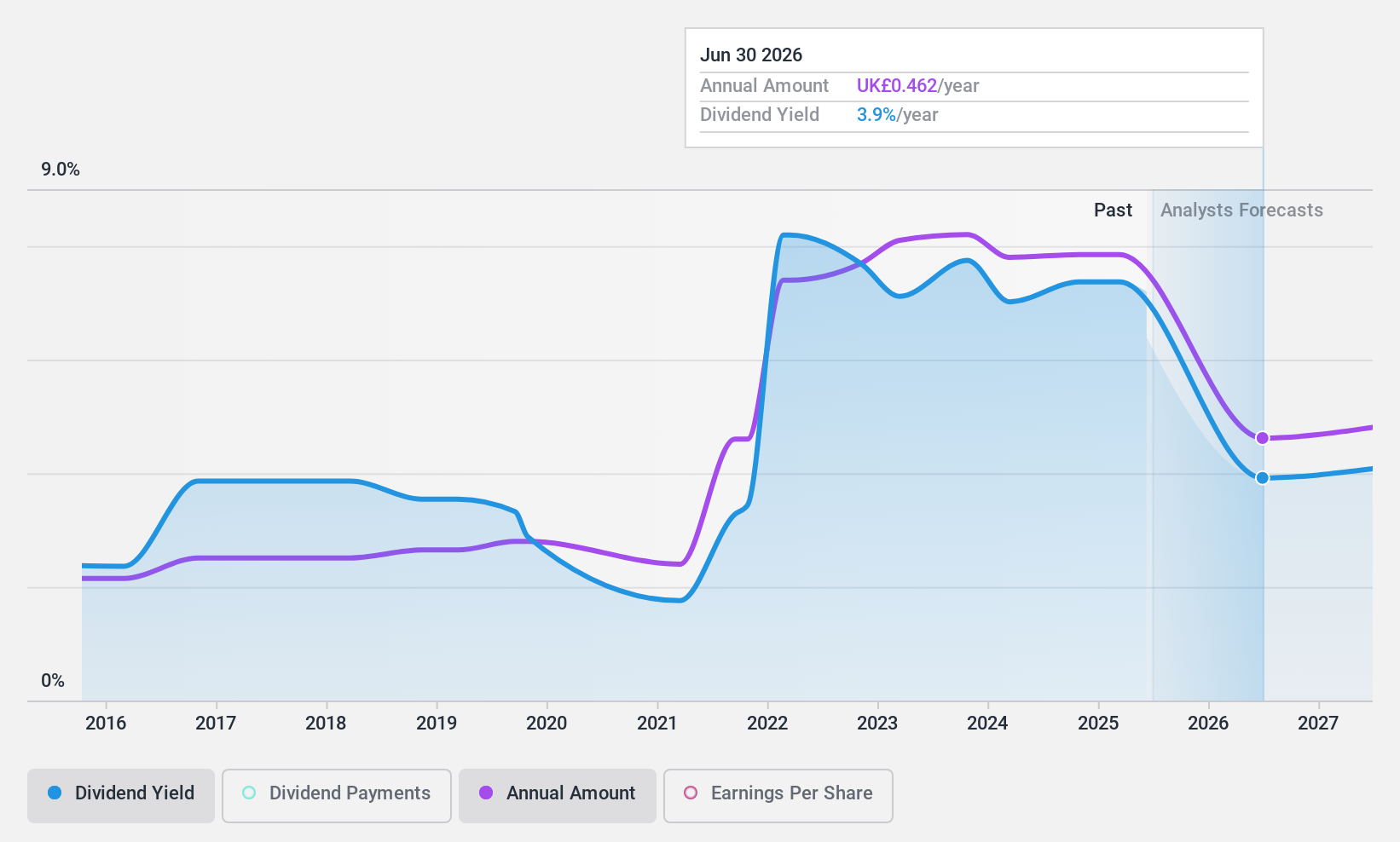

Dunelm Group (LSE:DNLM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dunelm Group plc operates as a retailer of homewares in the United Kingdom with a market capitalization of £2.18 billion.

Operations: The company's revenue primarily comes from its homewares retail segment, which generated £1.73 billion.

Dividend Yield: 7.2%

Dunelm Group has demonstrated a strong dividend yield, ranking in the top 25% of UK dividend payers. Despite a volatile dividend history, recent announcements include an interim and special dividend totaling £104.2 million. The company's dividends are covered by earnings and cash flows, with payout ratios of 58.6% and 52.6%, respectively. Recent sales updates show growth, with total year-to-date sales reaching £1.36 billion as of March 2025, supporting its capacity to sustain dividends.

- Click here to discover the nuances of Dunelm Group with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Dunelm Group is trading beyond its estimated value.

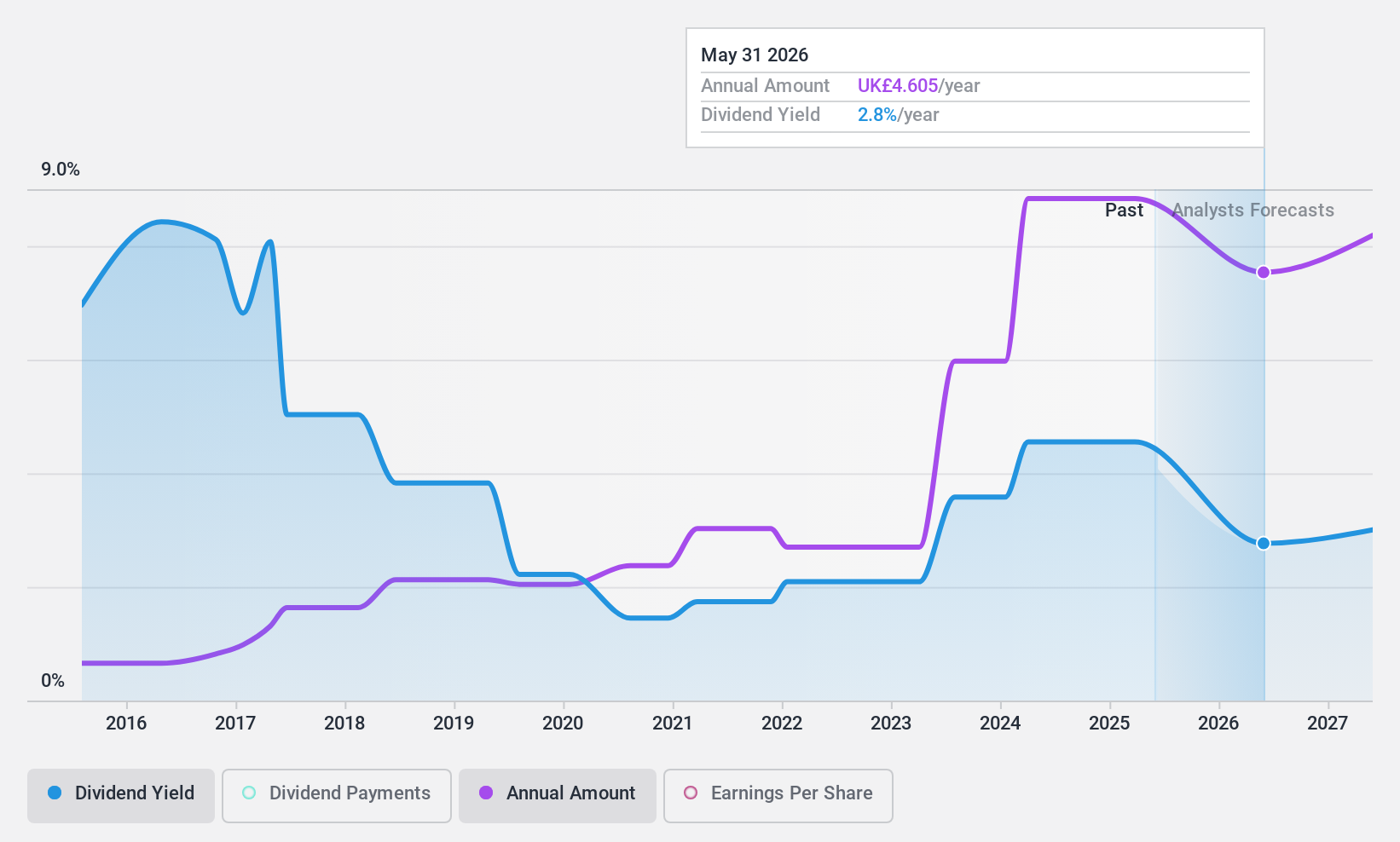

Games Workshop Group (LSE:GAW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Games Workshop Group PLC designs, manufactures, distributes, and sells fantasy miniature figures and games globally, with a market cap of £4.82 billion.

Operations: Games Workshop Group PLC generates revenue through its Core segment, which accounts for £528.50 million, and its Licensing segment, contributing £49 million.

Dividend Yield: 3.7%

Games Workshop Group's dividend yield of 3.7% is below the top UK payers, yet it has consistently increased over 10 years. Recent dividends total £5.20 per share for 2024/25, up from £4.20 the previous year, reflecting surplus cash distribution policy. Despite stable earnings growth and reliable payments, sustainability concerns arise due to a high cash payout ratio of 111.6%. Recent board changes and product announcements may influence future financial performance and dividend capacity.

- Click to explore a detailed breakdown of our findings in Games Workshop Group's dividend report.

- The analysis detailed in our Games Workshop Group valuation report hints at an inflated share price compared to its estimated value.

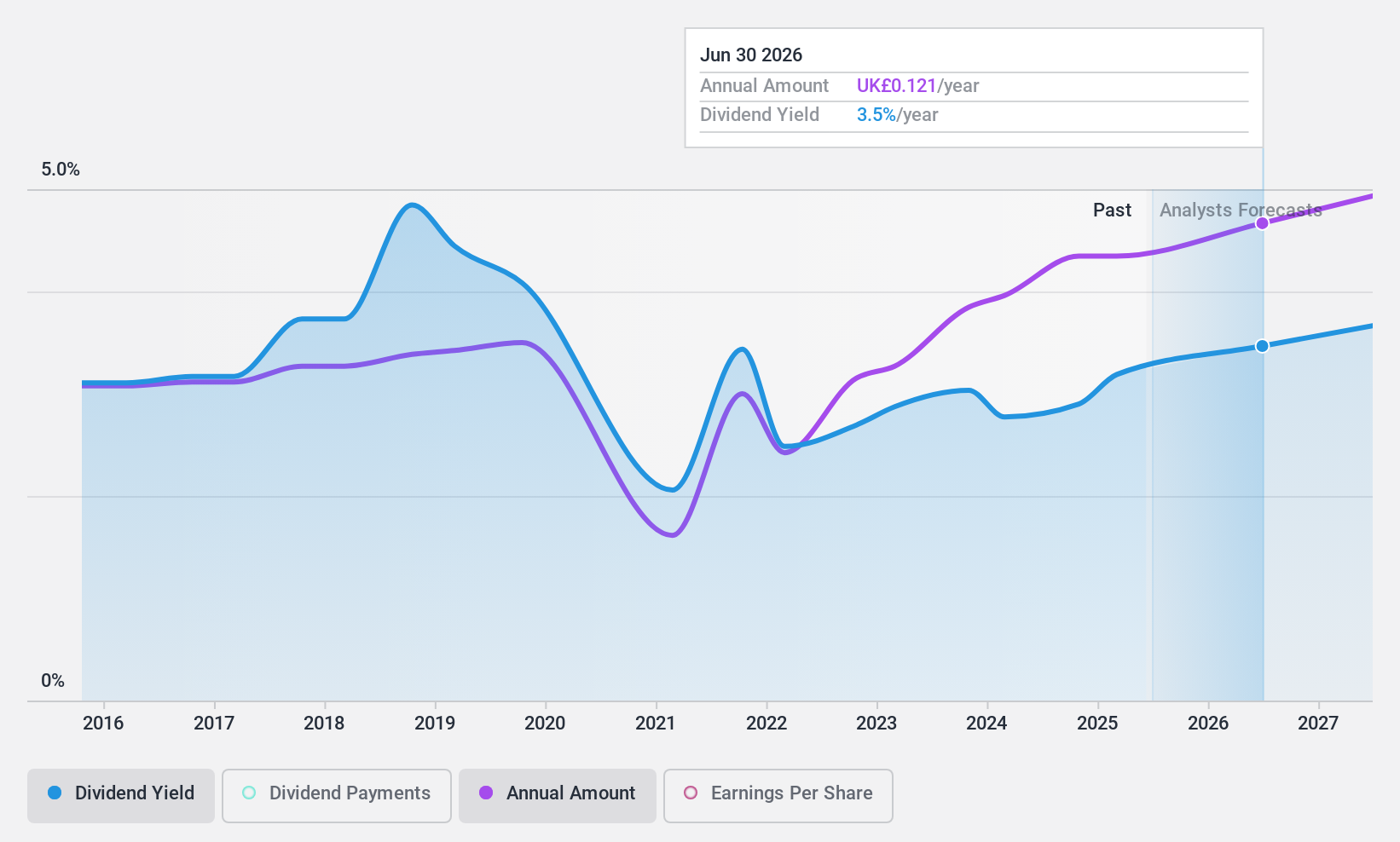

Wilmington (LSE:WIL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wilmington plc, along with its subsidiaries, offers data, information, training, and education solutions to professional markets globally and has a market cap of £316.03 million.

Operations: Wilmington plc generates revenue through its segments in Legal (£15.64 million), Finance (£69.85 million), and Health, Safety and Environment (HSE) (£10.39 million).

Dividend Yield: 3.2%

Wilmington's dividend yield of 3.2% is modest compared to top UK payers, with a sustainable payout ratio of 72.5% supported by earnings and a cash payout ratio of 57.1%. Despite past volatility, dividends have grown over the last decade. Recent board changes include Gordon Hurst replacing Martin Morgan as Chair in June 2025, while share buybacks commenced in February under a new mandate. Interim dividends remain steady at £0.03 per share for early 2025 distribution.

- Take a closer look at Wilmington's potential here in our dividend report.

- Our expertly prepared valuation report Wilmington implies its share price may be lower than expected.

Summing It All Up

- Click through to start exploring the rest of the 61 Top UK Dividend Stocks now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:DNLM

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives