- United Kingdom

- /

- Leisure

- /

- LSE:GAW

Top UK Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently experienced a downturn, influenced by weak trade data from China and declining commodity prices, which have impacted key sectors tied to global demand. In such fluctuating market conditions, dividend stocks can offer stability and income potential, making them an attractive option for investors looking to enhance their portfolios with reliable returns.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 3.12% | ★★★★★☆ |

| Seplat Energy (LSE:SEPL) | 5.79% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.99% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 6.74% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.23% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.72% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.40% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.66% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.39% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.59% | ★★★★★★ |

Click here to see the full list of 50 stocks from our Top UK Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Bunzl (LSE:BNZL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bunzl plc is a distribution and services company with operations in North America, Continental Europe, the United Kingdom, Ireland, and internationally, and has a market cap of approximately £7.84 billion.

Operations: Bunzl plc generates revenue primarily from its Packaging & Containers segment, amounting to £11.82 billion.

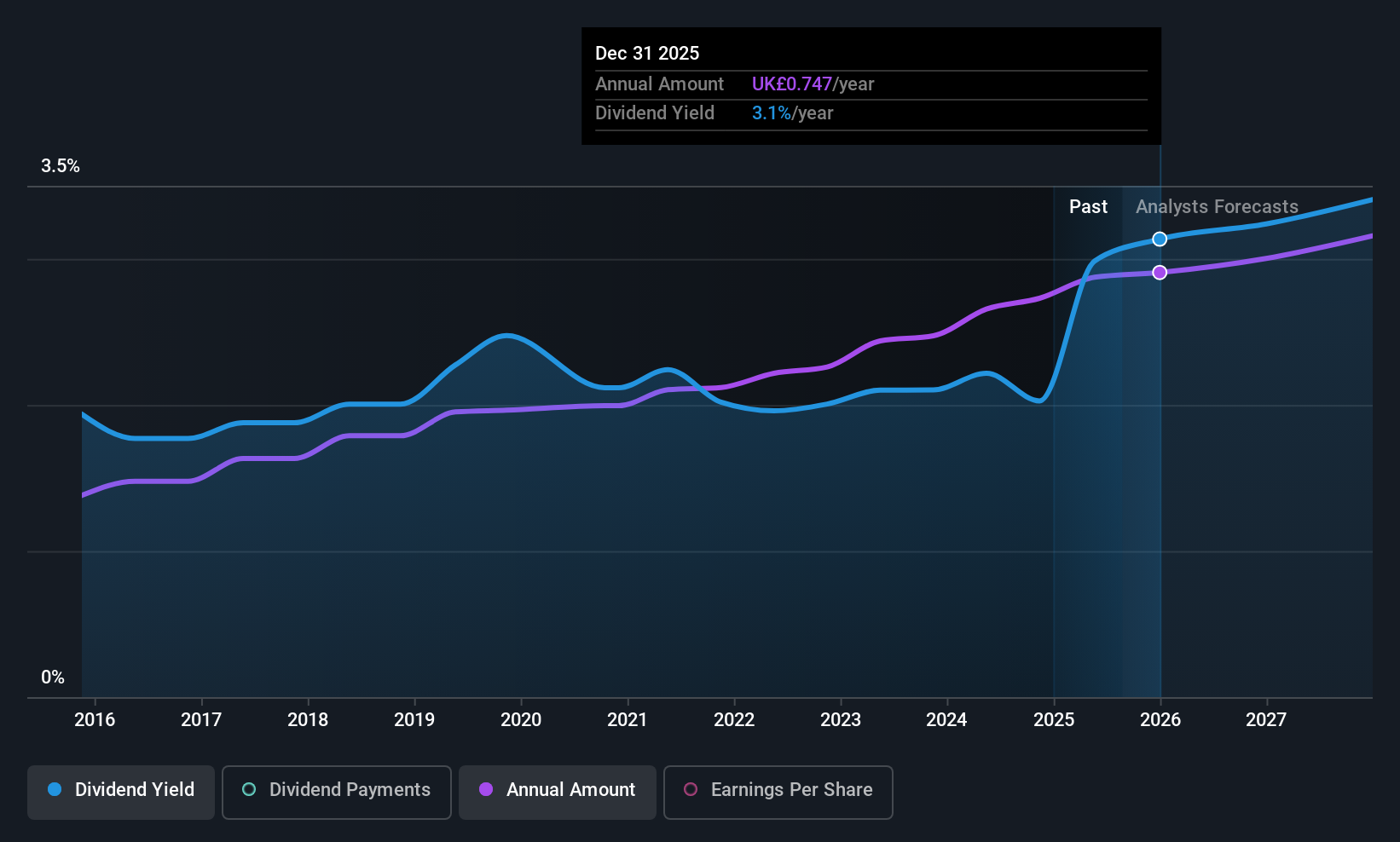

Dividend Yield: 3.1%

Bunzl's dividend payments, covered by earnings and cash flows with payout ratios of 50.5% and 29.1% respectively, have been volatile over the past decade despite recent increases. The company announced a 2025 interim dividend of 20.2 pence per share, totaling approximately £66 million in cash, amid ongoing share buybacks (£114 million for 4.19 million shares). Although its dividend yield (3.05%) is below top-tier UK payers, Bunzl continues to focus on acquisitions for moderate revenue growth despite declining margins.

- Take a closer look at Bunzl's potential here in our dividend report.

- Our valuation report here indicates Bunzl may be undervalued.

4imprint Group (LSE:FOUR)

Simply Wall St Dividend Rating: ★★★★★★

Overview: 4imprint Group plc operates as a direct marketer of promotional products in North America, the United Kingdom, and Ireland, with a market cap of £884.61 million.

Operations: 4imprint Group plc generates revenue primarily from its North America segment, which accounts for $1.33 billion, and the UK & Ireland segment, contributing $25 million.

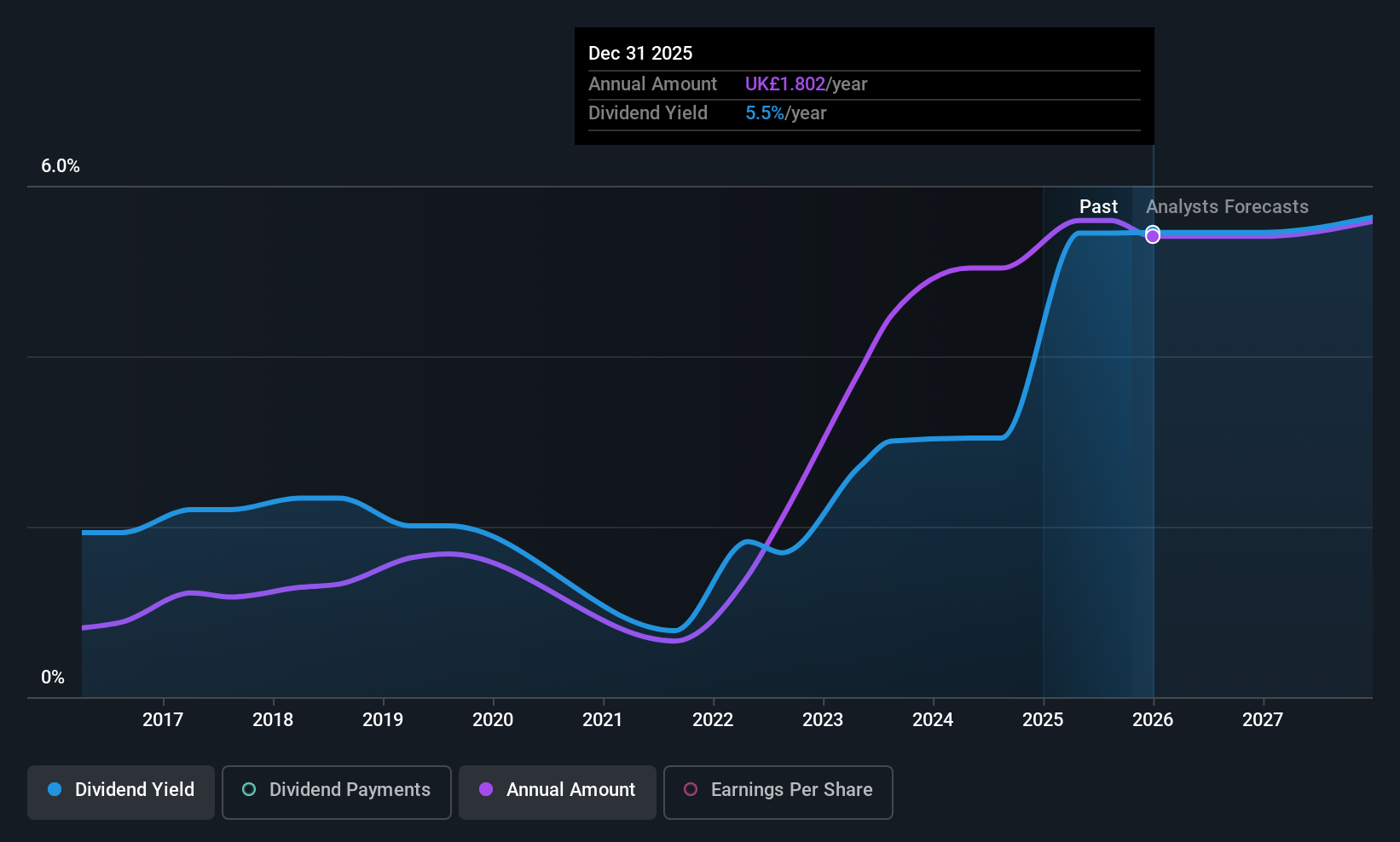

Dividend Yield: 5.6%

4imprint Group offers a high dividend yield (5.59%), ranking in the top 25% of UK payers, with stable and growing payments over the past decade. The dividend is well-covered by earnings and cash flows, with payout ratios at 57.2% and 54.2%, respectively. Despite a forecasted decline in earnings, recent results show steady performance with net income slightly up to US$55.5 million for H1 2025, supporting reliable dividends like the declared interim payment of £0.601 per share.

- Click to explore a detailed breakdown of our findings in 4imprint Group's dividend report.

- Upon reviewing our latest valuation report, 4imprint Group's share price might be too pessimistic.

Games Workshop Group (LSE:GAW)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Games Workshop Group PLC designs, manufactures, distributes, and sells fantasy miniature figures and games globally, with a market cap of approximately £4.91 billion.

Operations: Games Workshop Group PLC generates revenue through its core segment, which includes the design, manufacture, distribution, and sale of fantasy miniature figures and games (£565 million), as well as through licensing (£52.50 million).

Dividend Yield: 3.5%

Games Workshop Group maintains a stable dividend history with recent increases, declaring £2.25 per share for 2025/26, up from £1.00 in 2024/25. Although the dividend yield of 3.49% is below top-tier UK payers, it remains reliable and covered by earnings and cash flows (payout ratios at 87.4% and 83%). Despite an expected decline in earnings over the next three years, past year growth was strong at GBP196 million net income, supporting its dividend strategy.

- Dive into the specifics of Games Workshop Group here with our thorough dividend report.

- The analysis detailed in our Games Workshop Group valuation report hints at an inflated share price compared to its estimated value.

Next Steps

- Access the full spectrum of 50 Top UK Dividend Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GAW

Games Workshop Group

Engages in the design, manufacture, distribution, and sale of fantasy miniature figures and games in the United Kingdom, Continental Europe, North America, Australia, New Zealand, Asia, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives