- United Kingdom

- /

- Biotech

- /

- LSE:GNS

Top 3 Undervalued Small Caps With Insider Buys In United Kingdom For September 2024

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, which continues to struggle in its post-pandemic recovery. This broader market sentiment has created opportunities for discerning investors to identify undervalued small-cap stocks that show potential for growth. In this context, we explore three small-cap companies in the United Kingdom that have garnered insider buying interest, indicating confidence from those closest to the business.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Dr. Martens | 7.9x | 0.6x | 39.82% | ★★★★★★ |

| Domino's Pizza Group | 15.4x | 1.8x | 38.60% | ★★★★★☆ |

| C&C Group | NA | 0.4x | 45.20% | ★★★★★☆ |

| Bytes Technology Group | 26.8x | 6.1x | 4.39% | ★★★★☆☆ |

| CVS Group | 30.4x | 1.2x | 42.29% | ★★★★☆☆ |

| Essentra | 735.9x | 1.4x | 36.76% | ★★★★☆☆ |

| Genus | 167.2x | 2.0x | -0.97% | ★★★★☆☆ |

| NWF Group | 8.8x | 0.1x | 34.98% | ★★★☆☆☆ |

| Alpha Group International | 10.1x | 4.7x | -26.46% | ★★★☆☆☆ |

| Harworth Group | 12.5x | 6.5x | -618.99% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

Dr. Martens (LSE:DOCS)

Simply Wall St Value Rating: ★★★★★★

Overview: Dr. Martens is a British footwear company known for its iconic boots and shoes, with a market cap of approximately £2.50 billion.

Operations: Dr. Martens generates revenue primarily from footwear sales, with a recent gross profit margin of 65.58%. The company incurs costs including COGS (£301.90 million), operating expenses (£448.80 million), and non-operating expenses (£57.20 million).

PE: 7.9x

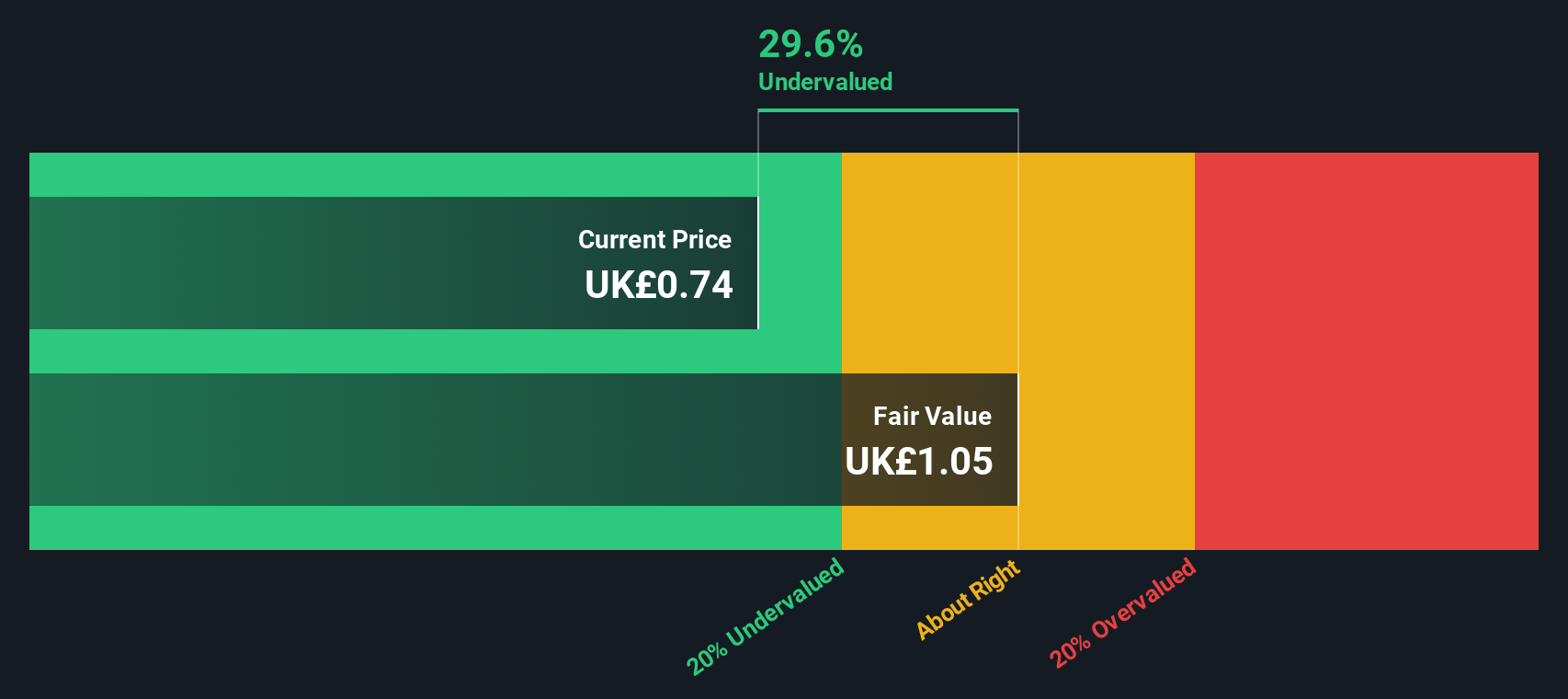

Dr. Martens, a prominent player in the UK market, has seen insider confidence with share purchases between January and March 2024. Despite high debt levels and reliance on external borrowing, their profit margins have improved from 7.9% to 12.9% over the past year. However, the company's stock remains highly volatile over recent months. Following an investor activism campaign that concluded in July 2024 without further discussions, future growth is projected at a modest 5.88% annually.

- Navigate through the intricacies of Dr. Martens with our comprehensive valuation report here.

Review our historical performance report to gain insights into Dr. Martens''s past performance.

Genus (LSE:GNS)

Simply Wall St Value Rating: ★★★★☆☆

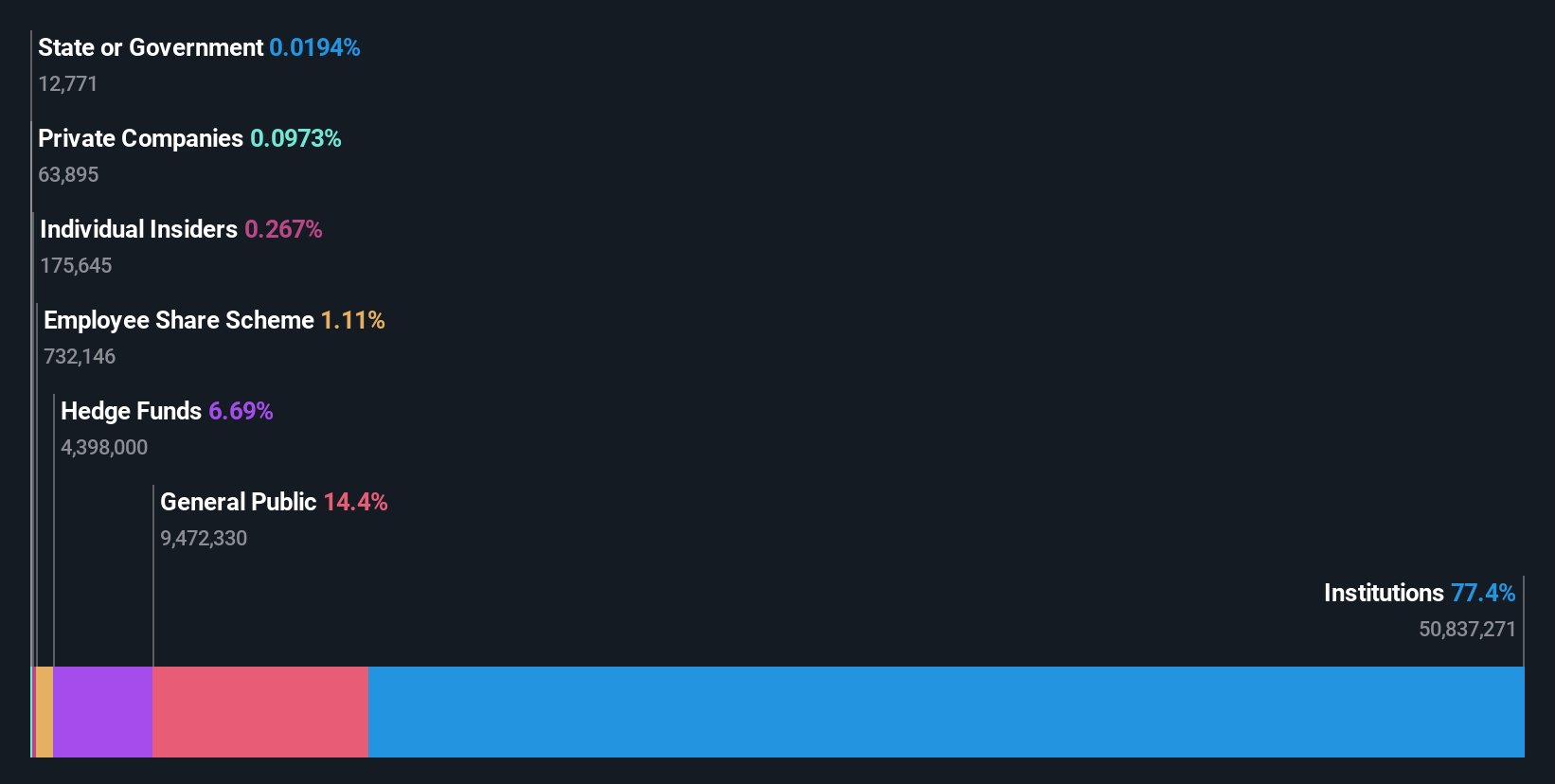

Overview: Genus is a biotechnology company specializing in animal genetics, with operations focused on improving livestock breeding and a market cap of approximately £2.50 billion.

Operations: The company generates revenue primarily from Genus ABS (£314.90 million) and Genus PIC (£352.50 million). Over the periods, net income margins have fluctuated, reaching as high as 14.05% and dropping to -1.40%.

PE: 167.2x

Genus, a UK-based small cap, recently reported full-year sales of £668.8 million and net income of £7.9 million, down from £689.7 million and £33.3 million respectively the previous year. Despite this decline, insider confidence remains high with significant share purchases in the past six months indicating potential undervaluation. The company’s earnings are forecast to grow 39% annually, suggesting promising future prospects despite current challenges such as lower profit margins and reliance on external funding sources.

- Take a closer look at Genus' potential here in our valuation report.

Understand Genus' track record by examining our Past report.

Victrex (LSE:VCT)

Simply Wall St Value Rating: ★★★☆☆☆

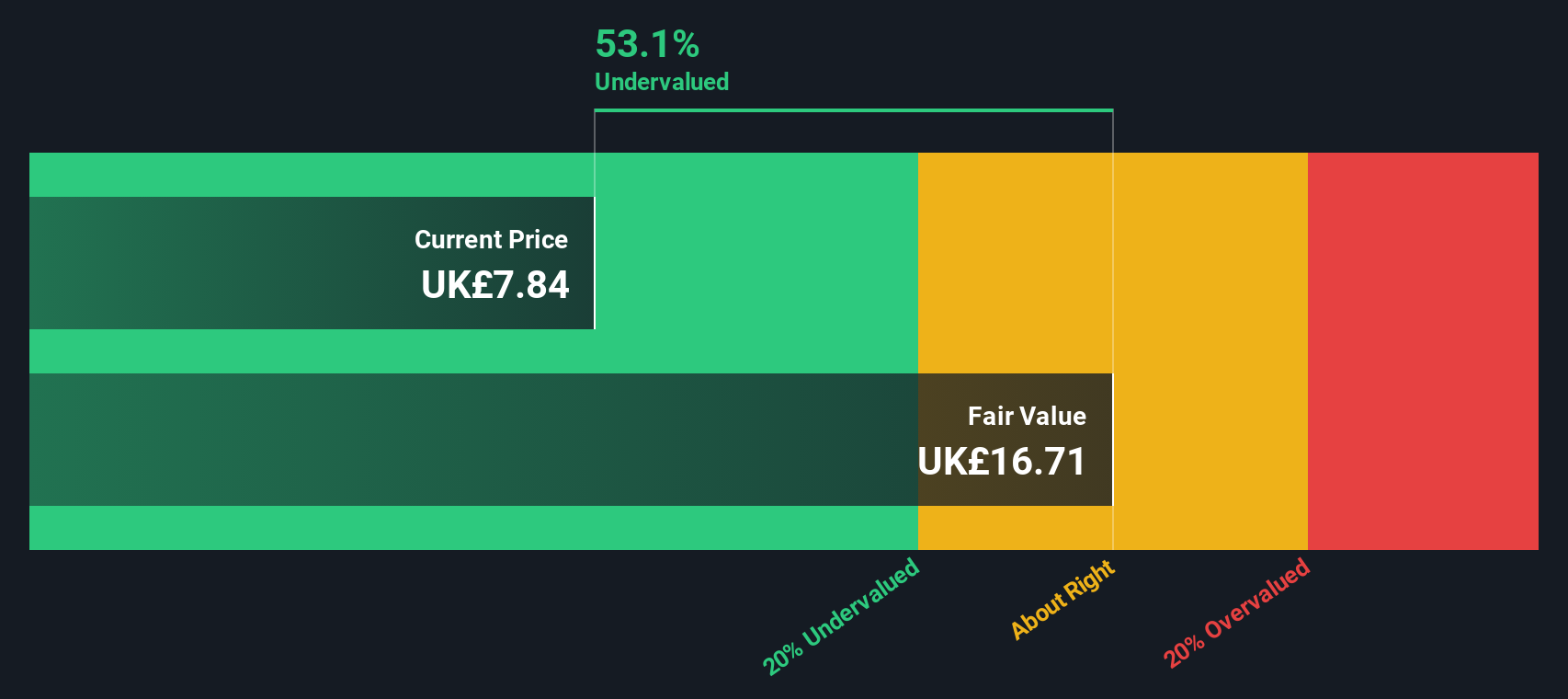

Overview: Victrex is a company that specializes in the production of high-performance polymers, with a market cap of approximately £1.60 billion.

Operations: Victrex's revenue streams are primarily from Sustainable Solutions (£229.8 million) and Medical (£59.1 million). The company's gross profit margin has shown fluctuations, reaching 55.44% in the quarter ending September 2023, while net income margin peaked at 35.38% in March 2018 but later declined to around 10.81% by September 2024 due to rising COGS and operating expenses over time.

PE: 27.8x

Victrex, a UK-based small-cap company, recently received FDA approval for an investigational study of its PEEK-OPTIMA Femoral Component in partnership with Maxx Orthopedics. This study will involve 120 patients across the US and builds on successful trials in Belgium, India, and Italy since 2021. Earnings are projected to grow by 38.07% annually despite lower profit margins (10.8%) compared to last year (21%). Insider confidence is evident with recent share purchases throughout the past year, indicating potential future growth prospects.

- Dive into the specifics of Victrex here with our thorough valuation report.

Gain insights into Victrex's historical performance by reviewing our past performance report.

Taking Advantage

- Take a closer look at our Undervalued UK Small Caps With Insider Buying list of 19 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GNS

Genus

Operates as an animal genetics company in North America, Latin America, the United Kingdom, rest of Europe, the Middle East, Russia, Africa, and Asia.

Good value with reasonable growth potential.