- United Kingdom

- /

- Consumer Durables

- /

- AIM:SPR

Is It Smart To Buy Springfield Properties Plc (LON:SPR) Before It Goes Ex-Dividend?

Springfield Properties Plc (LON:SPR) is about to trade ex-dividend in the next 3 days. This means that investors who purchase shares on or after the 4th of March will not receive the dividend, which will be paid on the 25th of March.

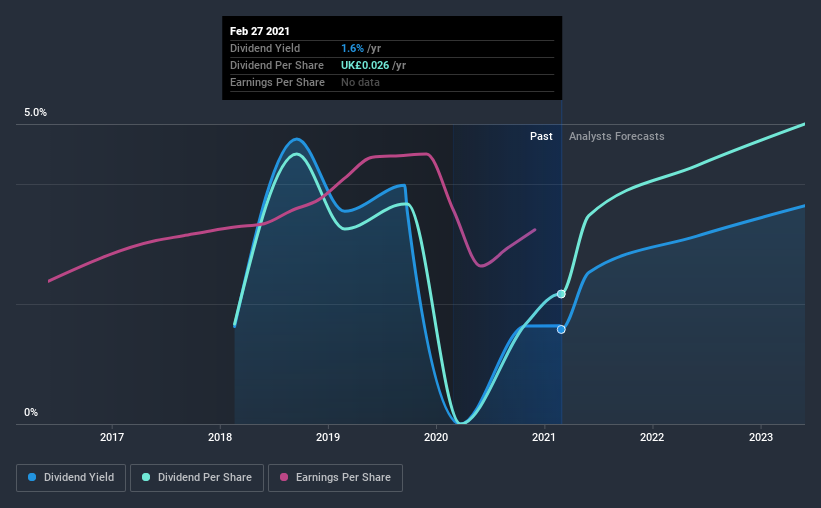

Springfield Properties's next dividend payment will be UK£0.013 per share, on the back of last year when the company paid a total of UK£0.02 to shareholders. Calculating the last year's worth of payments shows that Springfield Properties has a trailing yield of 1.6% on the current share price of £1.65. If you buy this business for its dividend, you should have an idea of whether Springfield Properties's dividend is reliable and sustainable. So we need to investigate whether Springfield Properties can afford its dividend, and if the dividend could grow.

View our latest analysis for Springfield Properties

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Springfield Properties paid out a comfortable 34% of its profit last year. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. This is why it's a relief to see Springfield Properties earnings per share are up 6.4% per annum over the last five years. Management have been reinvested more than half of the company's earnings within the business, and the company has been able to grow earnings with this retained capital. Organisations that reinvest heavily in themselves typically get stronger over time, which can bring attractive benefits such as stronger earnings and dividends.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the last three years, Springfield Properties has lifted its dividend by approximately 9.1% a year on average. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

Final Takeaway

Should investors buy Springfield Properties for the upcoming dividend? Earnings per share have been growing moderately, and Springfield Properties is paying out less than half its earnings and cash flow as dividends, which is an attractive combination as it suggests the company is investing in growth. We would prefer to see earnings growing faster, but the best dividend stocks over the long term typically combine significant earnings per share growth with a low payout ratio, and Springfield Properties is halfway there. There's a lot to like about Springfield Properties, and we would prioritise taking a closer look at it.

On that note, you'll want to research what risks Springfield Properties is facing. Case in point: We've spotted 4 warning signs for Springfield Properties you should be aware of.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Springfield Properties or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:SPR

Springfield Properties

Engages in the residential housebuilding and land development in the United Kingdom.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion