We can readily understand why investors are attracted to unprofitable companies. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

Given this risk, we thought we'd take a look at whether Sosandar (LON:SOS) shareholders should be worried about its cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for Sosandar

When Might Sosandar Run Out Of Money?

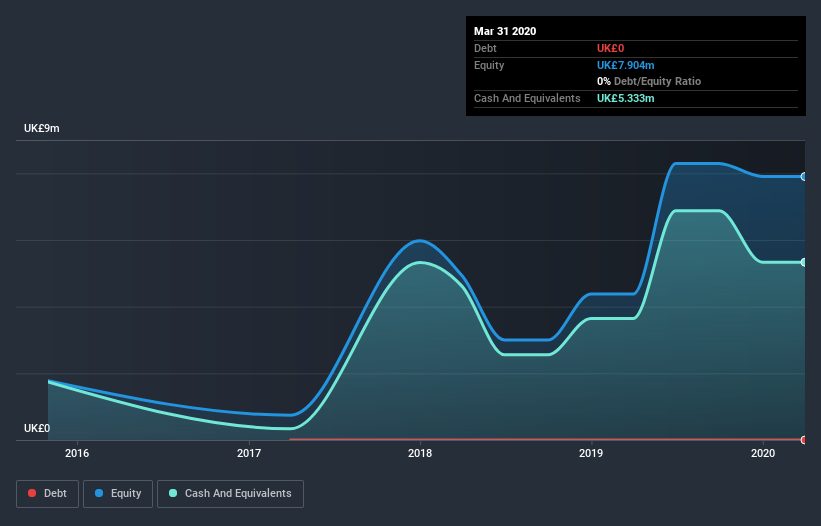

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. When Sosandar last reported its balance sheet in March 2020, it had zero debt and cash worth UK£5.3m. Looking at the last year, the company burnt through UK£9.2m. So it had a cash runway of approximately 7 months from March 2020. That's quite a short cash runway, indicating the company must either reduce its annual cash burn or replenish its cash. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Sosandar Growing?

Notably, Sosandar actually ramped up its cash burn very hard and fast in the last year, by 136%, signifying heavy investment in the business. Of course, the truly verdant revenue growth of 103% in that time may well justify the growth spend. Considering the factors above, the company doesn’t fare badly when it comes to assessing how it is changing over time. In reality, this article only makes a short study of the company's growth data. You can take a look at how Sosandar is growing revenue over time by checking this visualization of past revenue growth.

How Hard Would It Be For Sosandar To Raise More Cash For Growth?

Given the trajectory of Sosandar's cash burn, many investors will already be thinking about how it might raise more cash in the future. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Sosandar's cash burn of UK£9.2m is about 24% of its UK£38m market capitalisation. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

Is Sosandar's Cash Burn A Worry?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought Sosandar's revenue growth was relatively promising. Summing up, we think the Sosandar's cash burn is a risk, based on the factors we mentioned in this article. Taking a deeper dive, we've spotted 5 warning signs for Sosandar you should be aware of, and 2 of them are a bit concerning.

Of course Sosandar may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade Sosandar, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:SOS

Sosandar

Engages in the manufacture and distribution of clothing products in the United Kingdom and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026