- United Kingdom

- /

- Professional Services

- /

- LSE:RCDO

We Think Ricardo (LON:RCDO) Can Stay On Top Of Its Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies. Ricardo plc (LON:RCDO) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Ricardo

What Is Ricardo's Net Debt?

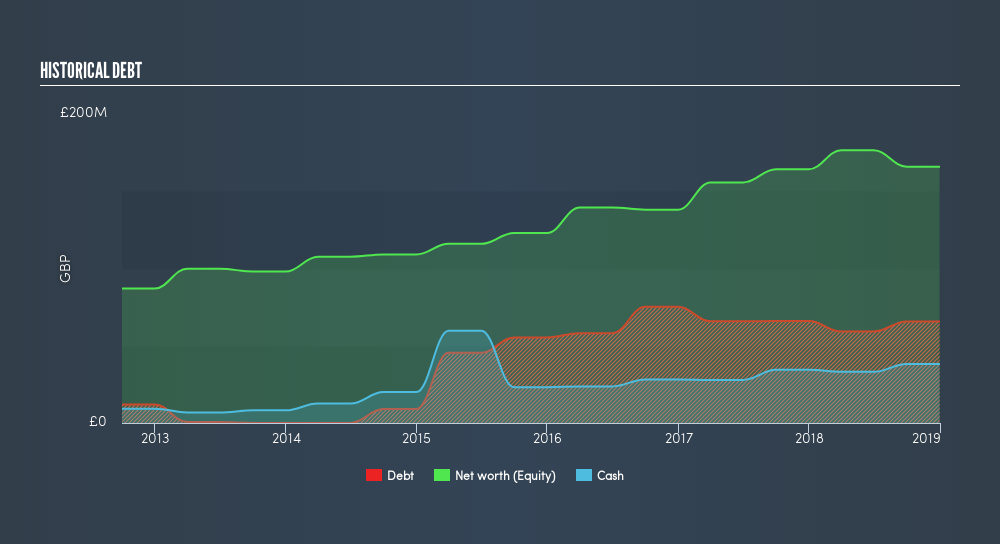

As you can see below, Ricardo had UK£65.7m of debt, at December 2018, which is about the same the year before. You can click the chart for greater detail. However, because it has a cash reserve of UK£38.2m, its net debt is less, at about UK£27.5m.

How Healthy Is Ricardo's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Ricardo had liabilities of UK£106.4m due within 12 months and liabilities of UK£73.9m due beyond that. Offsetting this, it had UK£38.2m in cash and UK£132.2m in receivables that were due within 12 months. So its liabilities total UK£9.90m more than the combination of its cash and short-term receivables.

Since publicly traded Ricardo shares are worth a total of UK£385.3m, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. Since Ricardo does have net debt, we think it is worthwhile for shareholders to keep an eye on the balance sheet, over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Ricardo has a low net debt to EBITDA ratio of only 0.59. And its EBIT covers its interest expense a whopping 19.5 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. The good news is that Ricardo has increased its EBIT by 3.4% over twelve months, which should ease any concerns about debt repayment. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Ricardo's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Looking at the most recent three years, Ricardo recorded free cash flow of 34% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

Ricardo's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But, on a more sombre note, we are a little concerned by its conversion of EBIT to free cash flow. Looking at all the aforementioned factors together, it strikes us that Ricardo can handle its debt fairly comfortably. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. We'd be motivated to research the stock further if we found out that Ricardo insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:RCDO

Ricardo

Provides environmental, technical, and strategic consultancy services in the United Kingdom, Europe, North America, China, rest of Asia, Australia, and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives