- United Kingdom

- /

- Commercial Services

- /

- LSE:MER

UK's Undervalued Small Caps With Insider Buying For December 2024

Reviewed by Simply Wall St

The United Kingdom's market landscape has been influenced by global economic factors, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, highlighting challenges for companies tied to international demand. In such an environment, identifying small-cap stocks that are perceived as undervalued and have insider buying activity can be appealing to investors seeking opportunities that may offer resilience or growth potential despite broader market uncertainties.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Headlam Group | NA | 0.2x | 26.04% | ★★★★★☆ |

| Sabre Insurance Group | 11.1x | 1.4x | 14.04% | ★★★★☆☆ |

| Marlowe | NA | 0.7x | 48.64% | ★★★★☆☆ |

| J D Wetherspoon | 15.6x | 0.4x | 17.94% | ★★★★☆☆ |

| Optima Health | NA | 1.2x | 38.13% | ★★★★☆☆ |

| Gooch & Housego | 97.0x | 0.8x | 35.92% | ★★★☆☆☆ |

| iomart Group | 29.8x | 0.8x | 22.47% | ★★★☆☆☆ |

| Reach | 6.8x | 0.5x | -134.65% | ★★★☆☆☆ |

| Genus | 142.7x | 1.7x | 25.10% | ★★★☆☆☆ |

| THG | NA | 0.3x | -1014.58% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

Renew Holdings (AIM:RNWH)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Renew Holdings is a UK-based engineering services group focused on infrastructure, energy, and environmental markets with a market cap of approximately £0.67 billion.

Operations: Renew Holdings generates revenue primarily through its operations, with recent figures showing a significant increase to £1.06 billion as of September 2024. The company's cost structure includes operating expenses that reached £986.1 million in the same period. The gross profit margin displayed an unusual figure of 100% for the last two periods, indicating potential anomalies or reporting changes in financial data.

PE: 18.3x

Renew Holdings, a smaller UK company, is positioned as potentially undervalued with an anticipated 10.36% annual earnings growth. Despite relying entirely on external borrowing for funding, which carries higher risk than customer deposits, insider confidence is evident through recent share purchases in the past months. With their fiscal year 2024 results expected soon, this backdrop suggests potential for future growth amid financial challenges and opportunities in their industry landscape.

- Delve into the full analysis valuation report here for a deeper understanding of Renew Holdings.

Gain insights into Renew Holdings' past trends and performance with our Past report.

Mears Group (LSE:MER)

Simply Wall St Value Rating: ★★★★☆☆

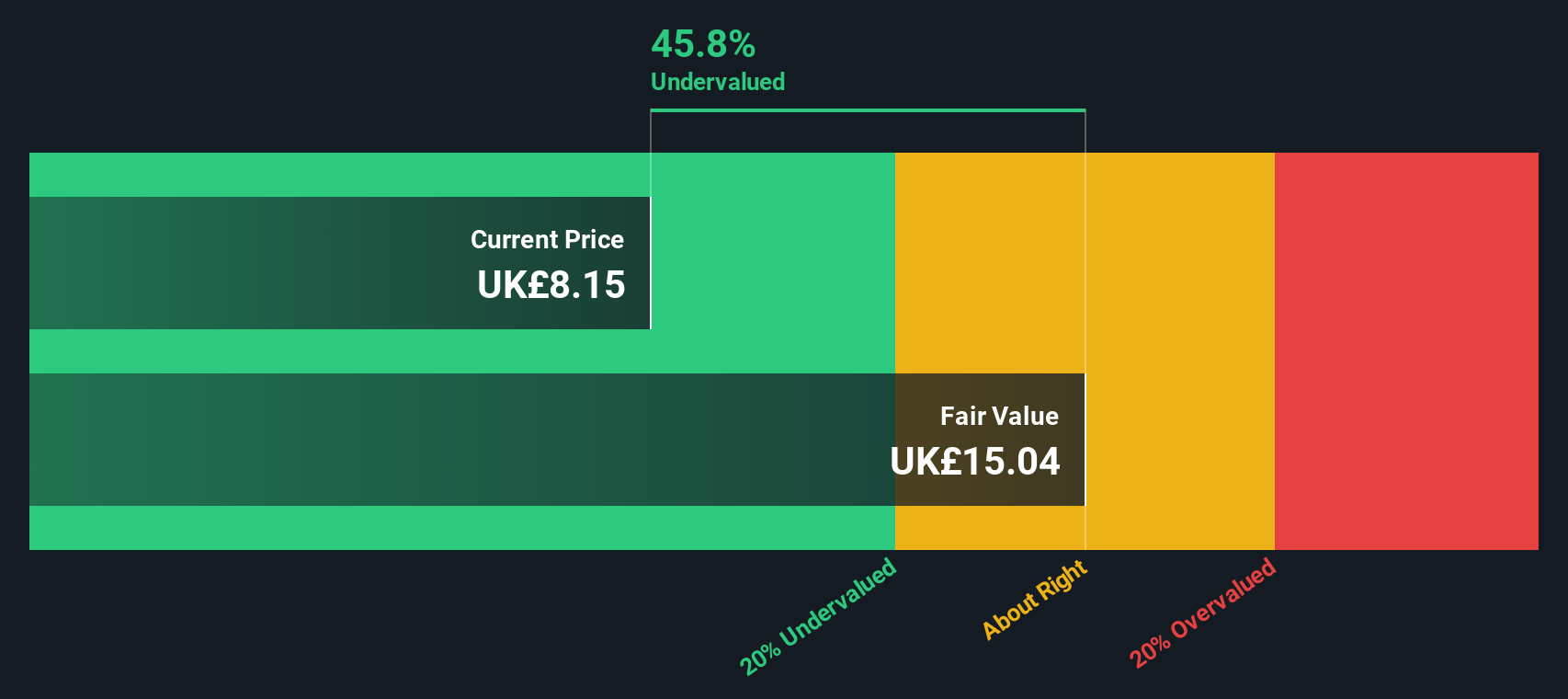

Overview: Mears Group is a UK-based company specializing in providing management and maintenance services, with a market capitalization of approximately £0.42 billion.

Operations: The company generates revenue primarily from its Management and Maintenance segments. Over the periods analyzed, the gross profit margin showed a trend of fluctuation, with a notable increase to 21.68% by mid-2024. Operating expenses are predominantly driven by general and administrative costs, which have been consistently significant across the periods observed.

PE: 7.9x

Mears Group, a UK-based company with a smaller market presence, recently updated its earnings guidance for 2024, projecting revenues around £1.1 billion, surpassing prior expectations. Despite forecasts suggesting a 15.6% annual decline in earnings over the next three years and reliance on higher-risk external borrowing for funding, insider confidence is evident as Andrew C. Smith acquired 25,000 shares worth approximately £91,100 in November 2024. This purchase reflects potential optimism amidst challenging financial projections.

- Unlock comprehensive insights into our analysis of Mears Group stock in this valuation report.

Assess Mears Group's past performance with our detailed historical performance reports.

Sabre Insurance Group (LSE:SBRE)

Simply Wall St Value Rating: ★★★★☆☆

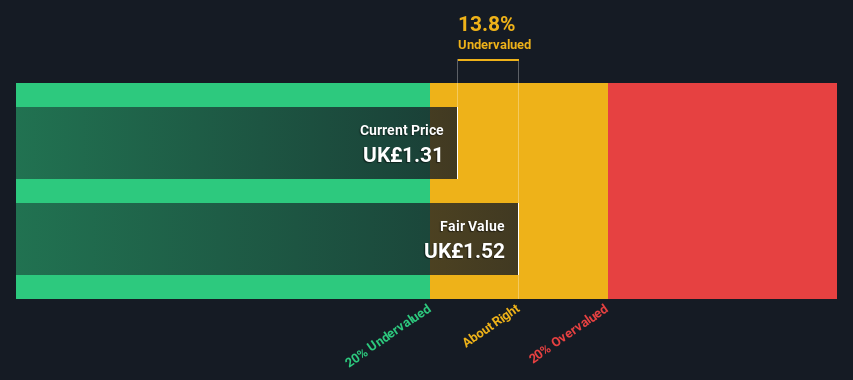

Overview: Sabre Insurance Group is a UK-based insurer specializing in motor vehicle coverage, including taxis and motorcycles, with a market cap of £0.25 billion.

Operations: The company's revenue streams are primarily driven by the motor vehicle segment, excluding taxis. Over recent periods, the gross profit margin has shown variability, with a notable increase to 37.30% in 2024 from a low of 11.14% in mid-2023. Operating expenses have fluctuated significantly, impacting net income margins which reached 13.08% by mid-2024 after experiencing lower figures in previous years.

PE: 11.1x

Sabre Insurance Group, a smaller player in the UK market, recently reported a rise in gross written premiums to £186.5 million for the nine months ending September 2024, up from £162.2 million last year. This growth highlights its potential despite relying entirely on external borrowing for funding, which carries higher risk than customer deposits. Insider confidence is evident with recent share purchases by insiders this year, suggesting belief in future earnings growth projected at 13.66% annually.

- Click to explore a detailed breakdown of our findings in Sabre Insurance Group's valuation report.

Evaluate Sabre Insurance Group's historical performance by accessing our past performance report.

Where To Now?

- Click this link to deep-dive into the 29 companies within our Undervalued UK Small Caps With Insider Buying screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MER

Mears Group

Provides various outsourced services to the public and private sectors in the United Kingdom.

Outstanding track record with excellent balance sheet and pays a dividend.