- United Kingdom

- /

- Diversified Financial

- /

- AIM:MAB1

3 UK Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

Amidst the recent downturn in the FTSE 100, driven by weak trade data from China and a faltering global economy, UK investors are seeking stability and income in their portfolios. In such uncertain times, dividend stocks can offer a reliable income stream and potential for long-term growth, making them an attractive option for those looking to enhance their investment strategy.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 4.00% | ★★★★★☆ |

| Seplat Energy (LSE:SEPL) | 7.58% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.98% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 6.40% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.26% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.75% | ★★★★★★ |

| Macfarlane Group (LSE:MACF) | 5.72% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.32% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 6.01% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.82% | ★★★★★☆ |

Click here to see the full list of 53 stocks from our Top UK Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Mortgage Advice Bureau (Holdings) (AIM:MAB1)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mortgage Advice Bureau (Holdings) plc, with a market cap of £394.11 million, operates in the United Kingdom offering mortgage advice services through its subsidiaries.

Operations: The company's revenue is primarily derived from the provision of financial services, amounting to £289.64 million.

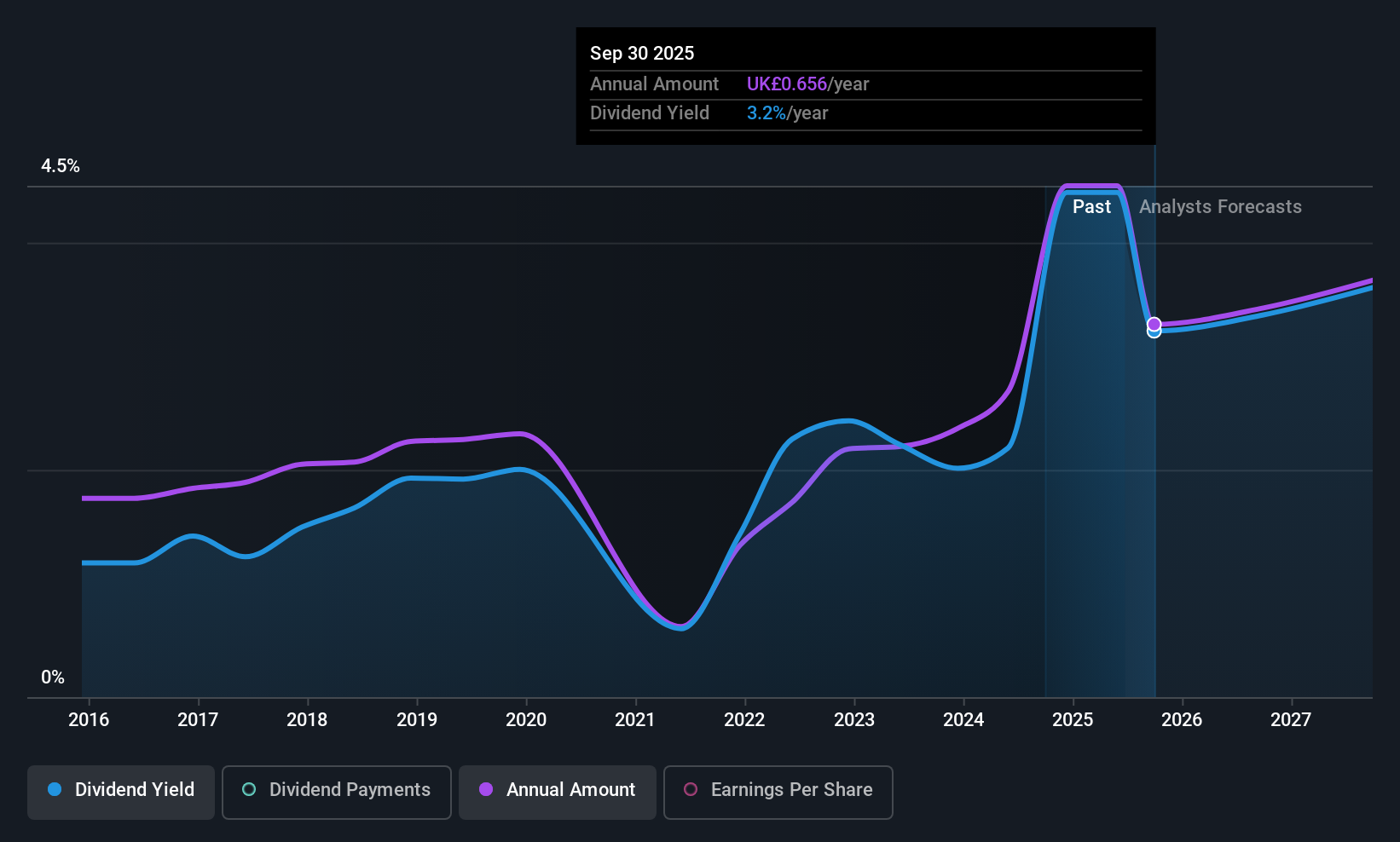

Dividend Yield: 3.2%

Mortgage Advice Bureau (Holdings) plc recently proposed a reduced interim dividend of 7.2 pence per share, aligning with their strategy to distribute 50% of full-year profits. Despite earnings growth, the dividend yield remains lower than top UK payers at 3.24%. The dividend is well-covered by both earnings and cash flows with payout ratios of 67% and 43.5%, respectively, but has been historically volatile and unreliable over the past decade.

- Unlock comprehensive insights into our analysis of Mortgage Advice Bureau (Holdings) stock in this dividend report.

- According our valuation report, there's an indication that Mortgage Advice Bureau (Holdings)'s share price might be on the expensive side.

Associated British Foods (LSE:ABF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Associated British Foods plc operates globally in the food, ingredients, and retail sectors with a market capitalization of £14.82 billion.

Operations: Associated British Foods plc generates revenue through its key segments, including Retail (£9.49 billion), Grocery (£4.13 billion), Sugar (£2.05 billion), Ingredients (£2.04 billion), and Agriculture (£1.62 billion).

Dividend Yield: 3%

Associated British Foods' dividend yield is modest at 3.02%, below the UK's top 25% payers. Despite a volatile dividend history, recent payments are well-covered by earnings and cash flows with payout ratios around 44%. The company confirmed a final dividend of 42.3 pence per share for the year ending September 2025. A potential Primark spin-off could impact future dividends, as ABF explores restructuring to enhance valuation and focus on its food business.

- Navigate through the intricacies of Associated British Foods with our comprehensive dividend report here.

- According our valuation report, there's an indication that Associated British Foods' share price might be on the cheaper side.

Mears Group (LSE:MER)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mears Group plc, with a market cap of £312.17 million, provides outsourced services to both public and private sectors in the United Kingdom through its subsidiaries.

Operations: Mears Group plc generates revenue from its Management segment at £533.92 million and Maintenance segment at £577.93 million in the United Kingdom.

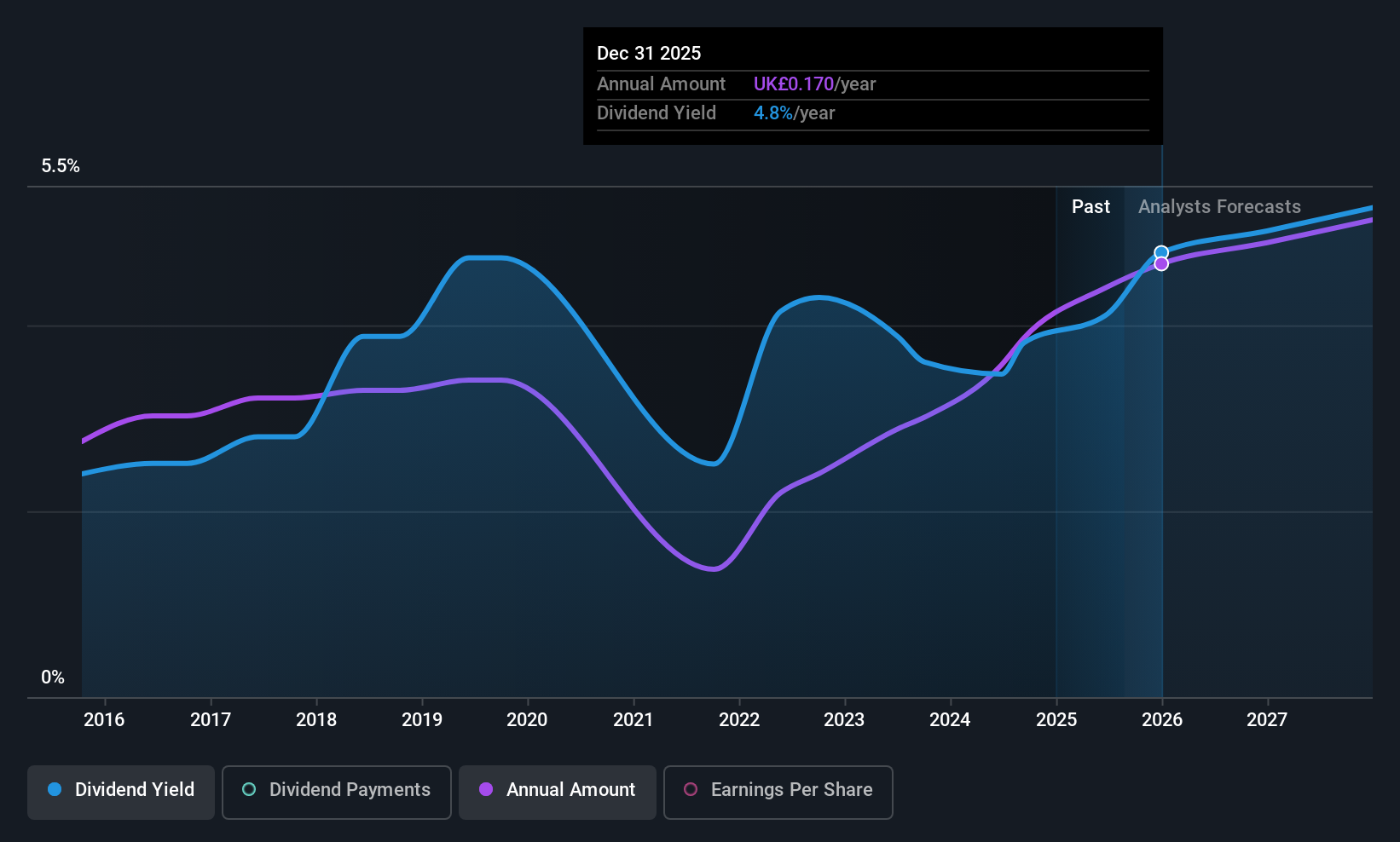

Dividend Yield: 4.7%

Mears Group's dividend yield of 4.67% is below the UK's top 25% payers, but its payouts are well-covered by earnings and cash flows with low payout ratios of 30.5% and 16.8%, respectively. Despite a history of volatility, dividends have grown over the past decade. Earnings grew by £13 million last year but are expected to decline annually by an average of £13 million over the next three years, potentially impacting future dividends.

- Take a closer look at Mears Group's potential here in our dividend report.

- Our valuation report here indicates Mears Group may be undervalued.

Next Steps

- Get an in-depth perspective on all 53 Top UK Dividend Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MAB1

Mortgage Advice Bureau (Holdings)

Provides mortgage advice services in the United Kingdom.

Outstanding track record with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success