- United Kingdom

- /

- Commercial Services

- /

- AIM:WATR

Here's Why I Think Water Intelligence (LON:WATR) Is An Interesting Stock

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In contrast to all that, I prefer to spend time on companies like Water Intelligence (LON:WATR), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Water Intelligence

How Fast Is Water Intelligence Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Water Intelligence has grown EPS by 29% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

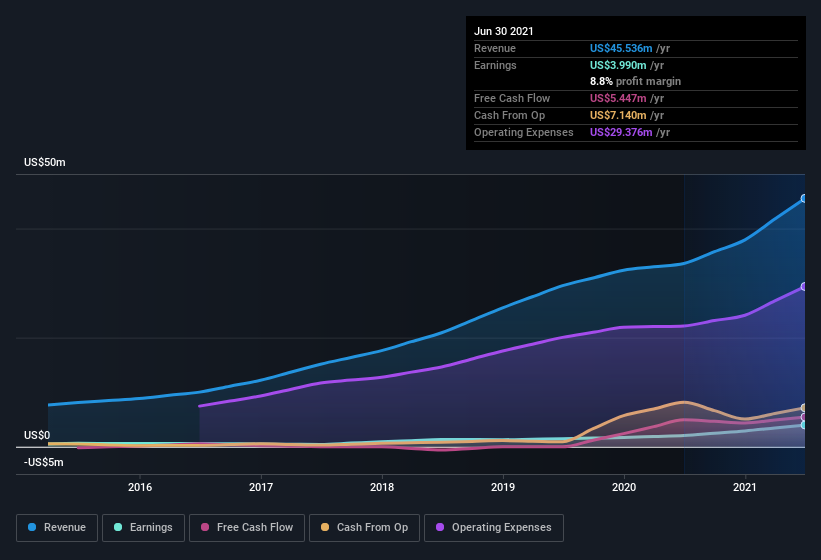

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Water Intelligence is growing revenues, and EBIT margins improved by 4.8 percentage points to 14%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Water Intelligence's future profits.

Are Water Intelligence Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that Water Intelligence insiders have a significant amount of capital invested in the stock. To be specific, they have US$37m worth of shares. That's a lot of money, and no small incentive to work hard. Those holdings account for over 27% of the company; visible skin in the game.

Should You Add Water Intelligence To Your Watchlist?

You can't deny that Water Intelligence has grown its earnings per share at a very impressive rate. That's attractive. Further, the high level of insider ownership impresses me, and suggests that I'm not the only one who appreciates the EPS growth. Fast growth and confident insiders should be enough to warrant further research. So the answer is that I do think this is a good stock to follow along with. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Water Intelligence that you should be aware of.

Although Water Intelligence certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Water Intelligence might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:WATR

Water Intelligence

Provides leak detection and remediation services for potable and non-potable water in the United States, the United Kingdom, Ireland, Australia, Canada, and internationally.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives