- United Kingdom

- /

- Commercial Services

- /

- AIM:TENG

Ten Lifestyle Group Plc (LON:TENG) Looks Just Right With A 38% Price Jump

Ten Lifestyle Group Plc (LON:TENG) shares have had a really impressive month, gaining 38% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 26% over that time.

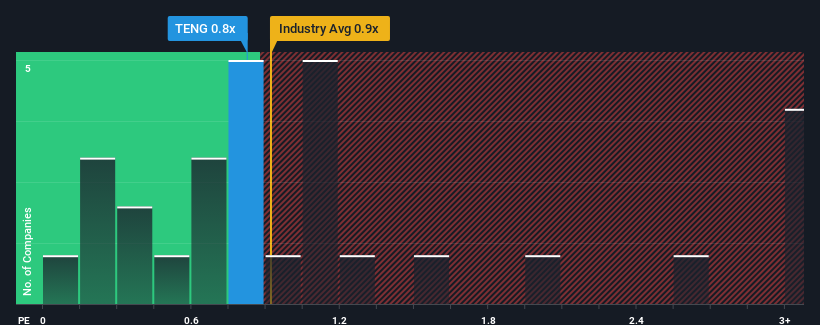

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Ten Lifestyle Group's P/S ratio of 0.8x, since the median price-to-sales (or "P/S") ratio for the Commercial Services industry in the United Kingdom is also close to 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Ten Lifestyle Group

How Has Ten Lifestyle Group Performed Recently?

Ten Lifestyle Group could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Ten Lifestyle Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is Ten Lifestyle Group's Revenue Growth Trending?

In order to justify its P/S ratio, Ten Lifestyle Group would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period has seen an excellent 92% overall rise in revenue, in spite of its uninspiring short-term performance. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Looking ahead now, revenue is anticipated to climb by 4.4% per year during the coming three years according to the only analyst following the company. That's shaping up to be similar to the 4.4% each year growth forecast for the broader industry.

In light of this, it's understandable that Ten Lifestyle Group's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Ten Lifestyle Group's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've seen that Ten Lifestyle Group maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Ten Lifestyle Group that you need to be mindful of.

If you're unsure about the strength of Ten Lifestyle Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Ten Lifestyle Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:TENG

Ten Lifestyle Group

Offers concierge services to private banks, premium financial services, and high-net-worth individuals in Asia, the Middle East, Africa, and the Americas.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026