- United Kingdom

- /

- Commercial Services

- /

- AIM:TENG

Some Shareholders Feeling Restless Over Ten Lifestyle Group Plc's (LON:TENG) P/S Ratio

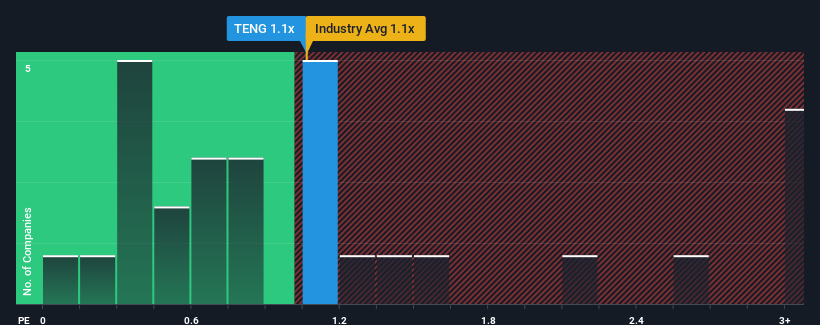

It's not a stretch to say that Ten Lifestyle Group Plc's (LON:TENG) price-to-sales (or "P/S") ratio of 1.1x seems quite "middle-of-the-road" for Commercial Services companies in the United Kingdom, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Ten Lifestyle Group

What Does Ten Lifestyle Group's P/S Mean For Shareholders?

Ten Lifestyle Group certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Ten Lifestyle Group's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Ten Lifestyle Group's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 37% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 44% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 2.5% as estimated by the only analyst watching the company. With the industry predicted to deliver 8.9% growth, that's a disappointing outcome.

With this information, we find it concerning that Ten Lifestyle Group is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It appears that Ten Lifestyle Group currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

Before you settle on your opinion, we've discovered 1 warning sign for Ten Lifestyle Group that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Ten Lifestyle Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:TENG

Ten Lifestyle Group

Offers concierge services to private banks, premium financial services, and high-net-worth individuals in Asia, the Middle East, Africa, and the Americas.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives