- United Kingdom

- /

- Commercial Services

- /

- AIM:SFT

3 UK Penny Stocks With Market Caps Up To £200M

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, impacting companies tied to its economic fortunes. Despite these broader market pressures, penny stocks—typically smaller or newer companies—continue to offer intriguing investment opportunities. These stocks may be seen as a throwback term but remain relevant for investors seeking growth potential at lower price points when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.975 | £190.6M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.10 | £794.96M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.05 | £404.29M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.525 | £176.67M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.29 | £302.86M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.51 | £196.12M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.474 | £229.49M | ★★★★★☆ |

| Ultimate Products (LSE:ULTP) | £1.39 | £121.5M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.906 | £70.43M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.464 | $265.96M | ★★★★★★ |

Click here to see the full list of 467 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Software Circle (AIM:SFT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Software Circle plc, along with its subsidiaries, licenses various software in the United Kingdom, Ireland, Europe, and internationally with a market cap of £99.47 million.

Operations: The company's revenue is primarily derived from its Graphics & Ecommerce segment (£10.45 million), followed by Health & Social Care (£2.63 million), Property (£1.55 million), Professional & Financial Services (£1.41 million), and Education (£0.13 million).

Market Cap: £99.47M

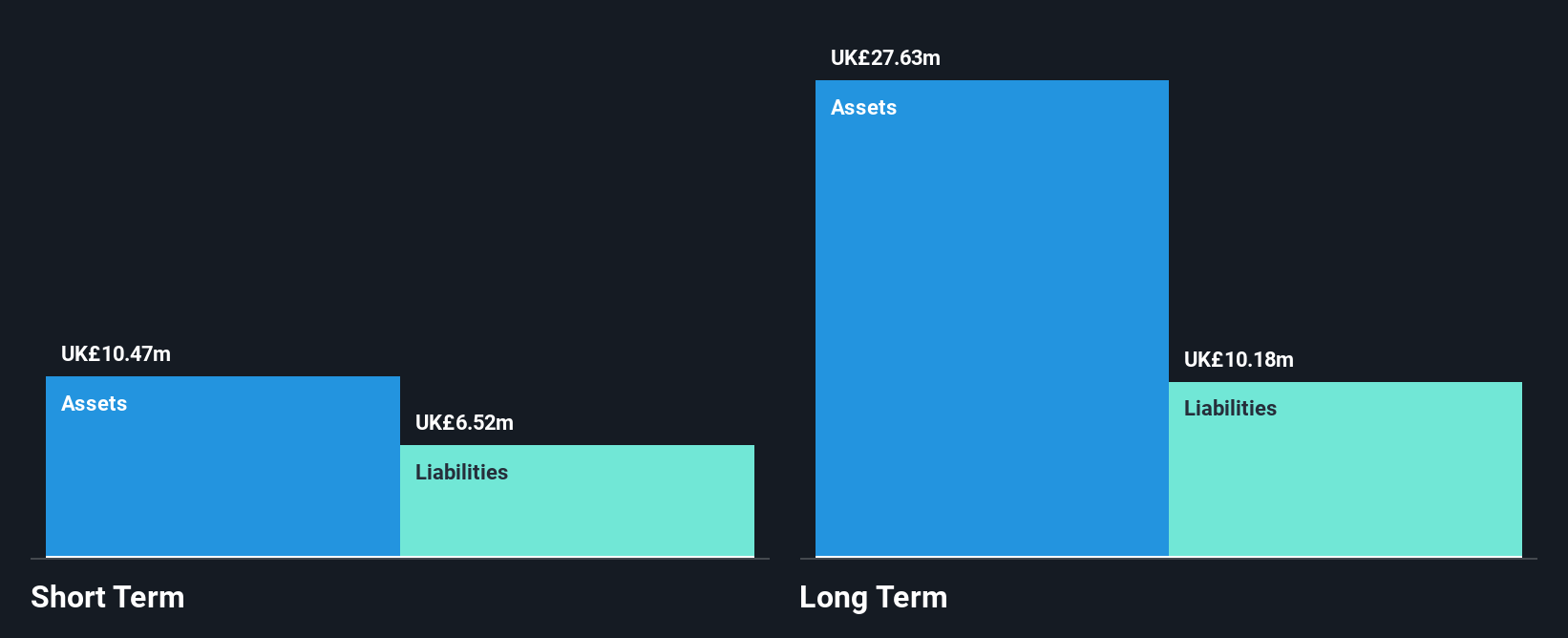

Software Circle plc, with a market cap of £99.47 million, has shown revenue growth in its Graphics & Ecommerce segment (£10.45 million), despite remaining unprofitable with a net loss of £2.37 million for the year ending March 31, 2024. The company benefits from a strong cash position that covers short and long-term liabilities and supports more than three years of operations due to positive free cash flow growth. Recent board changes include the resignation of Chairman Jan Mohr and Non-Executive Director Conrad Bona, reflecting strategic shifts as Software Circle navigates its financial challenges while trading significantly below estimated fair value.

- Click to explore a detailed breakdown of our findings in Software Circle's financial health report.

- Learn about Software Circle's historical performance here.

Braemar (LSE:BMS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Braemar Plc offers shipbroking services both in the United Kingdom and internationally, with a market capitalization of £82.53 million.

Operations: The company generates its revenue through three main segments: Chartering (£103.95 million), Risk Advisory (£23.11 million), and Investment Advisory (£25.70 million).

Market Cap: £82.53M

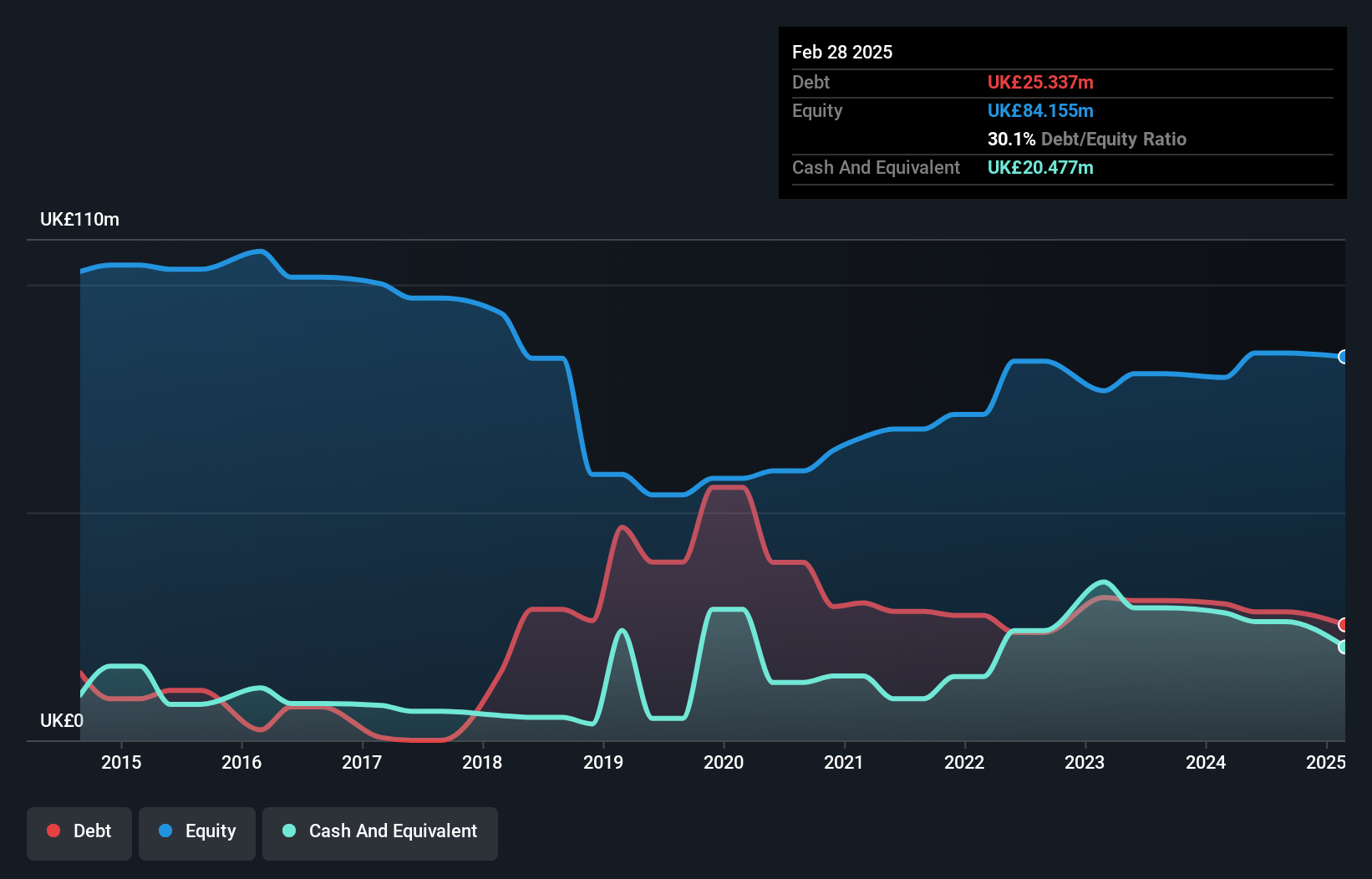

Braemar Plc, with a market cap of £82.53 million, operates in shipbroking and has shown resilience despite challenges. The company's revenue guidance for HY 2025 indicates stability with expected revenues not less than £75 million. While its net profit margin improved slightly to 3%, earnings growth has lagged behind industry averages. Debt management shows improvement, as the debt-to-equity ratio decreased significantly over five years, though cash flow coverage remains weak. Shareholder dilution occurred recently, but Braemar trades at a substantial discount to estimated fair value and maintains experienced management and board teams to navigate future prospects effectively.

- Dive into the specifics of Braemar here with our thorough balance sheet health report.

- Understand Braemar's earnings outlook by examining our growth report.

Harmony Energy Income Trust (LSE:HEIT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Harmony Energy Income Trust Plc is an investment company that focuses on commercial scale battery energy storage and renewable energy generation projects in the United Kingdom, with a market cap of £116.97 million.

Operations: The company reports revenue from unclassified services amounting to -£26.29 million.

Market Cap: £116.97M

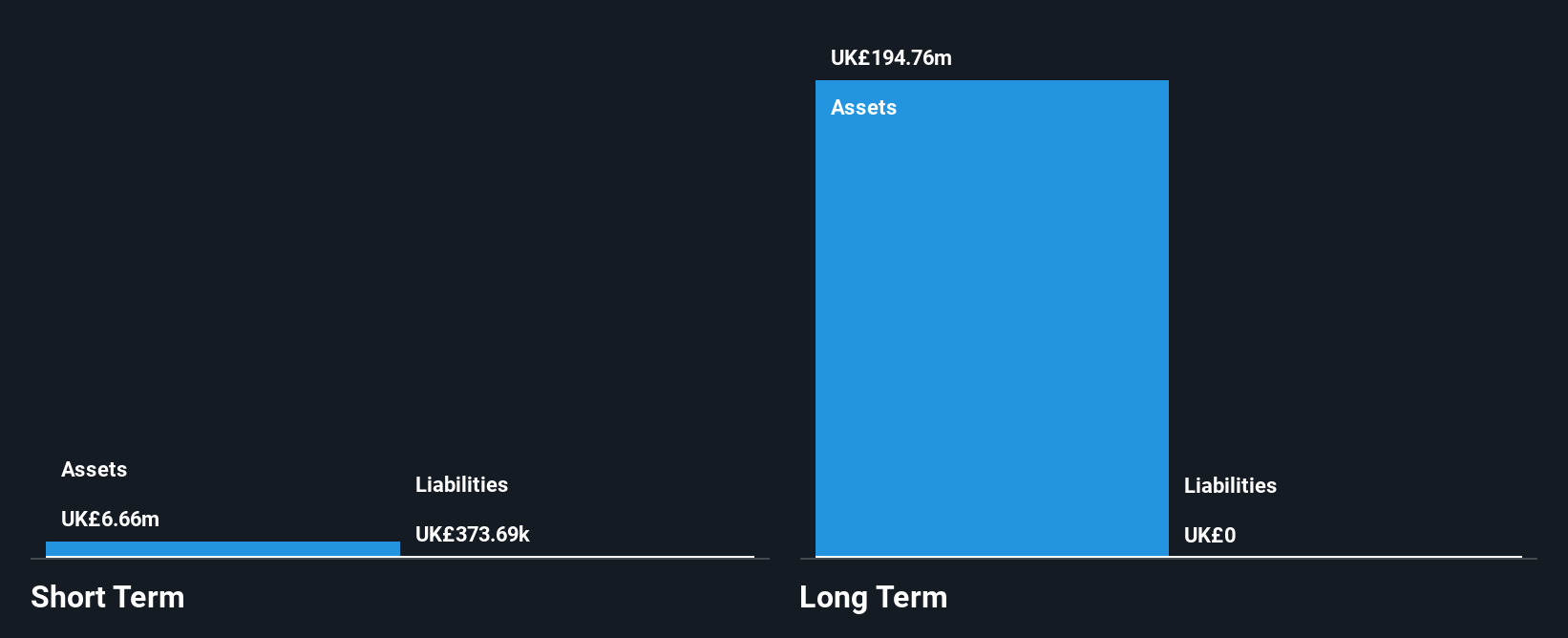

Harmony Energy Income Trust Plc, with a market cap of £116.97 million, focuses on battery energy storage projects in the UK and is currently pre-revenue, reporting -£26.29 million in revenue. The company is progressing with an asset sale process, having received strong interest and non-binding offers for its portfolio. Despite being unprofitable and experiencing a slight NAV decline to £215.43 million due to negative mark-to-market valuations, it remains debt-free with adequate short-term assets (£14.9M) covering liabilities (£449.8K). Its operational capacity recently increased to 625 MWh/312.5 MW following the energisation of its Rusholme project.

- Take a closer look at Harmony Energy Income Trust's potential here in our financial health report.

- Assess Harmony Energy Income Trust's future earnings estimates with our detailed growth reports.

Turning Ideas Into Actions

- Take a closer look at our UK Penny Stocks list of 467 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SFT

Software Circle

Engages in the licensing of various software in the United Kingdom, Ireland, Europe, and internationally.

Excellent balance sheet and slightly overvalued.