- United Kingdom

- /

- Aerospace & Defense

- /

- AIM:MSI

Undiscovered Gems in the UK to Watch This November 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index grapples with the repercussions of weak trade data from China, reflecting broader global economic challenges, investors are keeping a close eye on market volatility and its impact on small-cap stocks. In this environment, identifying promising opportunities involves seeking companies with robust fundamentals and resilience to external pressures, making them potential undiscovered gems in the UK market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 42.17% | 45.70% | ★★★★★★ |

| Goodwin | 19.83% | 10.66% | 18.55% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.01% | 5.12% | ★★★★★★ |

| BioPharma Credit | NA | 7.73% | 7.94% | ★★★★★★ |

| Georgia Capital | NA | 2.23% | 16.34% | ★★★★★★ |

| Vectron Systems | NA | 2.48% | 28.82% | ★★★★★★ |

| Nationwide Building Society | 282.42% | 9.69% | 21.24% | ★★★★★☆ |

| Law Debenture | 15.39% | 21.17% | 19.12% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.37% | 48.09% | 66.49% | ★★★★★☆ |

| FW Thorpe | 2.12% | 10.94% | 13.25% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

MS INTERNATIONAL (AIM:MSI)

Simply Wall St Value Rating: ★★★★★★

Overview: MS INTERNATIONAL plc is involved in the design, manufacture, construction, and servicing of various engineering products and structures globally, with a market capitalization of £255.01 million.

Operations: MS INTERNATIONAL generates revenue primarily from its Defence and Security segment (£82.45 million), followed by Forgings (£13.77 million) and Petrol Station Superstructures (£13.24 million). The Corporate Branding segment contributes £8.60 million to the overall revenue stream.

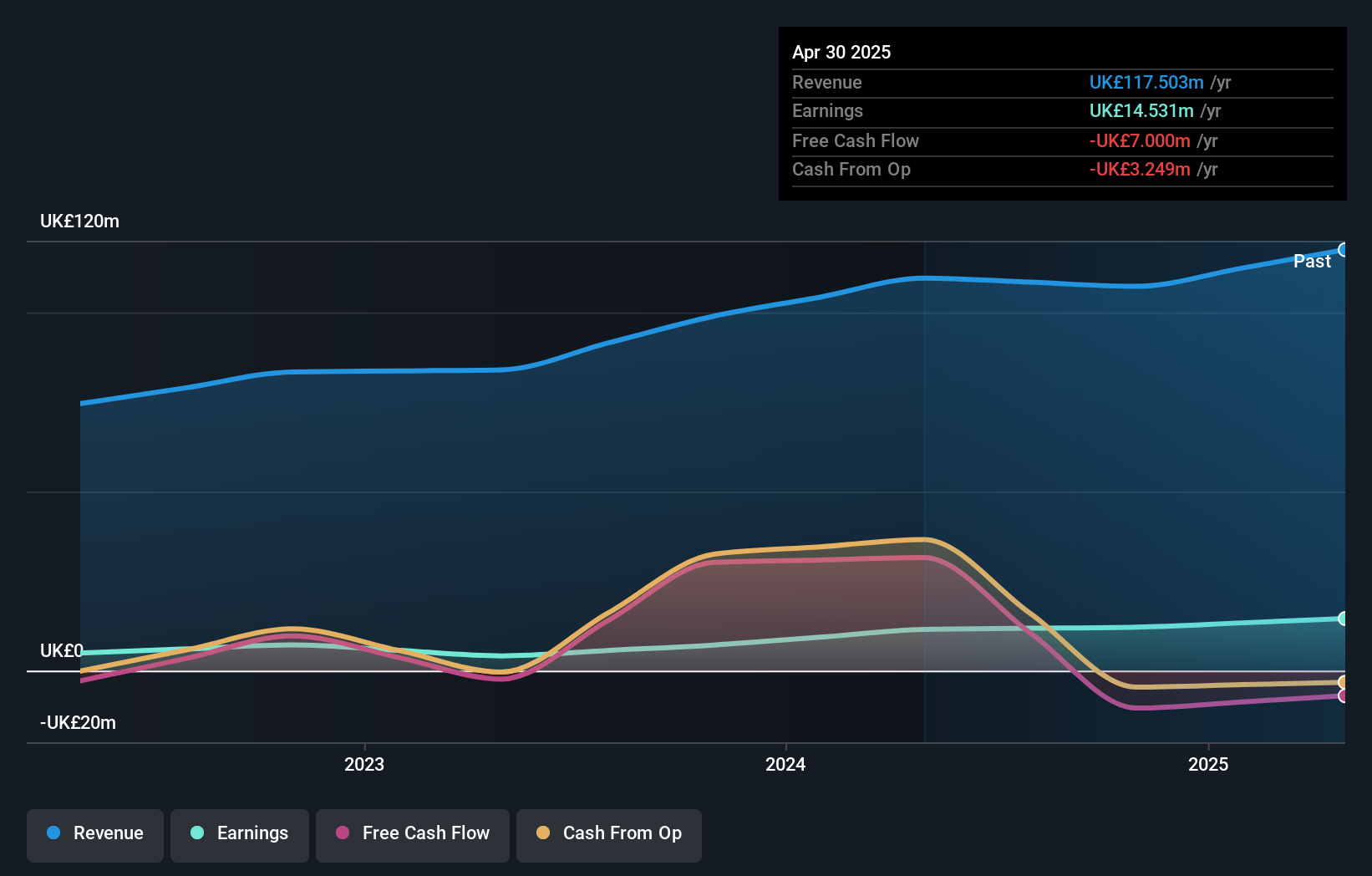

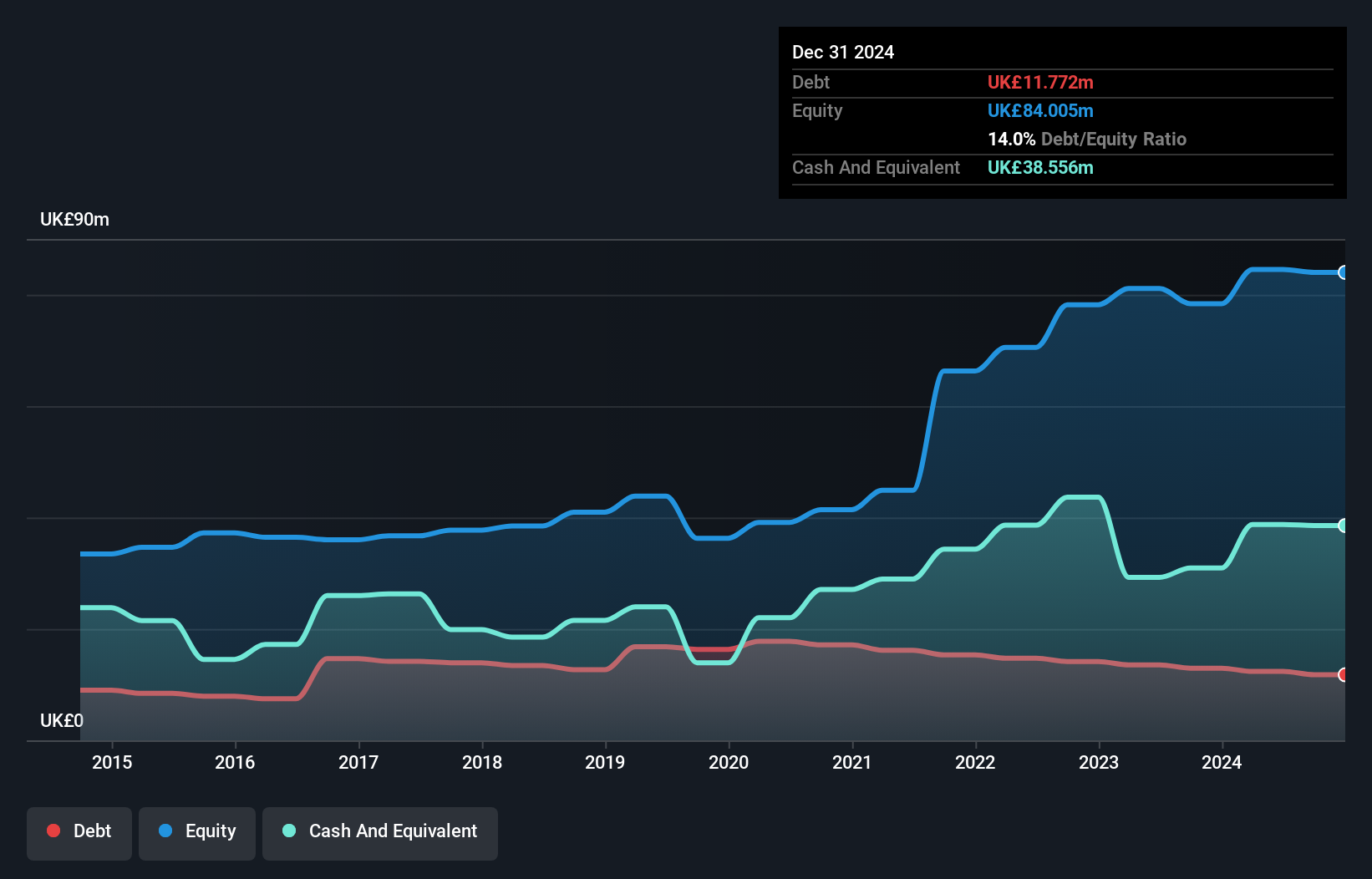

MS International, a nimble player in the Aerospace & Defense sector, boasts a compelling Price-To-Earnings ratio of 17.5x, undercutting the industry average of 22.8x. Over the past five years, its earnings have surged by an impressive 53% annually. Despite not outpacing industry growth last year, MSI's debt-free status and robust non-cash earnings highlight its financial health. Recently awarded a $34.5 million contract from the US Navy for gun mounts through its subsidiary MSI-Defence Systems US LLC, this deal underscores strong ties with NAVSEA and potential for continued collaboration beyond annual contracts in future years.

- Navigate through the intricacies of MS INTERNATIONAL with our comprehensive health report here.

Examine MS INTERNATIONAL's past performance report to understand how it has performed in the past.

Science Group (AIM:SAG)

Simply Wall St Value Rating: ★★★★★★

Overview: Science Group plc is a science and technology consultancy and systems business with operations in the United Kingdom, other European countries, North America, and Asia, with a market capitalization of £235.79 million.

Operations: Science Group plc generates revenue primarily from Professional Services (£68.87 million) and Systems, including Audio Chips and Modules (£13.17 million) and Submarine Atmosphere Management (£31.53 million). The company also earns from Freehold Properties (£3.89 million).

Science Group, a small player in the UK market, has shown remarkable financial resilience. Over the last year, its earnings surged by 410%, outpacing the industry growth of 1%. This performance was partly influenced by a significant one-off gain of £24M. The company's debt to equity ratio impressively decreased from 45% to 12% over five years, reflecting improved financial health. Trading at nearly 12% below estimated fair value suggests potential undervaluation. Although forecasts indicate an average annual earnings drop of about 60% over the next three years, Science Group's current metrics demonstrate strong operational footing and financial prudence.

- Click to explore a detailed breakdown of our findings in Science Group's health report.

Assess Science Group's past performance with our detailed historical performance reports.

AEP Plantations (LSE:AEP)

Simply Wall St Value Rating: ★★★★★★

Overview: AEP Plantations Plc, along with its subsidiaries, is engaged in the ownership, operation, and development of oil palm plantations in Indonesia and Malaysia with a market capitalization of £533.97 million.

Operations: AEP Plantations generates revenue primarily from the cultivation of plantations, amounting to $436.63 million.

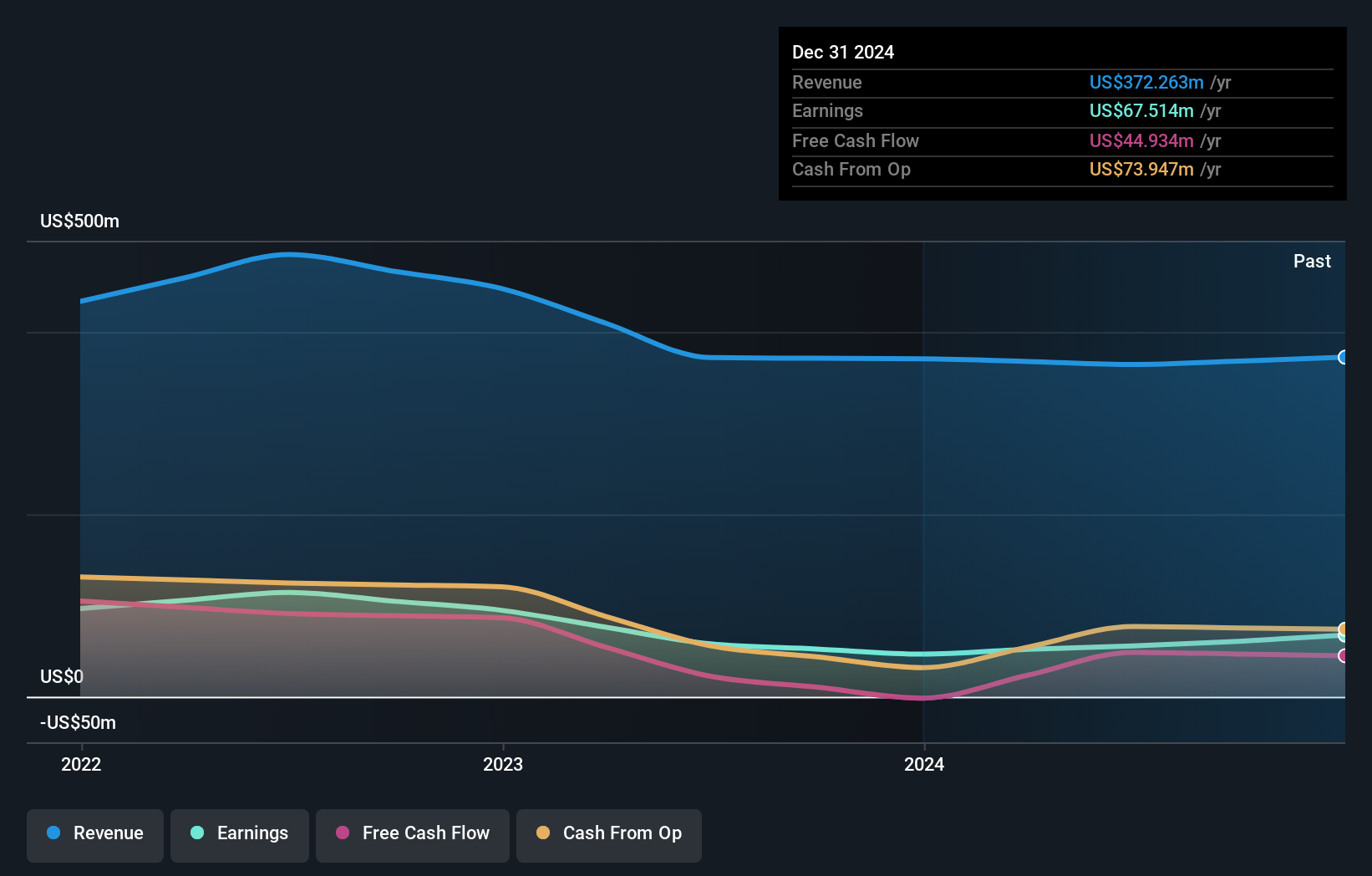

AEP Plantations, a notable player in the UK market, is currently trading 19.1% below its estimated fair value, presenting an attractive opportunity. Over the past year, AEP's earnings surged by 63.4%, outpacing the food industry's growth of 19.8%. The company is debt-free now compared to five years ago when its debt-to-equity ratio was 0.6%, reflecting prudent financial management. Recent production results show a boost in fresh fruit bunches by 7% and crude palm oil output up by 8%, thanks to improved operations in Indonesia and a new mill in North Sumatra driving efficiency gains.

- Get an in-depth perspective on AEP Plantations' performance by reading our health report here.

Gain insights into AEP Plantations' past trends and performance with our Past report.

Seize The Opportunity

- Click through to start exploring the rest of the 57 UK Undiscovered Gems With Strong Fundamentals now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MSI

MS INTERNATIONAL

Engages in the design, manufacture, construction, and servicing various engineering products and structures in the United Kingdom, Europe, the United States of America, Asia, South America, and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success