Stock Analysis

- United Kingdom

- /

- Professional Services

- /

- AIM:RWS

UK Exchange Highlights Three Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

The United Kingdom stock market has shown modest growth, rising 5.6% over the past year while remaining flat in the last week, with expectations of earnings growing by 13% annually. In this context, companies with high insider ownership can be particularly appealing as they often indicate a strong alignment between company management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Plant Health Care (AIM:PHC) | 26.4% | 121.3% |

| Petrofac (LSE:PFC) | 16.6% | 124.5% |

| Getech Group (AIM:GTC) | 17.3% | 86.1% |

| Gulf Keystone Petroleum (LSE:GKP) | 10.7% | 47.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 25.5% |

| Velocity Composites (AIM:VEL) | 28.5% | 143.4% |

| TEAM (AIM:TEAM) | 25.8% | 58.6% |

| Judges Scientific (AIM:JDG) | 11.5% | 25.3% |

| Afentra (AIM:AET) | 38.3% | 64.4% |

| Mothercare (AIM:MTC) | 15.1% | 41.2% |

Here's a peek at a few of the choices from the screener.

RWS Holdings (AIM:RWS)

Simply Wall St Growth Rating: ★★★★☆☆

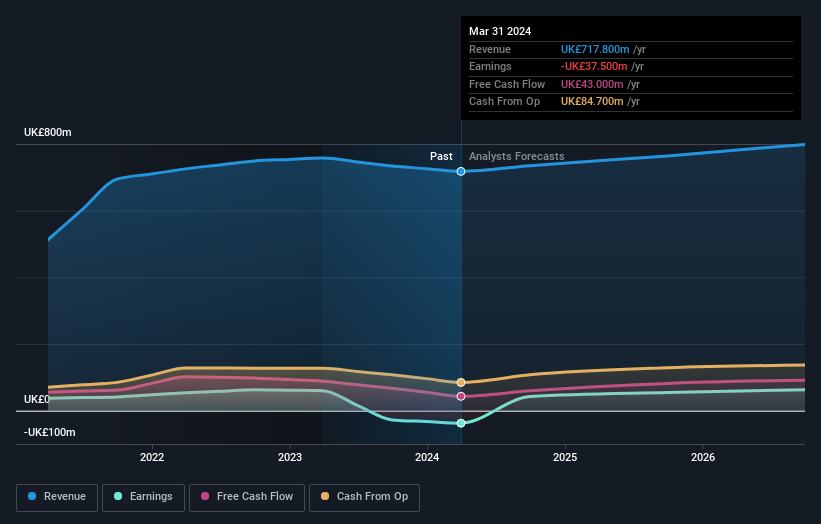

Overview: RWS Holdings plc specializes in technology-enabled language, content, and intellectual property services with a market capitalization of approximately £0.72 billion.

Operations: The company generates revenue through several key segments: IP Services (£105.10 million), Language Services (£325.40 million), Regulated Industry (£149.40 million), and Language & Content Technology (L&CT) (£137.90 million).

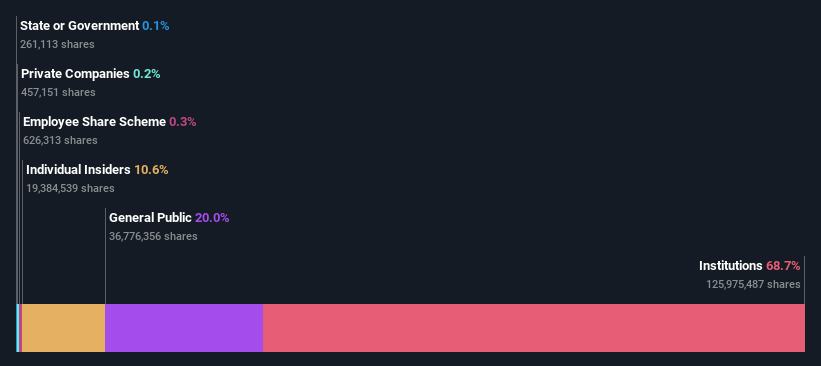

Insider Ownership: 24.6%

RWS Holdings, a UK-based growth company with significant insider ownership, is currently trading at a substantial discount to its estimated fair value. Despite this, the company's share price has been highly volatile recently. The dividend coverage by earnings or cash flows is weak, indicating potential sustainability issues. However, RWS is expected to become profitable within three years, with forecasted earnings growth significantly outpacing the market average. Recent product enhancements in AI and content management systems underscore its commitment to leveraging advanced technology for business efficiency and user engagement.

- Click to explore a detailed breakdown of our findings in RWS Holdings' earnings growth report.

- Upon reviewing our latest valuation report, RWS Holdings' share price might be too pessimistic.

Energean (LSE:ENOG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Energean plc is a company focused on the exploration, development, and production of oil and gas, with a market capitalization of approximately £1.93 billion.

Operations: The company generates revenue primarily from its oil and gas exploration and production activities, totaling approximately $1.42 billion.

Insider Ownership: 10.7%

Energean, a UK-based growth company with high insider ownership, reported substantial year-over-year earnings growth and is trading significantly below its fair value. Despite a high debt level and recent shareholder dilution, the company has seen a 49% increase in production volumes year-over-year as of the first quarter of 2024. While its dividend coverage is weak, suggesting sustainability concerns, Energean's revenue and earnings are expected to continue growing above the UK market average.

- Unlock comprehensive insights into our analysis of Energean stock in this growth report.

- Our valuation report unveils the possibility Energean's shares may be trading at a discount.

Foresight Group Holdings (LSE:FSG)

Simply Wall St Growth Rating: ★★★★★☆

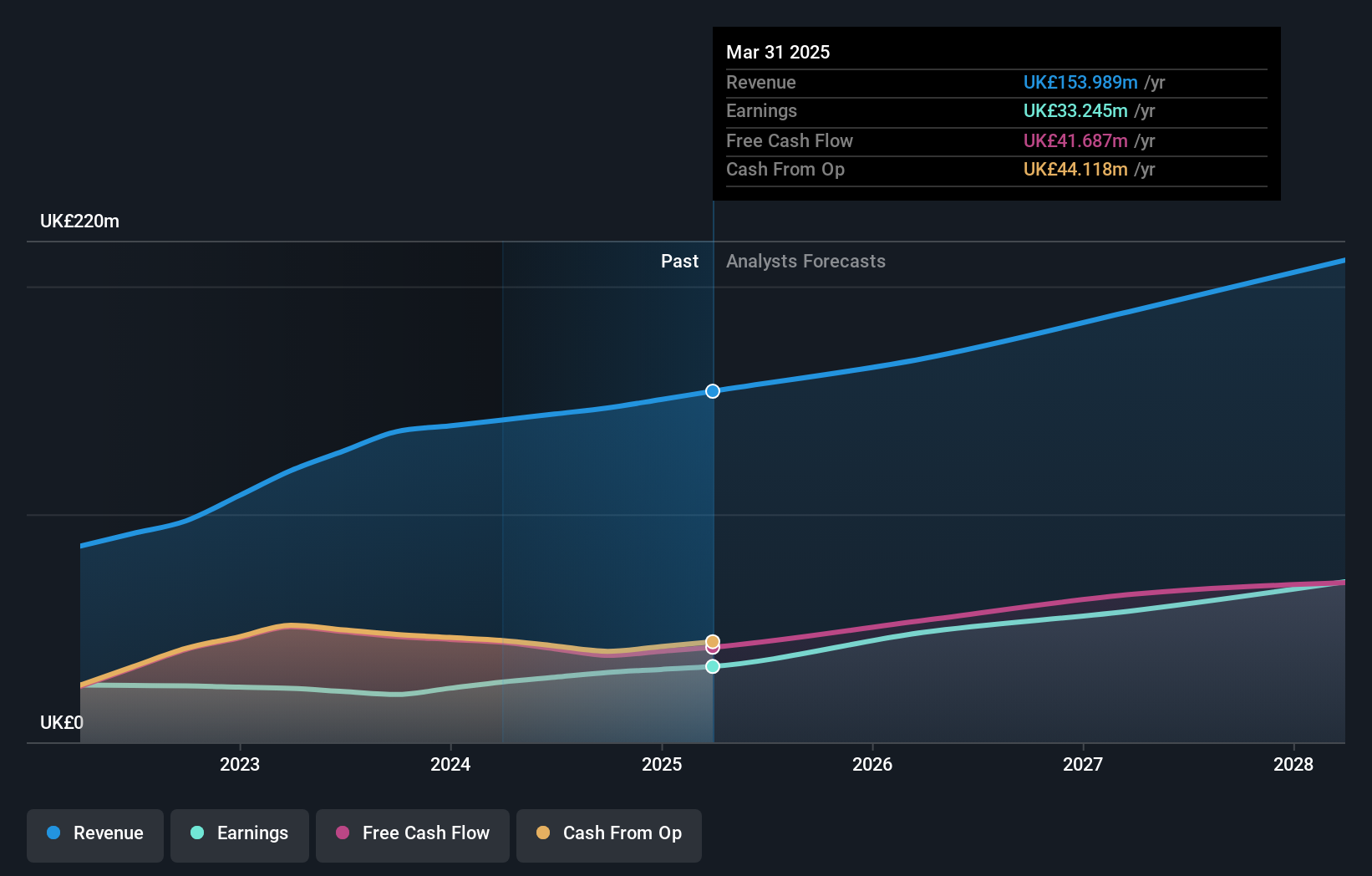

Overview: Foresight Group Holdings Limited is a company based in the UK that manages infrastructure and private equity, operating across the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market capitalization of approximately £526.93 million.

Operations: The company generates revenue through three primary segments: Infrastructure (£85.68 million), Private Equity (£39.28 million), and Foresight Capital Management (£11.33 million).

Insider Ownership: 31.7%

Foresight Group Holdings, a UK-based growth company with high insider ownership, is poised for robust expansion with earnings forecasted to grow at 30.9% annually, outpacing the UK market's 13.1%. Despite trading 38.4% below its estimated fair value and analysts projecting a significant price increase of 30.7%, concerns linger as its profit margins have declined from last year's 25.5% to 15.4%. Additionally, its dividend coverage is weak, raising questions about sustainability amidst this growth trajectory.

- Dive into the specifics of Foresight Group Holdings here with our thorough growth forecast report.

- Our valuation report here indicates Foresight Group Holdings may be undervalued.

Turning Ideas Into Actions

- Explore the 65 names from our Fast Growing UK Companies With High Insider Ownership screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether RWS Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:RWS

RWS Holdings

Provides technology-enabled language, content, and intellectual property (IP) services.

Flawless balance sheet, undervalued and pays a dividend.